European bourses are pointing to a subdued start to the week. Optimism surrounding China’s economic recovery is being offset by intensifying US – Sino relations, and fears of a second wave. Gold is surging.

Profits at Chinese industrial firms rose for a second straight month and at the quickest pace in over a year in June, boosting optimism surrounding the Chinese economic recovery following the coronavirus crisis.

According to the Chinese Statistics Bureau, profits at Chinese industrial firms jumped 11.5% yoy in June in the largest quarterly jump since March last year. The data adds to signs that the recovery is gaining momentum in China and comes after profits fell -12.5% in the January – June period.

The upbeat data comes as US – Chinese tension remain elevated following tit for tat moves that have seen the Chinese consulate in Houston closed and China takeover the US consulate in Chengdu.

Gold hits record high

Safe haven flows amid intensifying tensions, in addition to a weakening US Dollar have seen the value of gold soar. Gold hit an all time high on Monday to a peak of $1920.9, passing 2011’s high.

Safe haven flows, a weaker US Dollar, central bank stimulus and the prospect of additional US fiscal stimulus are lifting the precious metal, which also serves as a hedge against inflation. $2000 looks entirely achievable. Gold miners are expected to continue rising.

Fears that rising coronavirus cases in the US will undermine the fragile economic recovery are also dragging on sentiment and the US Dollar. Whilst the Euro’s newfound popularity continues to surge, even as Spain sees a spike in coronavirus cases.

Spain no longer “safe” Ryanair reports €185 million loss

The UK taking Spain off the safe travel list could see travel stocks under pressure at the start of the week, as it highlights the fluid nature of the pandemic and how vulnerable countries are to a second wave as soon as international travel ramps up a gear.

The UK taking Spain off the safe travel list could see travel stocks under pressure at the start of the week, as it highlights the fluid nature of the pandemic and how vulnerable countries are to a second wave as soon as international travel ramps up a gear.

These fears were highlighted by Ryanair as they experienced the most challenging quarter in its 35-year history after being forced to ground its fleet. Ryanair reported €185 million loss for the quarter as it carried just 500,000 passengers in the quarter compared to a usual 41.9 million. The firm confirmed that it restarted a meaningful service on 1st July, expecting to gradually ramp up its schedule to 70% by September. However, the fact that it refused to give any guidance for the remainder of the year hightlights the level of uncertainty that exists.

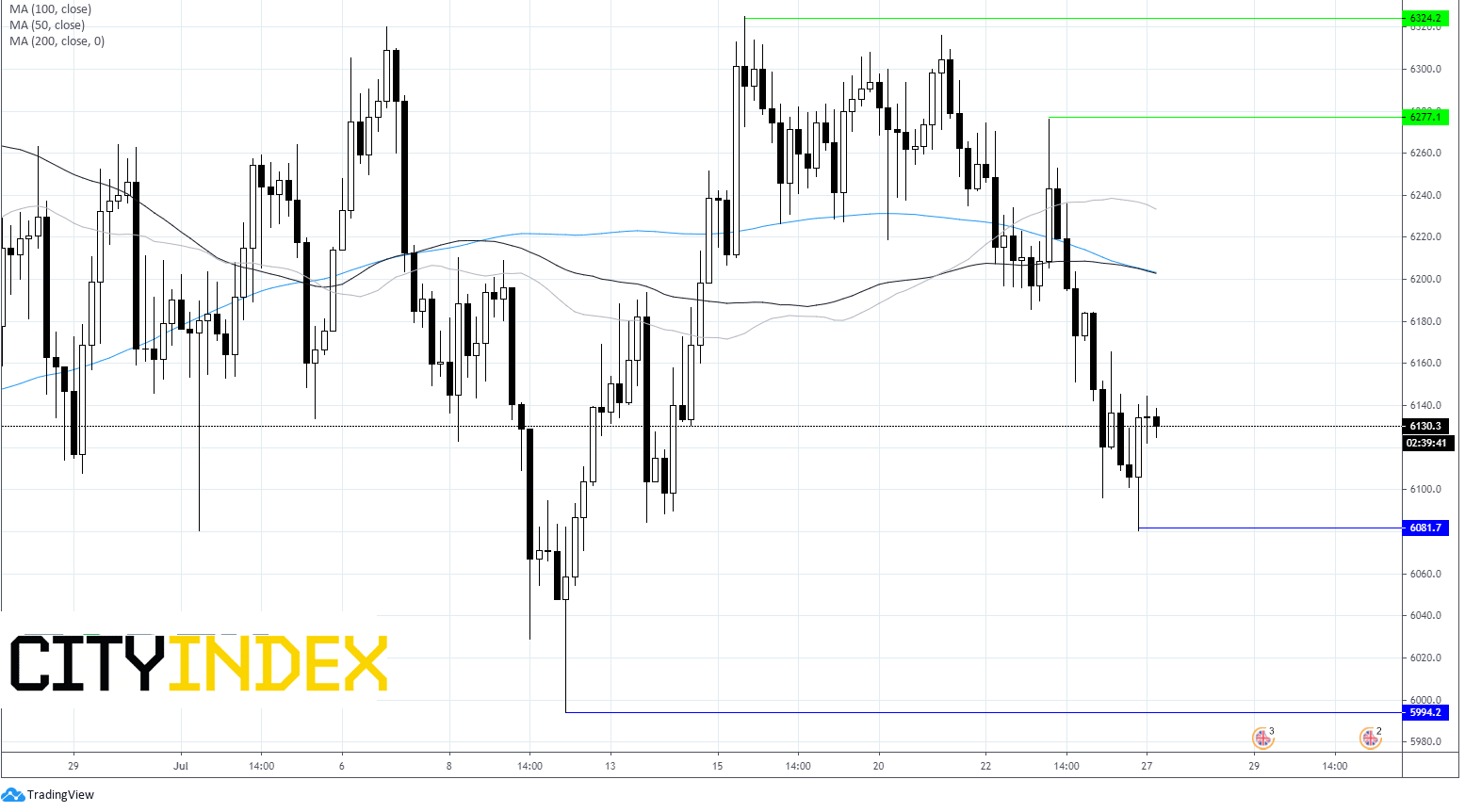

FTSE Chart

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM