European markets are set to jump on the open, as positive sentiment spills over from Asia. Talk from Trump of the reopening of the US economy, plus reports of a potential treatment for Covid-19 is boosting risk sentiment and overshadowing data showing that China experienced its deepest contraction on record in Q1.

Data overnight showed the impact of the coronavirus lock down on the world’s second largest economy. China’s economy contracted at a worse than expected -6.8% in the first three months of the year. Data also showed that retail sales continued to stall, however industrial production only dipped slightly suggesting the recovery in the sector is underway.

Under any normal circumstances these figures would send the market tumbling. However, these are clearly usual times. Traders are instead reacting to Trump’s talk of rolling back restrictions on business, joining a handful of other governments across the globe that are looking to gradually reopen their economies after the crippling lock down.

There is clearly a gulf between market expectations and the current underlying economic reality. However, markets are focused on what comes next rather than the here and now which goes some way to explaining why the market is rallying hours after China records an -6.8% decline in GDP.

Treatment and Vaccines

At this stage, attention is naturally turning to vaccinations and treatments for Covid-19. Reports that a Gilead drug is producing encouraging results in clinical trials is also giving risk sentiment a lift. Any successful treatment drug would essentially mean that economies can reopen more quickly, good news for a rebound. Without this, any recovery is expected to be more drawn out – more like a Nike tick, rather than V or U formation.

At this stage, attention is naturally turning to vaccinations and treatments for Covid-19. Reports that a Gilead drug is producing encouraging results in clinical trials is also giving risk sentiment a lift. Any successful treatment drug would essentially mean that economies can reopen more quickly, good news for a rebound. Without this, any recovery is expected to be more drawn out – more like a Nike tick, rather than V or U formation.

Levels to watch

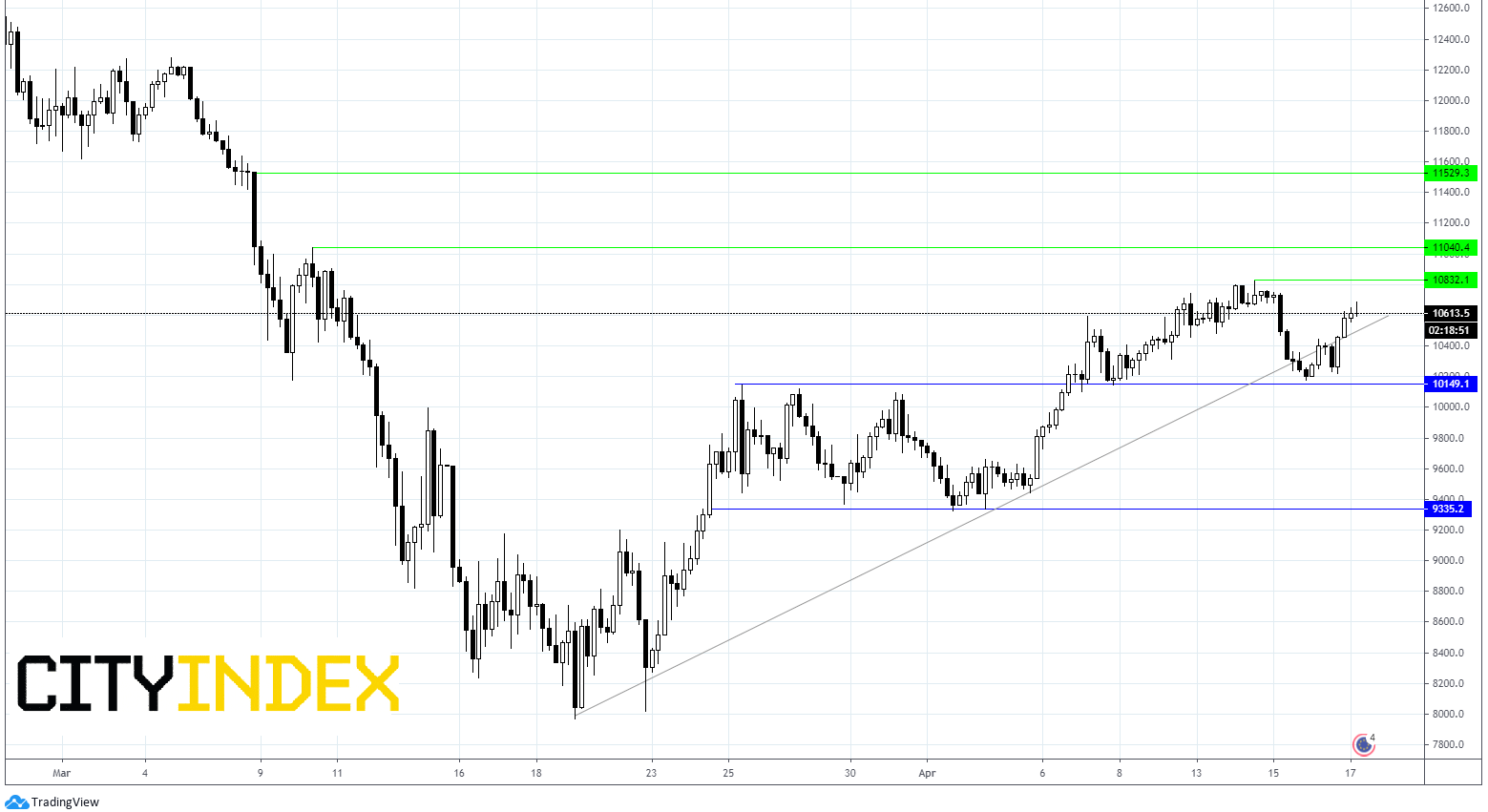

The Dax has jumped over 1% on the open. It remains above it ascending trend line in a bullish chart, after briefly dipping below earlier in the week.

Immediate resistance can be seen at 10830 (high 14th April) prior to 11040 (high 10th March) and 11530 (high 8th March)

Support can be seen at 10520 (trend line support) prior to 10150 and 9335.

Latest market news

Today 05:45 AM

Yesterday 11:09 PM

Yesterday 11:01 PM

Yesterday 04:00 PM

Yesterday 01:15 PM