Royal Dutch Shell under pressure after Q2 trading update

Royal Dutch Shell's profitability is being eroded by the impact of the coronavirus pandemic on the industry. Shell increases write-downs from $15 billion to $22 billion after tax to recognize the colossal impact of the crisis on demand for oil. The company said: "Oil Products sales volumes are expected to be between 3,500 and 4,500 thousand barrels per day”.

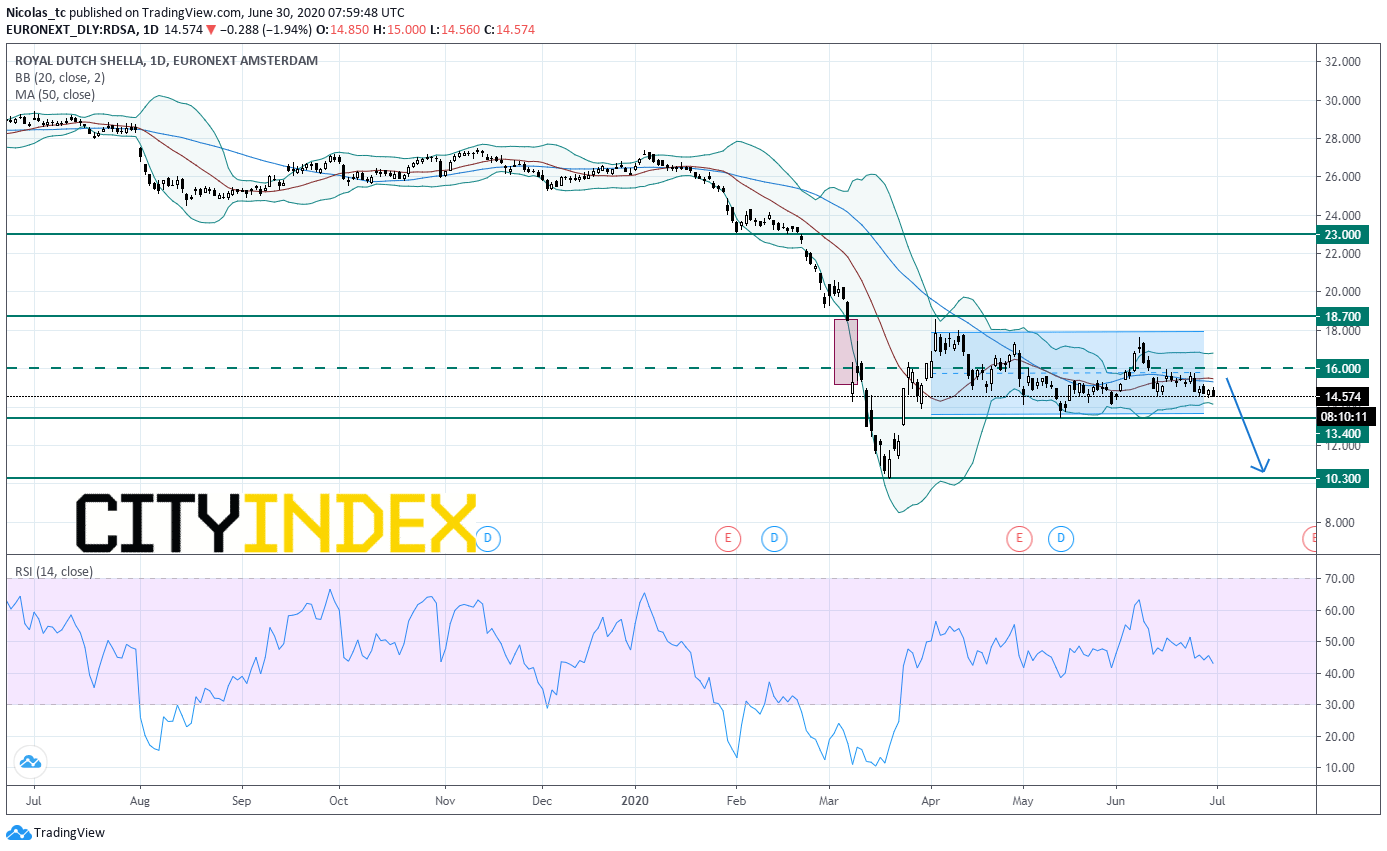

From a chartist’s point of view, the stock price remains stuck in a short term trading range between 18.7E and 13.4E. The bearish gap opened on the 9th of March still maintains a downward pressure. The daily Relative Strength Index (RSI, 14) is below its neutrality area at 50%. The stock price just fell below its 20/50DMAs. As long as 18.7E is resistance, the risk of a break below 13.4E will remain high. A break below 13.4E would trigger a bearish acceleration towards March low at 10.3E. Only a push above 18.7E would reverse the downtrend.

Source: GAIN Capital, TradingView