Nerves are getting the better of markets again as the summit looms

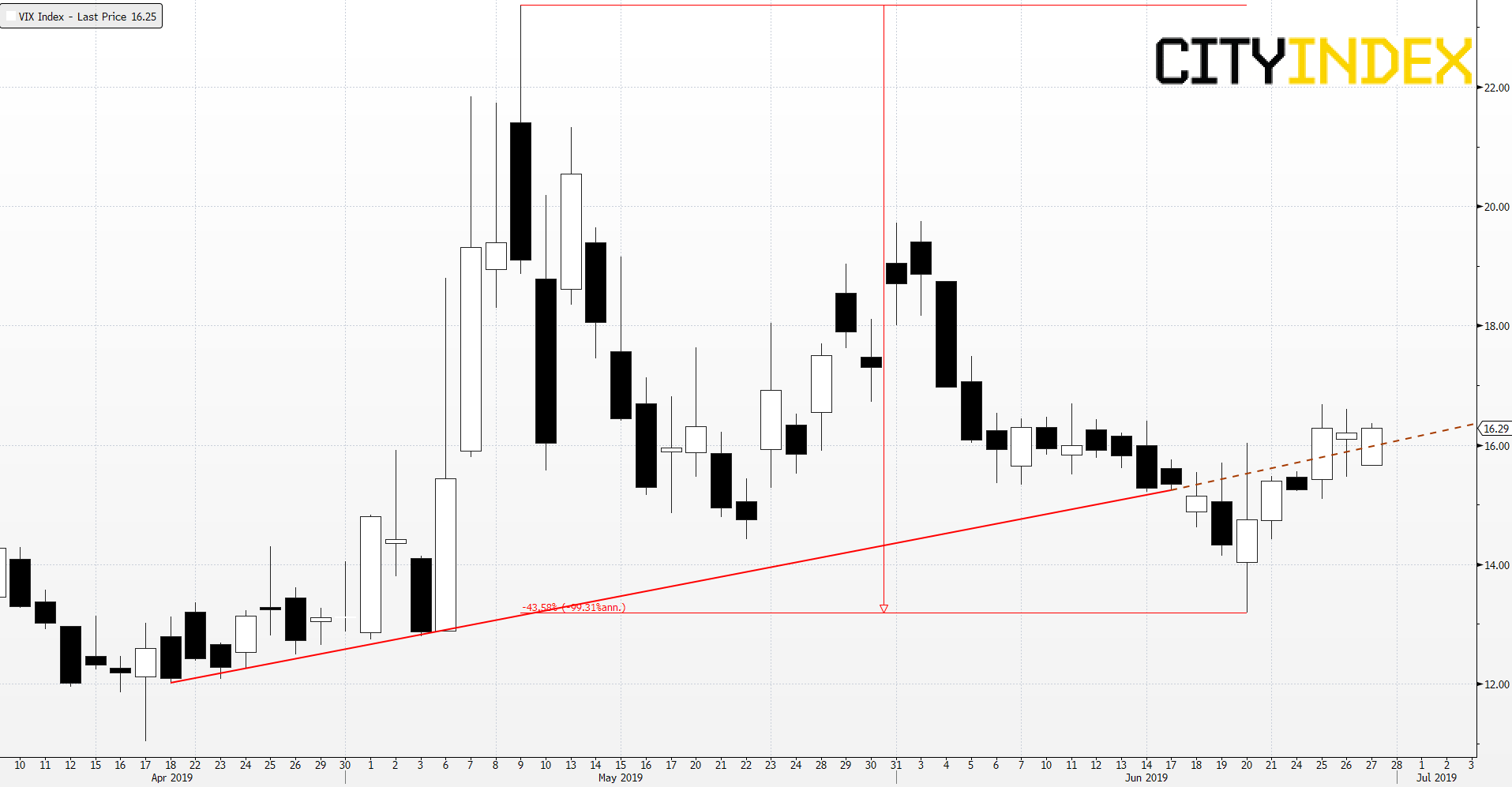

An optimistic tint over European and Asia Pacific markets was also reflected in Wall Street futures for most of Thursday morning. As the start of U.S. trading approaches though, futures there look more mixed and Europe’s confidence has again evaporated. That’s after U.S. shares saw a similar early ramp fizzle towards the end of their prior session, succumbing to the same jitters that capped Continental markets on Wednesday. The return of higher variance was marked by a spring back in implied volatility nominally projected by CBOE’s VIX gauge. Circumstantially, the lack of follow-through that typically follows reversion of this indicator to its recent baseline could be indicative. So could observations that the VIX is attempting to retake values above the floor of its rising trend since April.

CBOE VIX – daily [27-11-2019 1118 BST]

Source: Bloomberg/City Index

In short, there are decent signs that the apparent return of poise to risky assets may not run deep. As a re-cap, the logic underpinning the optimistic case ahead of this weekend’s G20 summit is as follows:

- Although the pattern of commentary that typically emanates from Washington ahead of trade talks is evident—reiterated threats combined with constructive affirmations—the U.S. has maintained a relatively consistent stance into the negotiations. U.S. Commerce Secretary Wilbur Ross noted last week that the G20 was too broad for detailed progress. And markets have been prepared for weeks for a best-case scenario that would merely see further tariffs suspended. Contained expectations ought to mean that any disappointment will also be limited

- In itself, the fact that there are concrete plans for a meeting at all has reduced the risk of further escalation. Donald Trump’s repeated boast of a warm relationship with Xi should also reduce dangers that their dispute will deepen in Osaka. Trump has twice agreed to postpone tariff hikes: with the European Union’s Jean-Claude Juncker last July and with Xi in December

The negative case, and the one which appears to have largely prevailed on this side of the Atlantic, is that U.S. President Donald Trump’s recent remark that he was ‘in no hurry’ to seal a trade deal with China might carry more weight than appeared on the surface. The STOXX Europe 600 Auto & Parts index continues to sharply underperform the broader market on a year-to-date basis, including the monetarily implicated STOXX Banks index. Automobiles is the only sector singled out explicitly for possible U.S. tariffs. Although a decision was deferred in May for up to six months, the terms of the suspension keep the threat of levies on the table. The basics of the pessimistic case:

- Mexico’s agreement to further clamp downs on illegal border crossings after tariff threats may have emboldened White House trade hawks to continue apply the strategy against China

- Furthermore, the likelihood of monetary easing may convince the President that the U.S. will soon have an economic cushion. Given his evident desire for rate cuts, he may even see a chance of killing two birds with one stone

Whilst the highest probability outcome remains a suspension of tariffs, the broader picture continues hint at a ‘June Swoon’ (or an early July swoon) regardless of trade relief. Aside from telling equity fund outflows in recent weeks and chart technical indications, another intimation is that allocations to U.S. government and prime funds have soared in 2019 to more than $3 trillion. That’s the most since the financial crisis. Ostensibly, this has been driven by U.S. short-term yields exceeding those of longer-maturing bonds. However the trend also depicts cash resolving to the side lines in a way that’s typical of rising uncertainty.