Another reminder that markets don’t operate in vacuums and of the invisible links that exist between various asset classes. This falls under the guise of Intermarket Analysis and is often used by professional traders either as part of their trading strategy or as part of their overall market analysis.

As a side note, for those interested in learning more about Intermarket Analysis and for holders of a funded City Index account you can sign up to a webinar I am hosting for City Index on Intermarket Analysis on the 14th of October here.

Returning to the currency market, in Mondays Week Ahead video, the comment was made that the U.S. dollar index, the DXY resembled “a ball being kept underwater”, fighting to reach the surface.

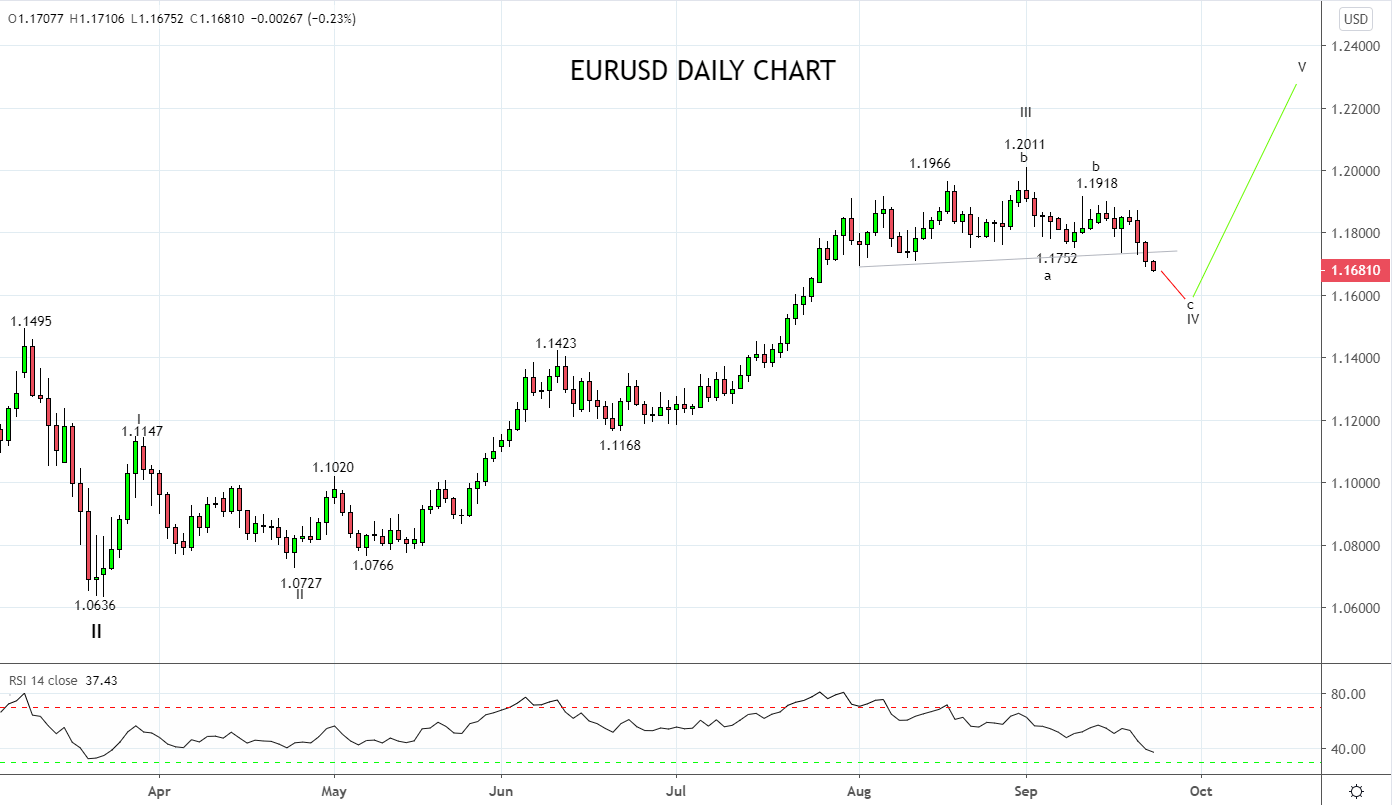

The opposite was true for the inversely correlated EURUSD. The preference being for the EURUSD’s retracement to deepen before the uptrend resumes.

When analyzing how much lower the EURUSD can retrace, there are several factors to consider including;

- Month-end and quarter-end flows which can be tricky to navigate.

- The special EU Council meeting originally scheduled for September 24-25 has been pushed back to October 1-2. The meeting will be used by EU leaders to discuss the single market, industrial policy, digital transformation, and the COVID-19 pandemic.

- Continuation of negative Brexit and COVID-19 headlines in the short term.

The preference from a timing perspective is to rebuy the EURUSD towards the middle of next week. From a pricing perspective, I am looking for signs of stabilisation near wave equality support 1.1650. However, should the decline extend below 1.1650 there isn't much in the way of support until the 1.1570 high from early January.

Keeping in mind that should the EURUSD break and close back above the bottom of its recent range, lets say 1.1780 to give it some room, it would be an initial indication that a tradable low is in place and that the EURUSD’s uptrend has resumed.

Source Tradingview. The figures stated areas of the 23rd of September 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation