The German DAX index was one of the weakest performers earlier in the day, but along with global markets its has since bounced back as Wall Street hit a new record. German stocks have been pushing higher in recent times owing, in part, to the ECB’s decision to restart QE. With the US and China agreeing to a phase one deal, investors are also hoping that German exports to China could rebound in 2020. So, the DAX looks poised to extend its recovery and it may even be able to surpass its previous record high hit in January 2018.

Source: Trading View and City Index.

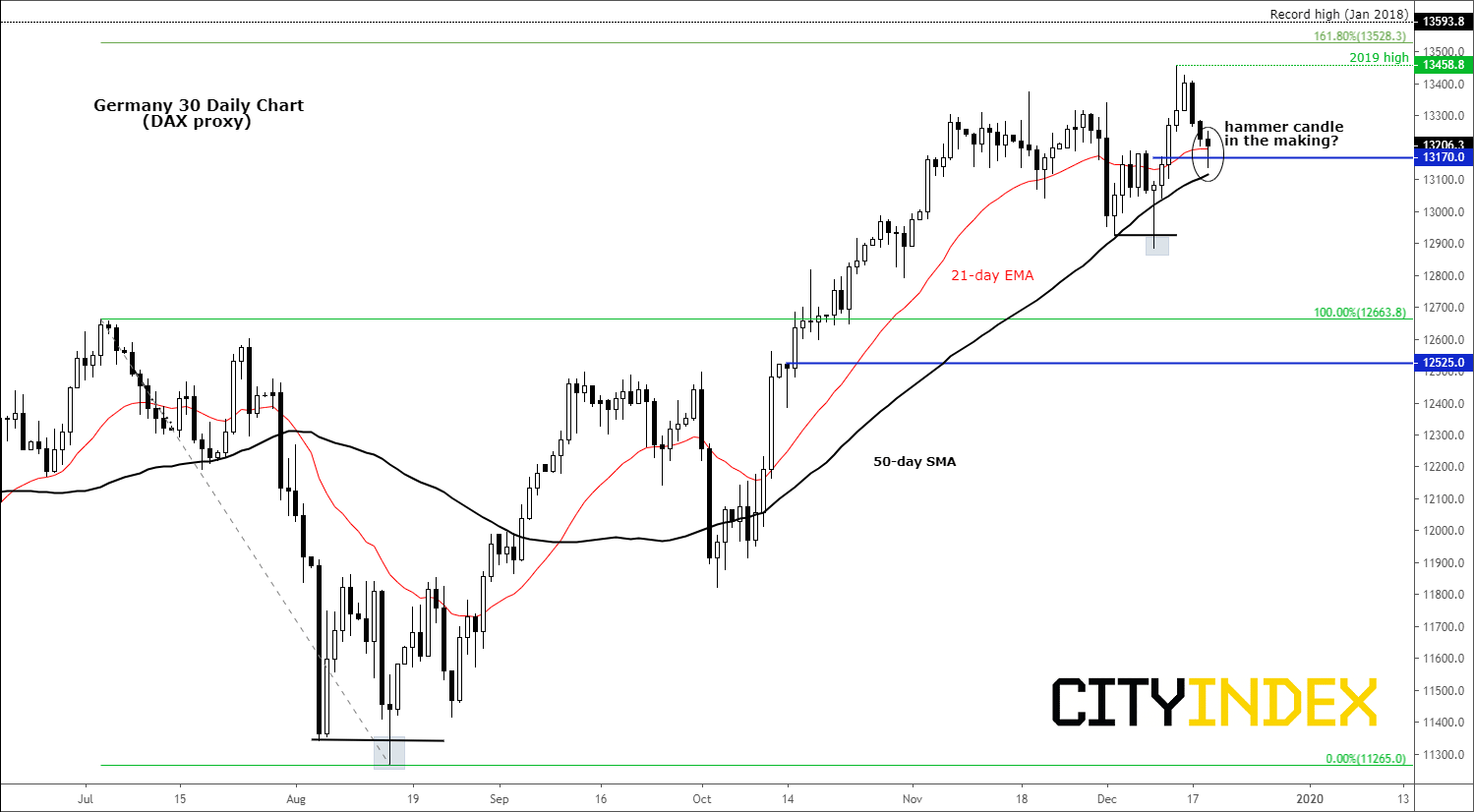

Indeed, the DAX currently looks in good health from a technical point of view as it resides comfortably above its major moving averages, including the 50- and 200-day (not shown on the chart). In fact, the index has managed to find support from its faster moving 21-day exponential average and support around 13170 today. If the index futures continue to push higher this evening, then we will end up with a hammer-like candle. This could trigger fresh buying momentum as we head towards Christmas and year-end. Ahead of the prior record high of 13596, a couple of levels to watch include the high from last week which is also the current 2019 peak at just below 13460, followed by the 161.8% Fibonacci extension level at just below 13530.