Santa Claus rally takes a breather in thin volume

There will be no further updates on the City Index site until Wednesday, January 2, 2013. The Santa Claus rally has seen the UK and […]

There will be no further updates on the City Index site until Wednesday, January 2, 2013. The Santa Claus rally has seen the UK and […]

There will be no further updates on the City Index site until Wednesday, January 2, 2013.

The Santa Claus rally has seen the UK and US stock indices pull back during a week of thin volume. Traders are preparing for the festive holidays and some say that until the Fiscal Cliff is out of the way it may be prudent to sit on the side before establishing large positions. However some short term traders are still seeking intraday moves to capture smaller moves and with a few more days ahead before closing out 2012, there could still be some opportunities to see a move above the key resistance levels. Whilst the overall trend remains bullish, December could continue to push higher despite the pullback. See key levels below:

FTSE 100 retests 5900 level

Now that the FTSE 100 is above the 5900 resistance level the index has pulled back to test this level which could now prove a support base. With the bullish trend intact the index may reach for the 6000 level next week. But traders should note that if upside volume does not pick up and the FTSE 100 continues to pull back lower then we may see the index dip below 5900 and test 5830 before finding further support and then attempt to head higher. Deeper retracements should not be ruled out as trading volume becomes thinner into next week. Buying the dips may provide short term opportunities to 6000.

Dow Jones must clear 13338 level

If the Dow Jones index is to remain bullish the ideal situation would be to clear past 13338 by next week. So far the index has failed to get above this level for this past week. If Friday can see buyers come in then we may just set the stage for next week to tackle the upside targets. Here too the momentum remains bullish unless we see further declines but support levels at 13000 will need to hold and prevent the index from falling further. As December is generally a positive month historically, the current pullback may just keep the bears away a little longer.

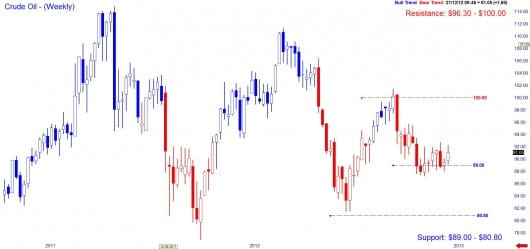

Crude Oil holds above $89.00

Earlier this week the price of Crude Oil looked fragile. By testing support at $89.00 the commodity showed signs of weakness but has so far managed to hold onto the short term level. Going into next week we would like to see Crude Oil trade above this week’s high to prove that the support level of $89.00 is valid. A failure to hold here may see oil drop sharply back to the$80.80 level and with the trend remaining overall bearish this scenario could become likely if weakness continues into the year end. But for now as long as oil is above $89.00 we could see $93 – $95 as an objective.