Ryanair, the airline group, announced that full-year net income dropped 26.7% on year to 649 million euros while operating profit rose 10.3% to 7.37 billion euros on operating revenue of 8.49 billion euros, up 10.4%. The company had cut its weekly cash burn to a little more than 60 million euros in May from about 200 million euros in March, showing that things might be under control.

Regarding the outlook, the company stated: "Group expects to record a loss of over E200m in Q1, with a smaller loss expected in Q2 (peak summer) due to a substantial decline in traffic and pricing from Covid-19 groundings. The Group currently expects to carry less than 80m passengers in FY21 (almost 50% below its original 154m target). Ryanair's return to scheduled flying will be rendered significantly more difficult by competing with flag carrier airlines who will be financing below cost selling with the benefit of over E30bn in unlawful State Aid, in breach of both EU State Aid and competition rules."

The company has confirmed that up to 3,250 jobs could be slashed while staff could face 20% pay cuts.

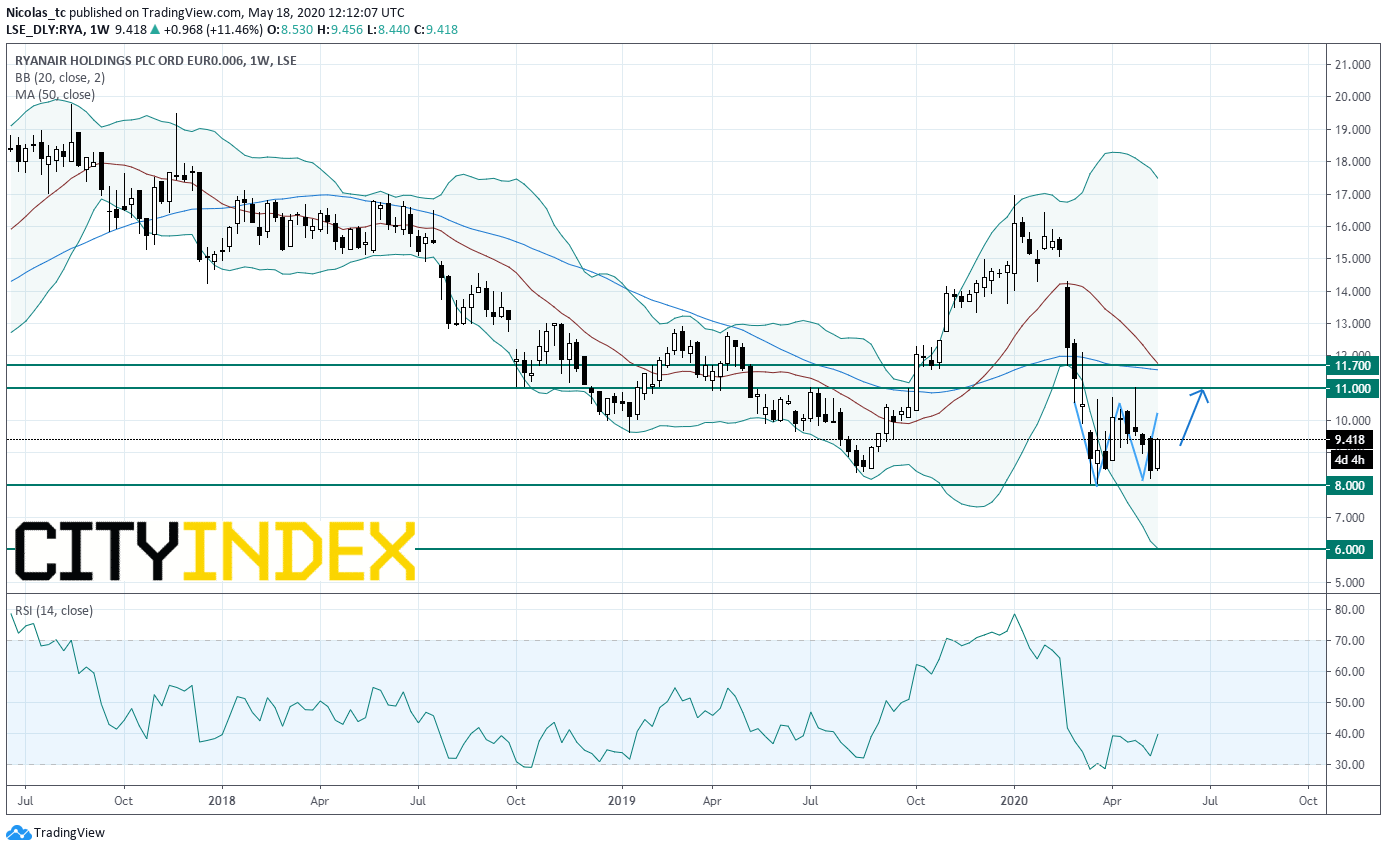

From a technical perspective, a key support base has formed at 8E and has allowed for a temporary stabilization. A potential double bottom pattern is taking shape (reversal up trend pattern), however not yet validated. The weekly Relative Strength Index (RSI, 14) has landed on its oversold are at 30% and is reversing up.

As long as 8E is support, a rebound towards 11E can be expected.

Caution: a break below 8E would deliver a strong sell signal with 6E as main target.

Source: GAIN Capital, TradingView