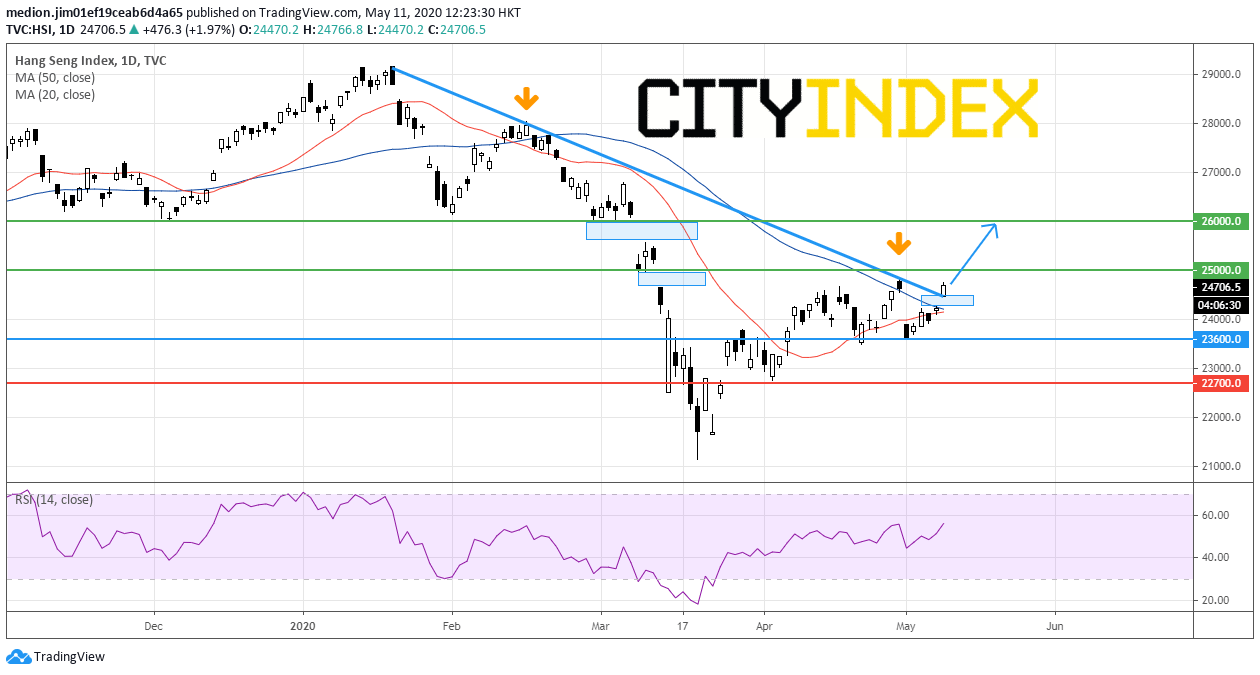

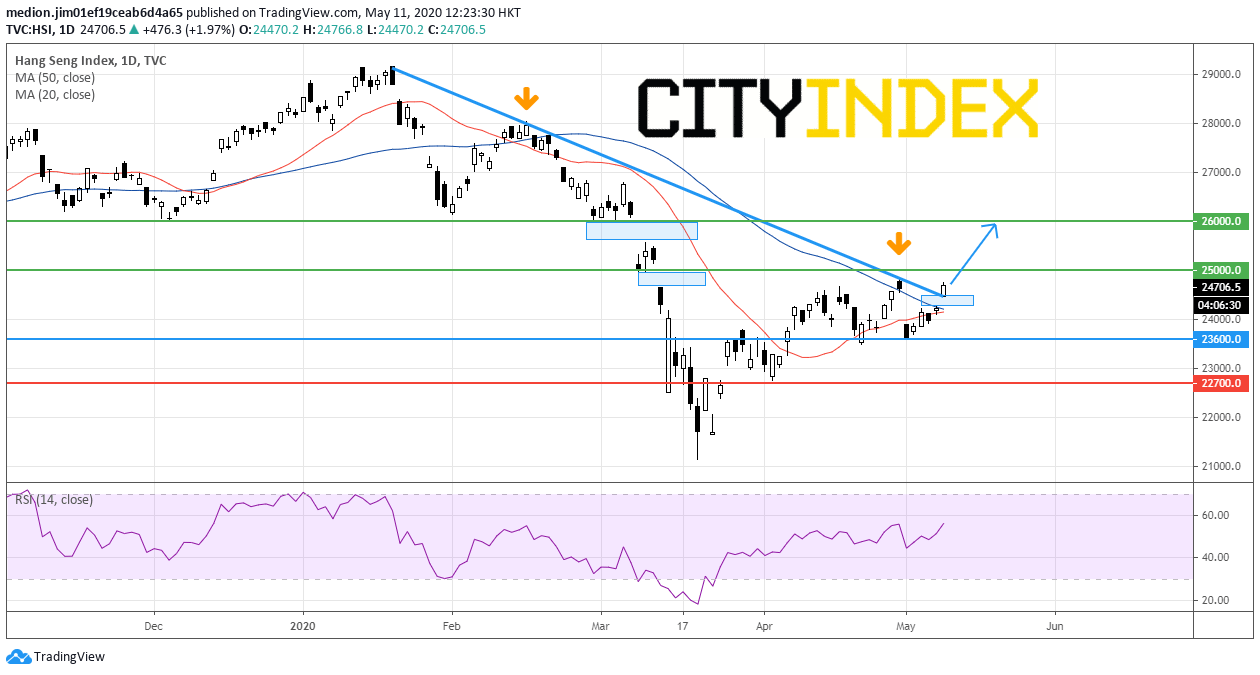

Short Term Outlook of Hang Seng Index: Gap Up and Break the Trend line.

Hong Kong's Hang Seng Index jumped around 2% following the rise of the U.S. market last Friday. In Asia Pacific, Japan's Nikkei Index was up around 1.4% and Australia's ASX200 Index climbed around 1.7%.

China's central bank pledged "more powerful" policies to deal with unprecedented economic challenges caused by the Covid-19 pandemic. As Hong Kong's market is highly correlated to China, it would be positive news to the Hong Kong market also.

Investors should focus on China's April CPI (3.7% expect), PPI (-2.5% expect), industrial production (+1.5% expect) and retail sales (-6.0% expect) this week.

Hence, as long as the previous low at 23600 is not broken, the index prices could consider a further upside to the resistance levels at 25000 (the gap occurred on March 12) and 26000 (the gap created on March 9).

Alternatively, a break below 23600 would erase the bullish outlook and test the support level at 22700.

Source: GAIN Capital, TradingView

China's central bank pledged "more powerful" policies to deal with unprecedented economic challenges caused by the Covid-19 pandemic. As Hong Kong's market is highly correlated to China, it would be positive news to the Hong Kong market also.

Investors should focus on China's April CPI (3.7% expect), PPI (-2.5% expect), industrial production (+1.5% expect) and retail sales (-6.0% expect) this week.

On a Daily chart, the index posts "Gap up" and breaks above the declining trend line drawn from January. It would be a very strong signal to call for the upward acceleration. Besides, the 20-day moving average is very close to the 50-day one. It is highly possible to indicate a bullish cross signal, which should enhance the positive outlook. In addition, the RSI is still heading upward, suggesting the upward momentum for the index prices.

Hence, as long as the previous low at 23600 is not broken, the index prices could consider a further upside to the resistance levels at 25000 (the gap occurred on March 12) and 26000 (the gap created on March 9).

Alternatively, a break below 23600 would erase the bullish outlook and test the support level at 22700.

Source: GAIN Capital, TradingView

Latest market news

Today 01:15 PM

Today 11:30 AM

Today 08:18 AM