Sands China (1928.HK) Needs to Break Above Corrective Channel for a Further Upside

Sands China (1928), an integrated resort operator, said it swung to a net loss of 180 million dollars in April from a net profit of 148 million dollars in the prior-year period, and adjusted property EBITDA loss totaled 105 million dollars, compared with an adjusted property EBITDA of 239 million dollars last year.

Recently, Investment Bank Morgan Stanley projected that there would be a partial removal of restrictions by mid-Jun, by then there will be resilient demand from Chinese gamblers.

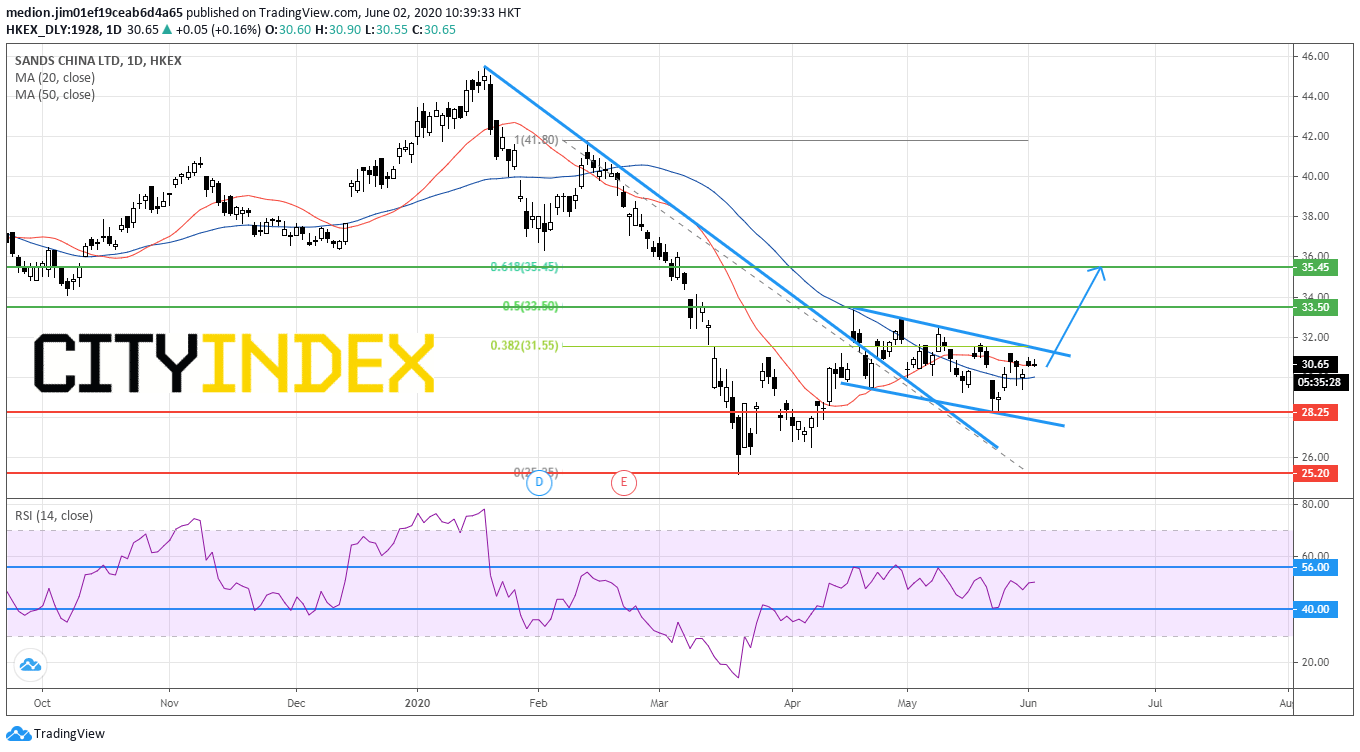

From a technical point of view, the stock remains trading within the corrective channel after breaking the declining trend line drawn From January top. The 50-period moving average is flattening, while the RSI stays within the range between 40 and 56. Both indicators would indicate the lack of momentum for the prices.

Therefore, the stock is needed to break above the recent corrective channel to enhance the bullish outlook. Otherwise, the stock would continue its consolidation phase.

The resistance levels would be located at HK$33.50 (the April high and 50% retracement between February top and March low) and HK$35.45 (61.8% retracement between February top and March low). The support levels would be set at HK$28.25 (the bottom of May) and HK$25.20 (the low of March).

Source: GAIN Capital, TradingView

Recently, Investment Bank Morgan Stanley projected that there would be a partial removal of restrictions by mid-Jun, by then there will be resilient demand from Chinese gamblers.

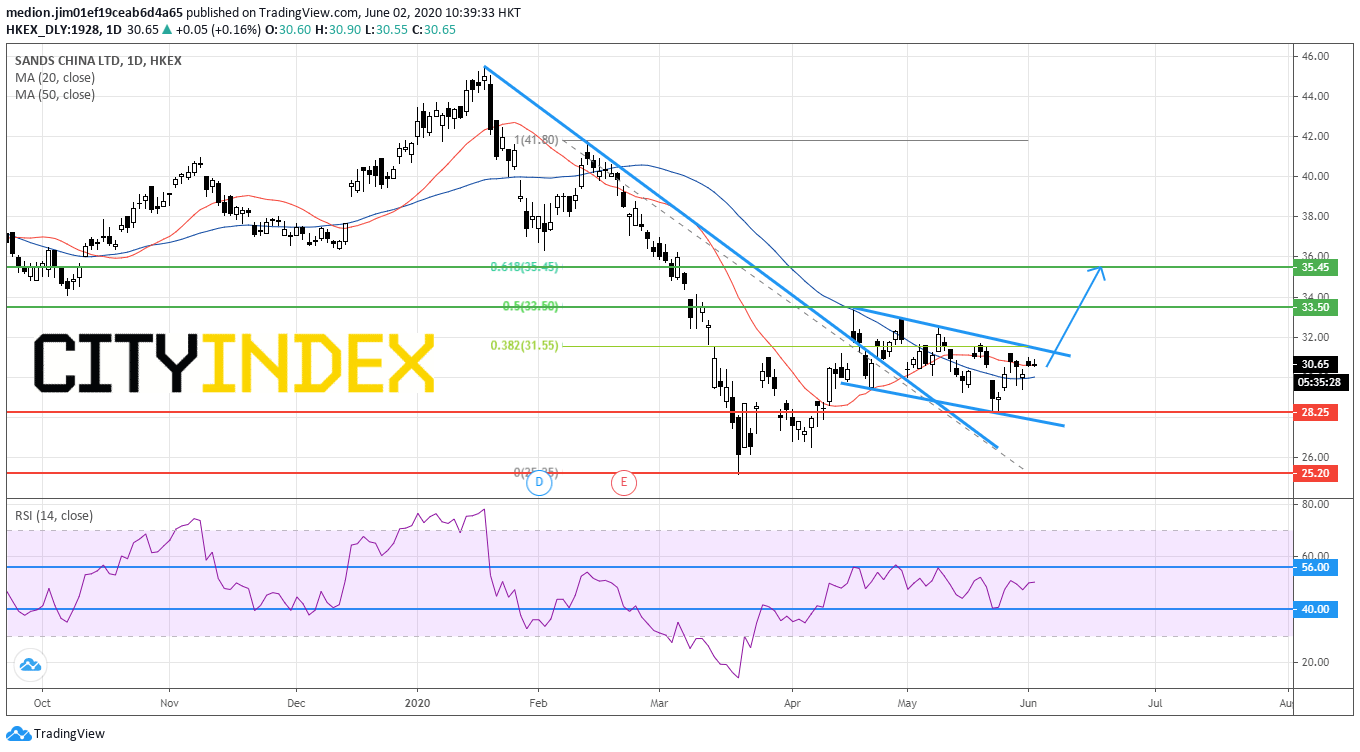

From a technical point of view, the stock remains trading within the corrective channel after breaking the declining trend line drawn From January top. The 50-period moving average is flattening, while the RSI stays within the range between 40 and 56. Both indicators would indicate the lack of momentum for the prices.

Therefore, the stock is needed to break above the recent corrective channel to enhance the bullish outlook. Otherwise, the stock would continue its consolidation phase.

The resistance levels would be located at HK$33.50 (the April high and 50% retracement between February top and March low) and HK$35.45 (61.8% retracement between February top and March low). The support levels would be set at HK$28.25 (the bottom of May) and HK$25.20 (the low of March).

Source: GAIN Capital, TradingView

Latest market news

Today 01:15 PM

Today 07:49 AM

Today 04:24 AM