Shimao Property (813-hk): Consolidate before Next Rally

Shimao Property (813-hk), a Chinese real estate group which was added to the Hang Seng China Enterprises Index in June, climbed to a record high at $37.20 on Monday and reached our forecast made in late May.

In fact, the company has been benefited from the recovery in China's economic activity which led to a rebound in property demand. Last week, company announced that contracted sales rose 6.4% on year to 30.2 billion yuan in June and were up 10.1% to 110.48 billion yuan in the first half of the year.

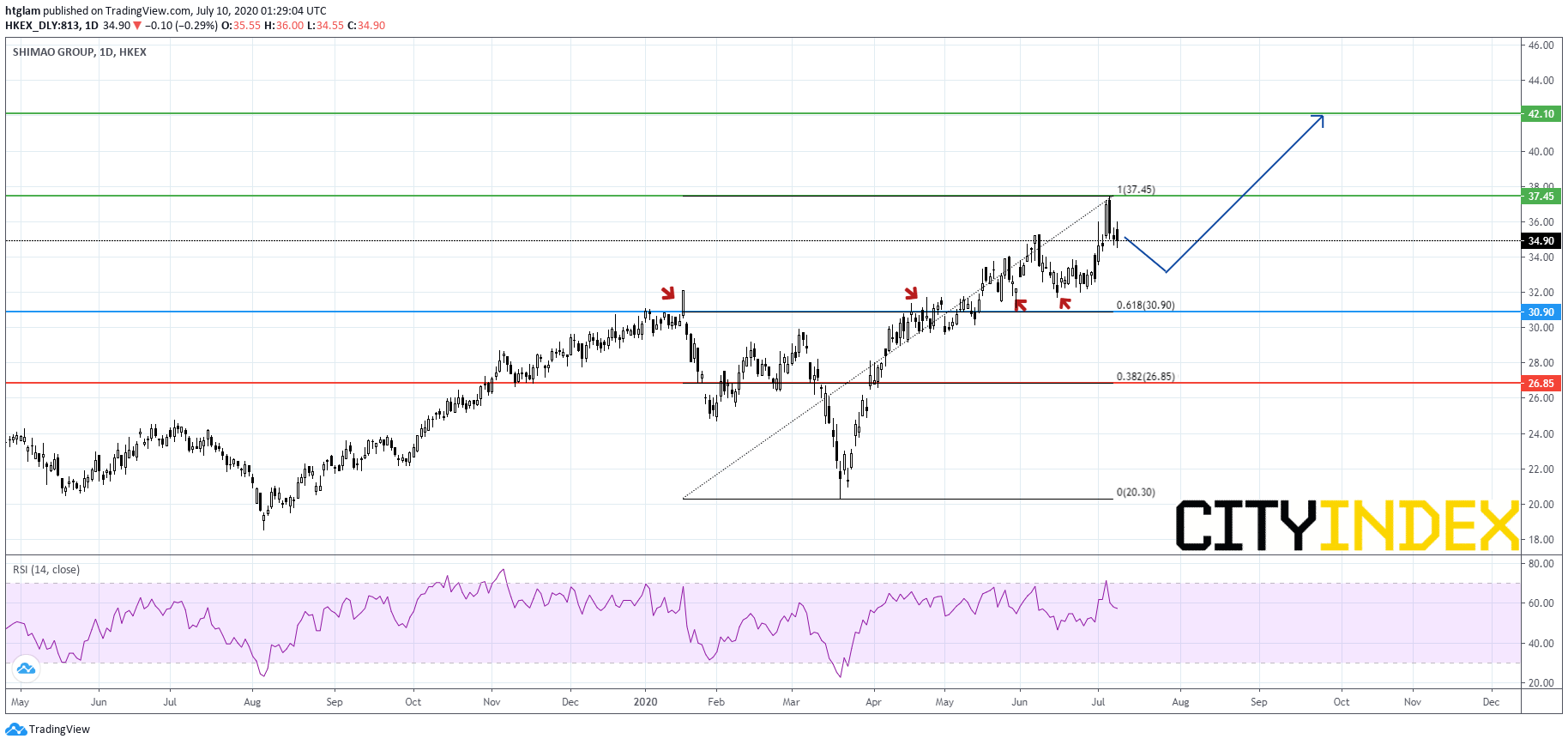

From a technical point of view, Shimao Property might continue to trade within a bullish consolidation range before starting a new rally. Previously, it has rebounded after retreating to its previous high marked in April and January, suggesting that the prior resistance now acts as a support. Bullish investors may consider $30.90 as the nearest support, which is also the 61.8% Fibonacci retracement support of the rally started in March, and a break above the nearest resistance at $37.45 would open a path to the next resistance at $42.10. Alternatively, a break below $30.90 might trigger a pull-back to the next support at $26.85.