Rolls-Royce shares down after trading update

The company sticks to guidance. “We continue to expect the Group to turn cash flow positive at some point during the second half of 2021, (...) Our target to deliver at least £750 million free cash flow (excluding disposals) as early as 2022 is also unchanged."

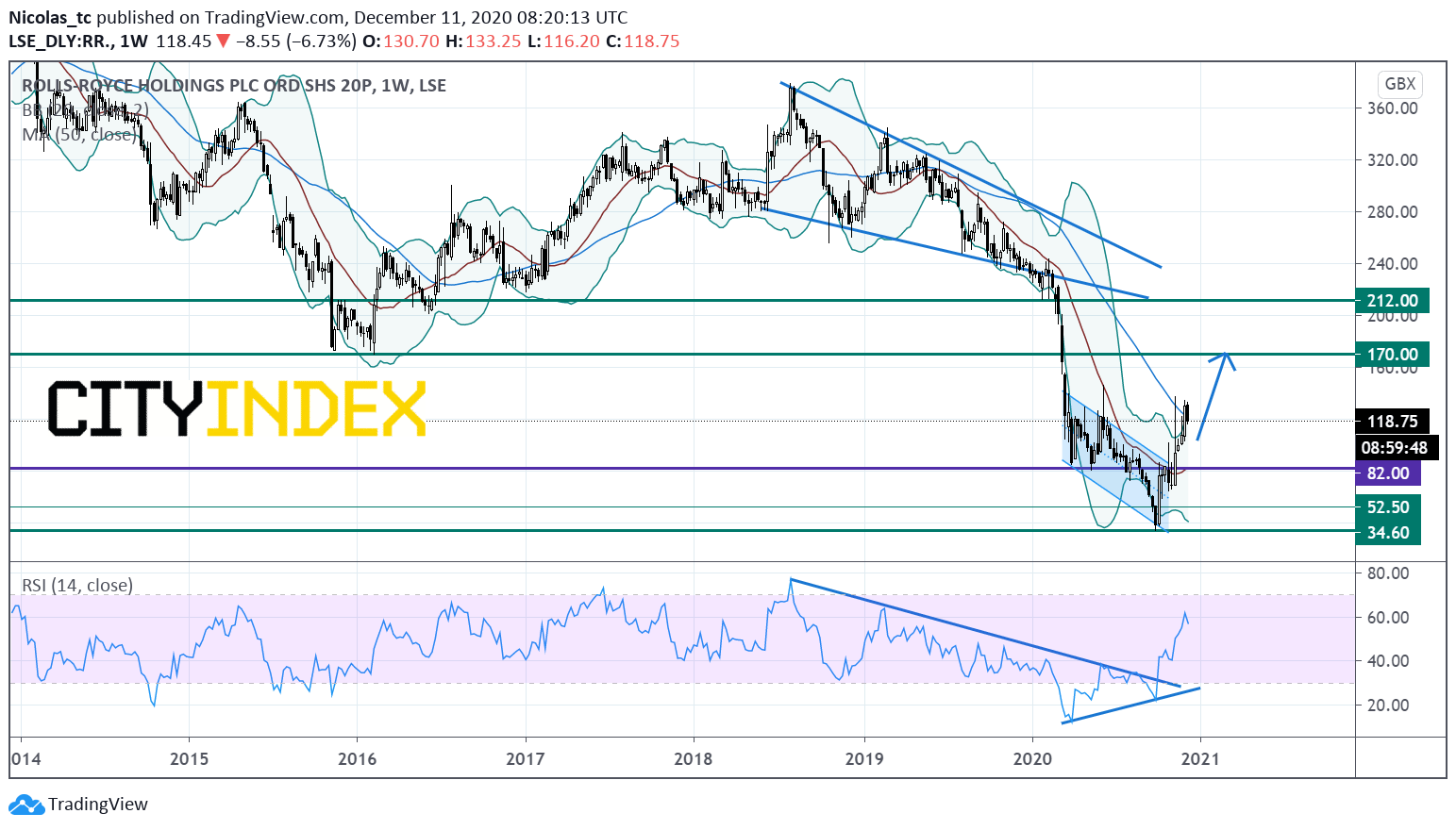

From a chartist point of view, the stock price remains in a medium term bearish trend. However, the stock is showing signs of reversal. Prices escaped from a downward-sloping channel. In addition, the weekly RSI (14) validated a bullish divergence (bullish event). The 20WMA is turning up. Readers may look to take advantage of any pullback in the stock price that may surface. As long as 82p is support, a rise towards the key horizontal resistance at 170p (overlap) is likely. Alternatively, a break below 82p would invalidate the bullish view and would call for a test of the former low at 34.6p.

Source: TradingView, Gain Capital