Royal Mail Earnings Preview | Royal Mail Shares Price | Royal Mail Shares

When will Royal Mail release full-year results?

Royal Mail will release full-year results on the morning of Thursday May 20. This will cover the 12 months to the end of March 2021.

Royal Mail earnings consensus: what to expect

What a difference 12 months can make. A year ago, Royal Mail shares were only just starting to recover after hitting record lows in April 2020, having lost its allure with investors for a variety of reasons. Its chairman admitted Royal Mail had not adapted quick enough to the fundamental shift toward more parcels and fewer letters. Its CEO had abruptly quit less than two years into the job after overseeing a plunge in profits and a drawn-out dispute with trade unions. Jobs and expenditure were being cut and dividends were suspended.

Today, it is a different story. Royal Mail is now making more money sending parcels up and down the country rather than letters, partly thanks to the shift to online shopping during the pandemic, and its current chief executive Simon Thompson, a former executive of tech-savvy Ocado, has put this transformation at the heart of his ambitions for the company. As a result, revenue and profits should both soar this year.

Royal Mail said in March that revenue for the year would be up more than £900 million from the £10.84 billion delivered in the last financial year, implying a figure of at least £11.74 billion, but analysts are expecting the company to significantly beat that figure with estimates closer to £12.5 billion.

It said adjusted operating profit should be around £700 million, more than double the £325 million reported the year before. A Reuters-compiled consensus shows analysts are expecting that to feed through to the bottom-line, forecasting strong rises in both adjusted and statutory profits.

|

Royal Mail Earnings Consensus |

FY2019/20 |

FY2020/21e |

|

Revenue |

£10.84 billion |

£12.51 billion |

|

Adjusted Pretax Profit |

£275 million |

£626.3 million |

|

Reported Pretax Profit |

£180 million |

£567.9 million |

Royal Mail has also announced that it will make a one-off dividend payment of 10.0 pence per share for the financial year on September 6 to shareholders on the register on July 30. This will be the first one-off payout to be made by the company since going public in 2013 and Royal Mail intends to outline a brand new dividend policy when it releases its results to give investors an idea about what sort of returns they can expect going forward as the business continues to transform itself.

The swift turnaround in fortunes has seen Royal Mail shares treble over the past year, making it the fifth best performing stock in the FTSE 250 during the period.

Still, while things have improved significantly for Royal Mail over the last year, there remains significant challenges for the 500-year old business to overcome to make sure it can compete with today’s rivals spanning from traditional competitors like DPD, Hermes and FedEx to the likes of Amazon.

Most of the concerns stem from its UK business. Its international arm, GLS, has been the driver of results recently. GLS has seen revenue double since 2016 thanks to its focus on parcels and although it only accounts for about one-third of Royal Mail’s total revenue it contributes about half of its operating profit. A new plan was recently unveiled for GLS, which should see its revenue grow by a compound annual growth rate of around 12%, operating profit more than double, and generate over EUR1 billion in free cashflow between the last financial year and 2025.

While the pandemic has helped accelerate the domestic business shift to parcels from letters, there are still concerns over the amount of work needed to ensure Royal Mail doesn’t fall behind and how much it will cost. This includes establishing new parcel hubs and adopting more automation without reigniting tensions with trade unions. Thompson is scheduled to provide a detailed update on the UK business alongside the results in the hopes it can provide a firm growth strategy like it did for GLS.

Where next for the Royal Mail share price?

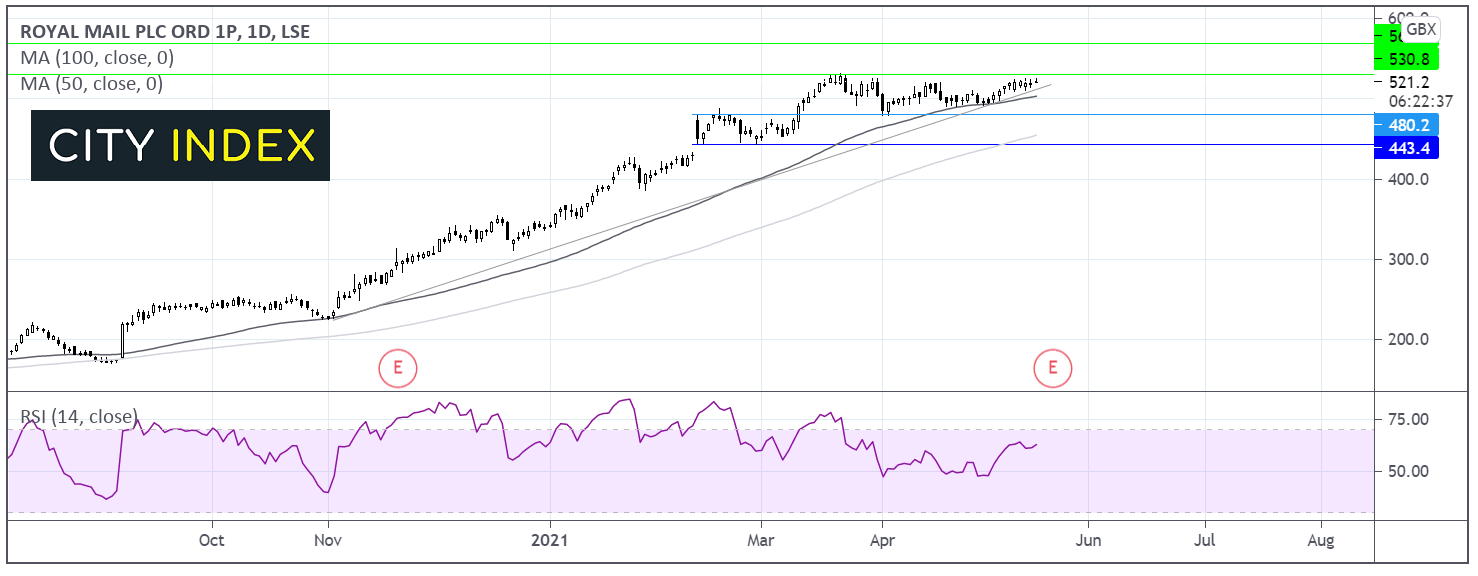

Royal Mail has been trading in a firm uptrend since early November. The Royal Mail share price trades above its multi-month ascending trendline and its 50 & 100 sma on the daily chart.

The RSI is pointing northwards and in bullish territory, but not yet overbought suggesting that here could be more upside to come.

Buyers need to break above resistance at 330p a two year high reached in March in order to extend gains towards 570p a level last seen in February 2018.

It would take a move below the 50 sma at 500p to negate the near term uptrend and bring 480p into target. A move below this level could see the sellers gain traction and target 440p the March low.

How to trade Royal Mail shares

You can trade Royal Mail shares with City Index by following these four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Royal Mail’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade