With just a few trading sessions left until the Christmas holiday period, markets and volumes are winding down. The impact of reduced liquidity, evident in the slippery price action in GBPUSD early Tuesday morning, providing a reminder of the “flash crash” in AUDUSD and other AUD cross rates in January of this year.

Due to liquidity risks, I prefer to use the lead into Christmas to focus on potential trades for 2020. Earlier this week we outlined our bearish medium-term view of the U.S. dollar index, the DXY. Another on the radar is a firm favourite of ours in recent months the NZDUSD.

The NZDUSD has been on a one-way ticket north since mid-November when the RBNZ surprised the market and confirmed our own out of consensus view by keeping interest rates on hold at 0.75%. The economic data since then has vindicated the RBNZ’s decision, reinforced by the release of stronger than expected Westpac consumer confidence and ANZ business confidence numbers this week.

Also supporting the NZDUSD, confirmation in last week’s Half Yearly Economic and Fiscal Update (HYEFU) of NZ $12 billion dollars of fiscal stimulus alluded to here as well as a decision by the RBNZ to allow banks longer to raise capital buffers.

The good run of data looks set to continue today (Thursday morning at 8.45 am Sydney time) with the release of NZ Q3 GDP data. The market is looking for Q3 GDP to increase by 0.6%, twice the number projected by the RBNZ in their November Monetary Policy Statement. This is likely to see the banks who have not already done so remove forecasts for the RBNZ to cut interest rates again in February, or at any point over the first half of 2020.

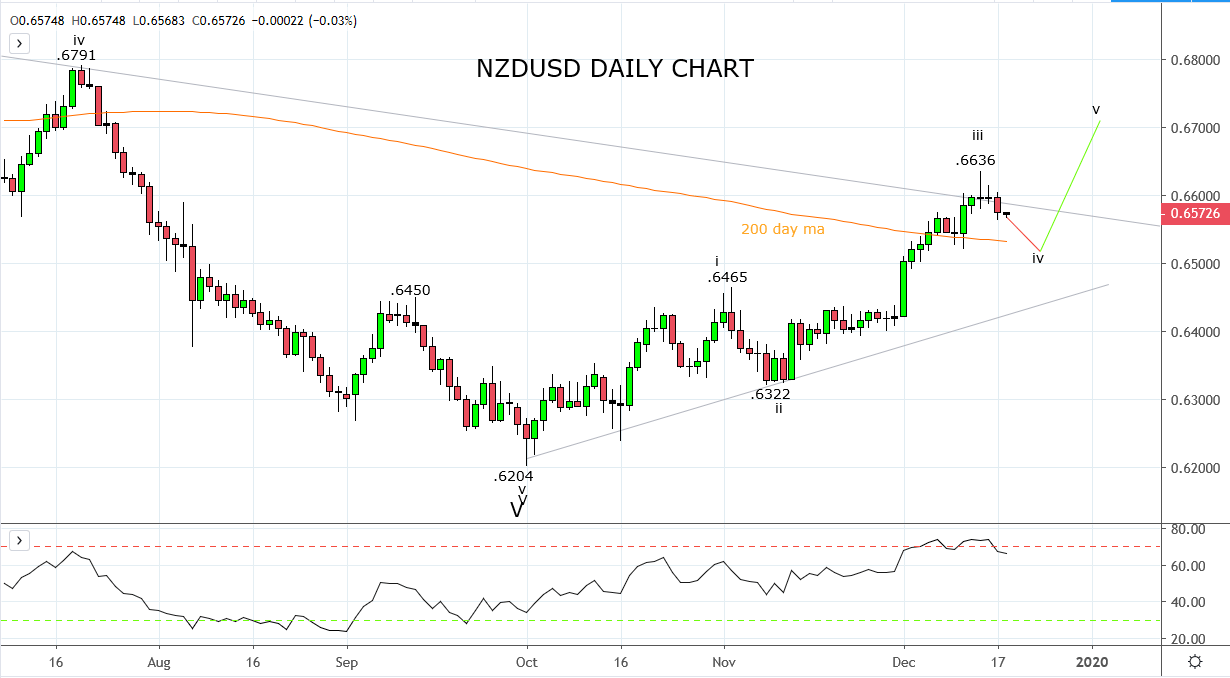

After reaching our upside target of .6600c (trendline resistance) and because of the supportive fundamentals outlined above, I am looking at levels to rebuy the NZDUSD. Presuming the current pullback continues and displays corrective qualities, the .6530/20 support (last week’s lows and the 200-day moving average) offers a potential buy zone in anticipation of a rally towards .6680/00 in 2020.

Source Tradingview. The figures stated areas of the 18th of December 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation