A combination of vaccine optimism and fiscal stimulus is boosting the mood in the market on Tuesday. Encouraging results from Oxford’s vaccine candidate, in addition to EU leaders agreeing to a €750 billion Recovery Fund is overshadowing rising tension between the UK and China and soaring covid numbers in California.

Vaccine optimism

Vaccine optimism continues to underpin the market after Oxford /AstraZeneca reported a good immune response in Phase 3 trials for its vaccine candidate, which crucially had no adverse side effects. Given that a vaccine is the surest, quickest and possibly the only way to return to pre-coronavirus economic growth and normalcy, investors are particularly sensitive to vaccine headlines.

Brexit talks & Mike Pompeo visits

Brexit talks are due to restart today. Hopes and expectations of any agreement are low after recent talks’ disappointment. US Secretary of State Mike Pompeo is also in the UK to discuss China, 5G and free trade deal with Prime Minister Boris Johnson. His arrival comes after Britain suspended its extradition treaty with Hong Kong in retaliation to the national security law imposed by China. The move has stoked tensions between the UK and China accelerating deteriorating relations

Coronavirus stats

There is no high impacting economic data due to be released leaving sentiment to drive the markets. Coronavirus statistics are also likely to remain in focus, particularly after California reported almost 12,000 new cases, taking the total to 400,000. If it were a country it would be up there with some of the highest infected countries.

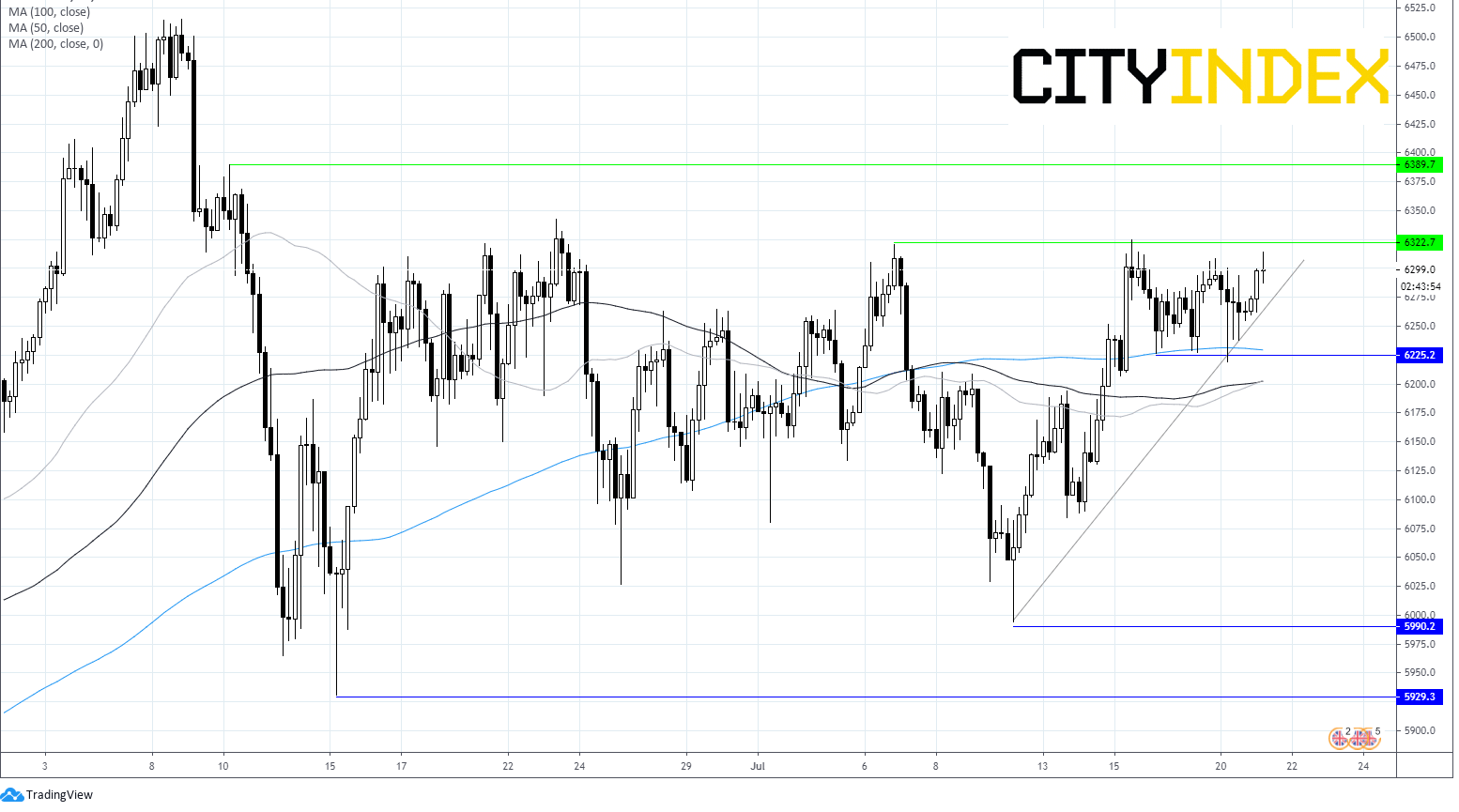

FTSE Chart