Once the FTSE’s biggest dividend payer and months after cutting its dividend for the first time since WW2, Shell reaffirmed its commitment to shareholder pay-outs.

Shell reported Q3 profits of $955 million, easily ahead of $146 million expected but still some 80% lower from the $4.76 billion profit recorded for the same quarter last year, before the collapse of oil prices.

Dividend commitment reaffirmed

Shell’s results painted a very similar picture to BP’s which reported earlier in the week – narrower refining margins and a slowdown in the trading business. However, a solid performance in the vast retail division, which includes petrol stations and convenience stores mean that Shell managed to outperform exceeding profits and throwing in a surprise 4% dividend increase, a renewed sign of confidence

Shell’s results painted a very similar picture to BP’s which reported earlier in the week – narrower refining margins and a slowdown in the trading business. However, a solid performance in the vast retail division, which includes petrol stations and convenience stores mean that Shell managed to outperform exceeding profits and throwing in a surprise 4% dividend increase, a renewed sign of confidence

Shell announced a dividend of 16.65 cents for the three month period after cutting the dividend just 6 months earlier for the first time since 1940. The increase in dividend could make Shell a compelling investment case, according to the CEO and given that the stock is down 60% YTD a well needed case as the stock yields over 5%. The question is will it be enough to attract investors back?

Covid & going green

Oil giants have faced a double challenge in this year annus horribilis as they deal with not only plummeting oil prices, which spiked into negative territory in April but they are also facing mounting pressure to meet environmental goals.

Oil giants have faced a double challenge in this year annus horribilis as they deal with not only plummeting oil prices, which spiked into negative territory in April but they are also facing mounting pressure to meet environmental goals.

Shell is looking to completely overhaul its business with a major restructuring plan to reduce greenhouse gas emission to 0 by 2050. In line with plans to shrink its oil & gas division it will cut down to 6 energy & chemical parks from a current 14 oil refineries. 9000 jobs will be slashed, equating to 10% of the workforce will be slashed as part of the overhaul.

Royal Dutch Shell’s share price has tanked over 60% so far this year, worse than its peers as investors fret over outlook for the price of oil.

Royal Dutch Shell’s share price has tanked over 60% so far this year, worse than its peers as investors fret over outlook for the price of oil.

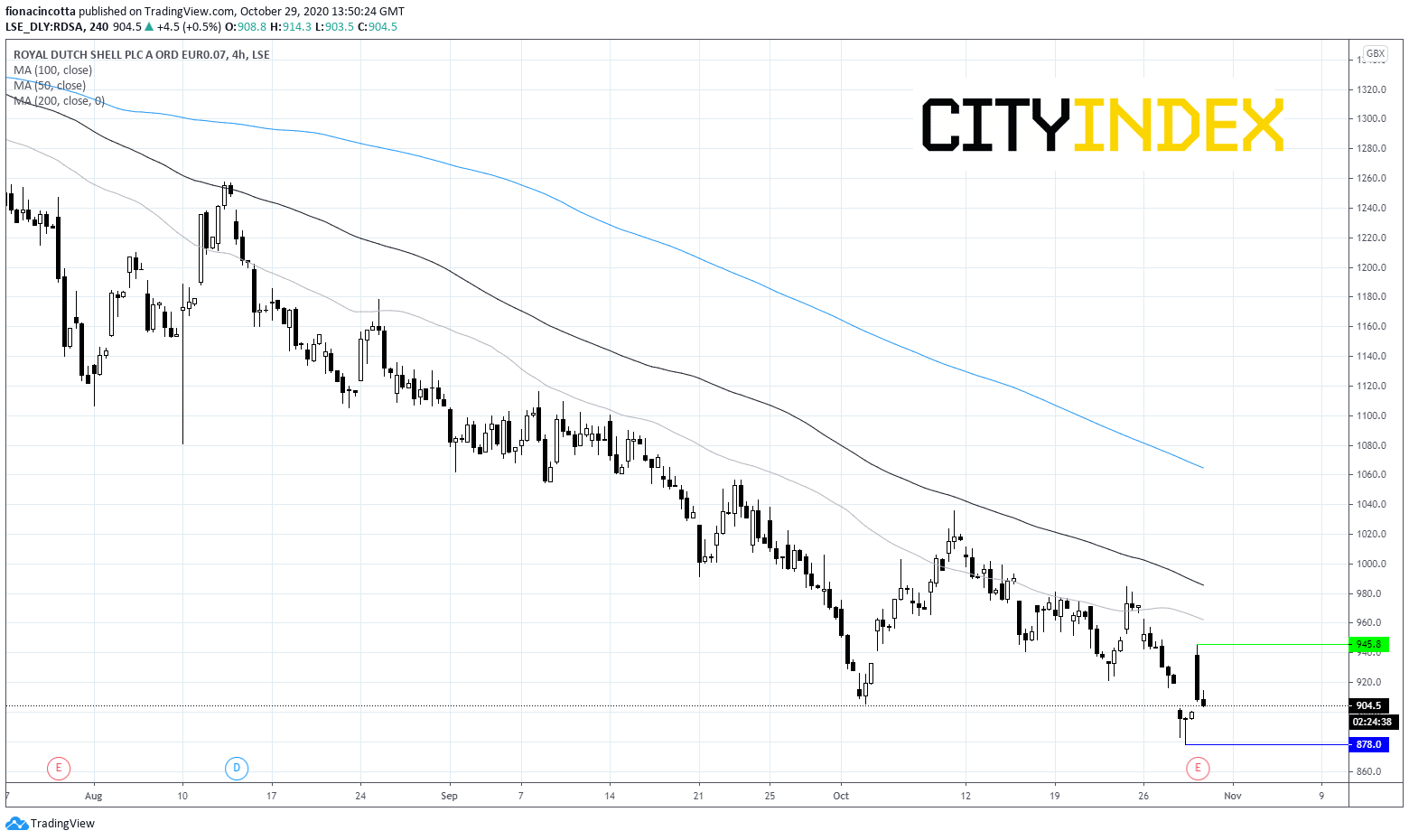

RDSA chart thoughts

The stock trades 2% higher on the day. However, it trades clearly below its 50,100 & 200 sma on the daily chart and even zooming into the 4-hour chart we see the same bearish trend. Whilst the stock has picked up off yesterday’s historically low 878p nadir, the outlook remains negative. A push above the 50 sma on the 4 hr chart at 960 could negate the near term bearish trend.

Latest market news

Yesterday 10:40 PM

Yesterday 04:00 PM