After gapping about 20% higher as markets responded to the weekend attack on Saudi Arabia’s oil infrastructure — which reduced the nation’s oil output by more than half — oil prices have given back a significant chunk of those gains, although they still remain sharply higher on the day. The Saudi news also triggered a safe-haven response in the wider markets with gold rising and most stock indices and US index futures falling. Sentiment was hurt further by fresh signs that the ongoing US-China trade war was hurting activity at the world’s second largest economy. Industrial production in China rose by just 4.4% year-over-year in August compared with 4.8% in July and 5.2% expected. This was also the worst reading since February 2002. On top of this, retail sales growth slowed down again, this time to 7.5% compared to 7.6% in July and below expectations of 7.9%.

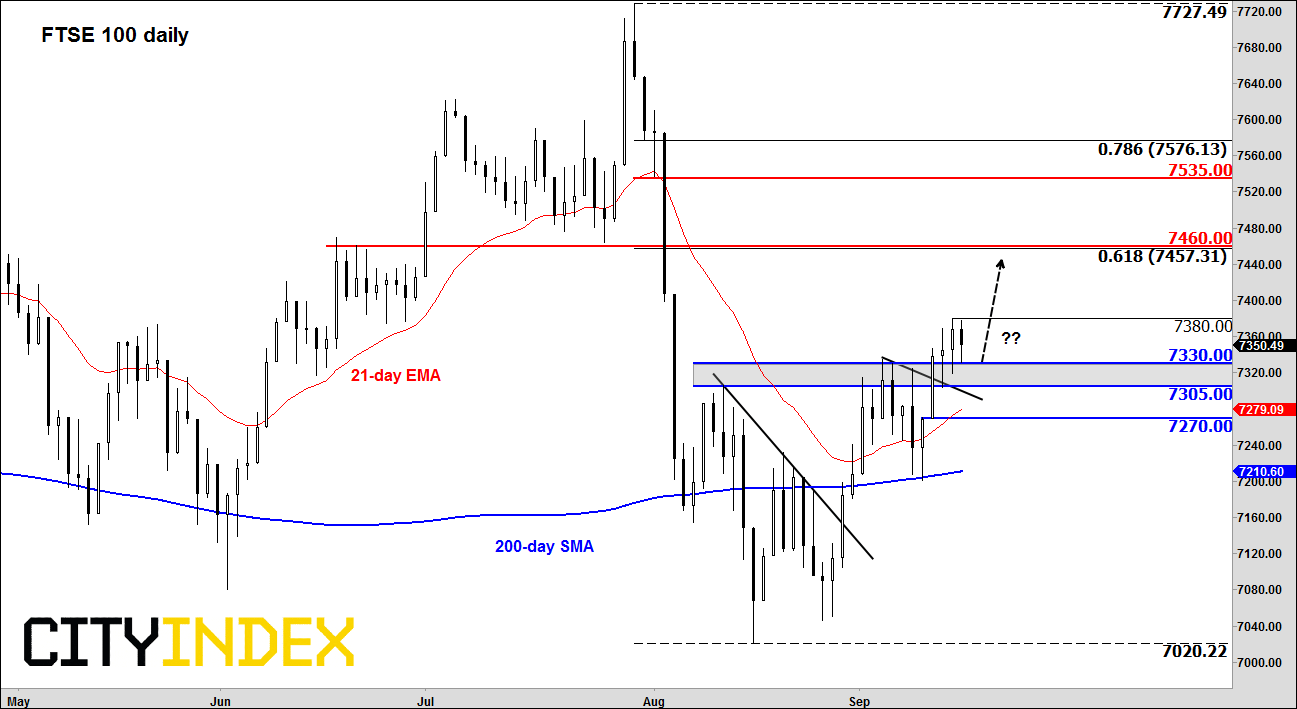

FTSE outperforms on oil, pound

Despite the latest slowdown signs in China and falls for global stocks in response to the Saudi news, the UK’s FTSE 100 managed to reclaim most of its lost ground before almost turning flat this morning. Other major indices were still lower at the time of writing, however. The FTSE’s relatively strong performance is hardly a surprise given that BP and Shell (both of which rose on the oil news) are among the heaviest weighted stocks in the index. However, stocks of insurance companies and International Consolidated Airlines Group fell, and that prevented the FTSE from rising more meaningfully. Also helping the FTSE was the fact that sterling eased off its monthly highs hit on Friday as the GBP/USD hit a key resistance area circa 1.2480 as investors awaited fresh Brexit-related headlines.

Oil attack implications

The oil attack means Saudi’s crude production capacity could be impacted for weeks and this could keep Brent prices and stocks of energy companies supported for a while. However, OPEC’s other members will be more than happy to step up production to make up for some of the short falls in Saudi’s regular crude production. US President Donald Trump has meanwhile already authorised the release of US reserves and this has helped to lower prices following the big spike overnight. However, the longer-term impact is unclear at the moment and depends on how severe or otherwise the damage is going to be. Also, with the US suggesting that Iran could have been behind the attack, there is a small risk that this could turn to something much bigger in the region, possibly involving US military action. However, if this turns out to be a one-off attack and everyone is convinced that it was indeed the Houthi rebels rather than the Iranian government, then in that case the situation could calm down pretty quickly.

Fed in focus

Source: eSignal and City Index.