Our last update on the S&P500 was in early December, shortly after an apparent escalation in President Trump's trade war over a 24-hour period, which included tariff threats against Argentina, Brazil, China and France as well as NATO members whom he considered weren’t spending enough on defense.

Fearing the damage that a trade war escalation would do to the global economy, equity markets were quick to respond. Headlines predicted that Trump's tariff tirade had curtailed the usual end-of-year Santa stock market rally before it had even started. We argued to the contrary and that after a brief pullback, the Santa rally would take place as usual in 2019 here.

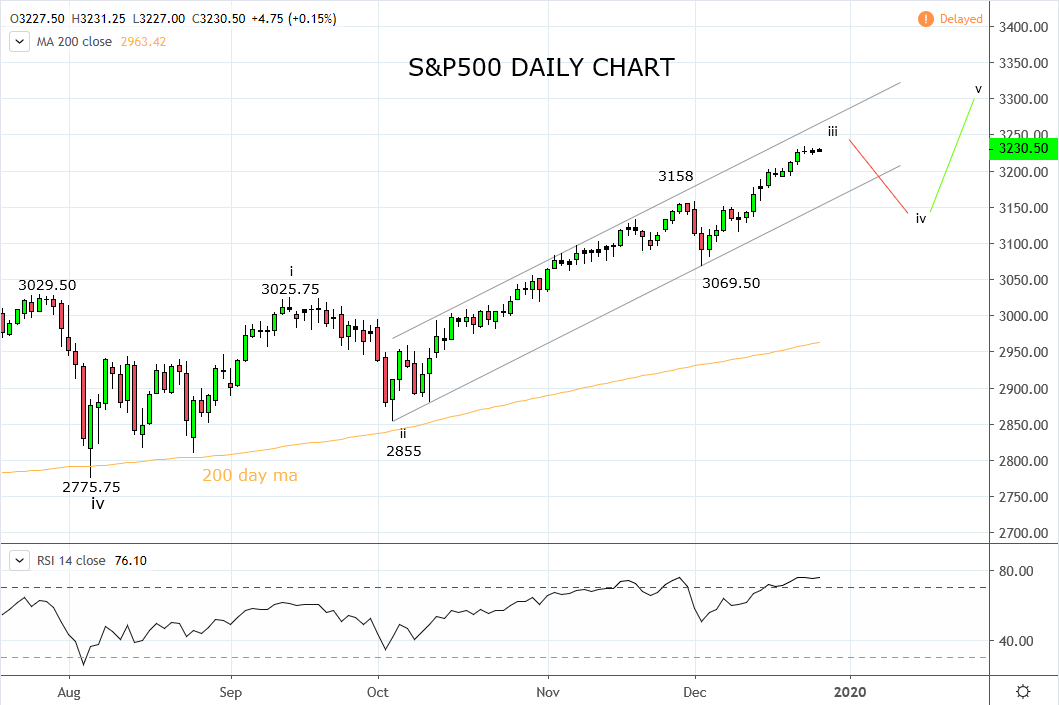

After reaching and breaching our 3200 target last week, the S&P500 is exhibiting short term signs of being overbought. However, with the festive season in full swing, light trading volumes, fund managers unlikely to sell their favourite stocks before year-end and investors optimistic after the U.S. and China agreed to a trade deal, the S&P500 looks set to end 2019 near to all-time highs.

In light of this, the most likely window for a pullback is in early January. Although with economic data continuing to show signs of improvement, subdued inflation and supportive monetary policy, dips in the S&P500 are likely to be shallow, within the 3-5% range.

Technically, following the break to new highs in late October, the S&P500 has been trading within a bullish trend channel. Should a pullback occur in January, the first level of support would come from the lower bound of the trend channel, currently 3150/3130 area. Below there, medium-term support starts at 3070 and extends down to the previous highs 3030/3025 area.

With this in mind, dips towards the support regions mentioned above would be viewed as buying opportunities, in expectation of the uptrend resuming in February 2020. Only a break and close below 3020/10 would be cause to reassess the bullish view.

Source Tradingview. The figures stated areas of the 26th of December 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation