Siemens rebound faces significant hurdle near 89E

Industrial business profit and EPS were ahead of consensus.

Regarding the outlook, the company stated: "We expect even stronger impacts from the pandemic on business development in our fiscal third quarter. Beyond the third quarter of fiscal 2020, macroeconomic developments and their influence on Siemens currently cannot be reliably assessed. Therefore, we can no longer confirm our original guidance for fiscal 2020. We now expect a moderate decline in comparable revenue in fiscal year 2020."

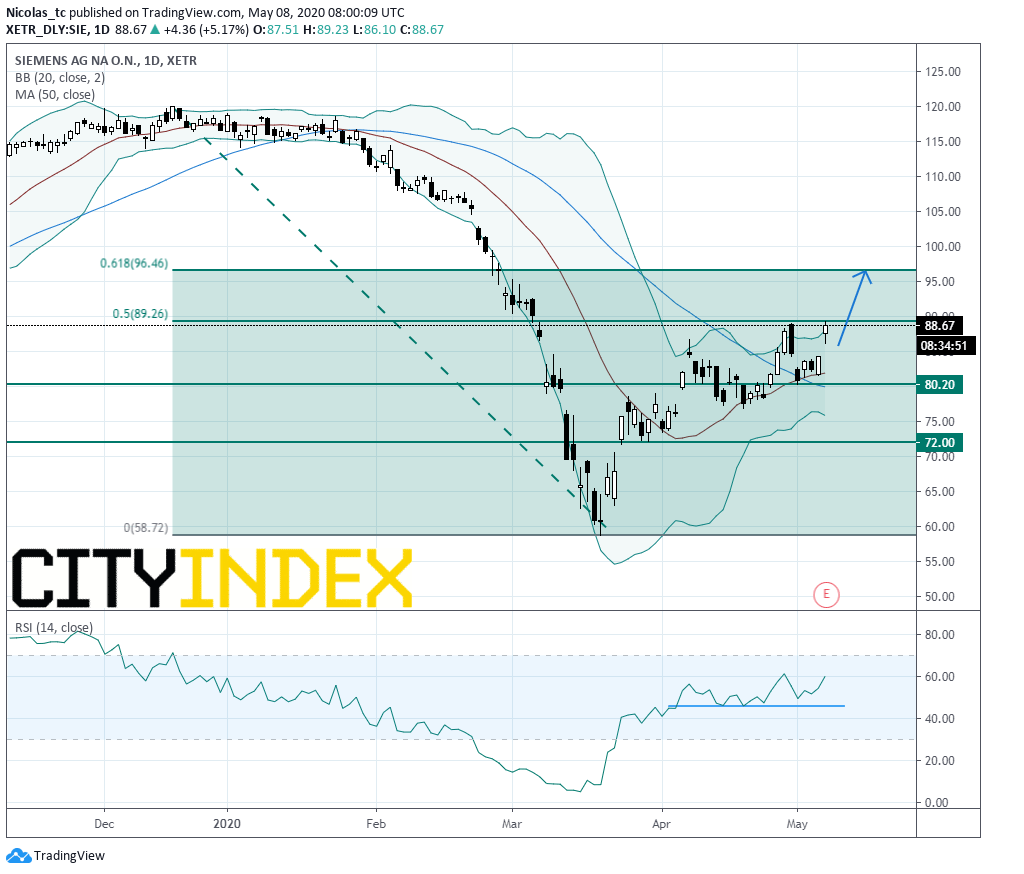

From a technical perspective, the stock price remains within a short term bullish trend, supported by the rising 20-day simple moving average (trailing stop). The daily Relative Strength Index (RSI, 14) is holding above its horizontal support at 50%. Prices face significant hurdle near 50% Fibonacci retracement level at 89E.

A break above this resistance level would call for a new up move towards 61.8% Fibonacci retracement at 96E.

Alternatively, a break below 80.2E would invalidate the short term bullish bias and would call for a down move towards 72E.

Source: GAIN Capital, TradingView