RISK ON!!

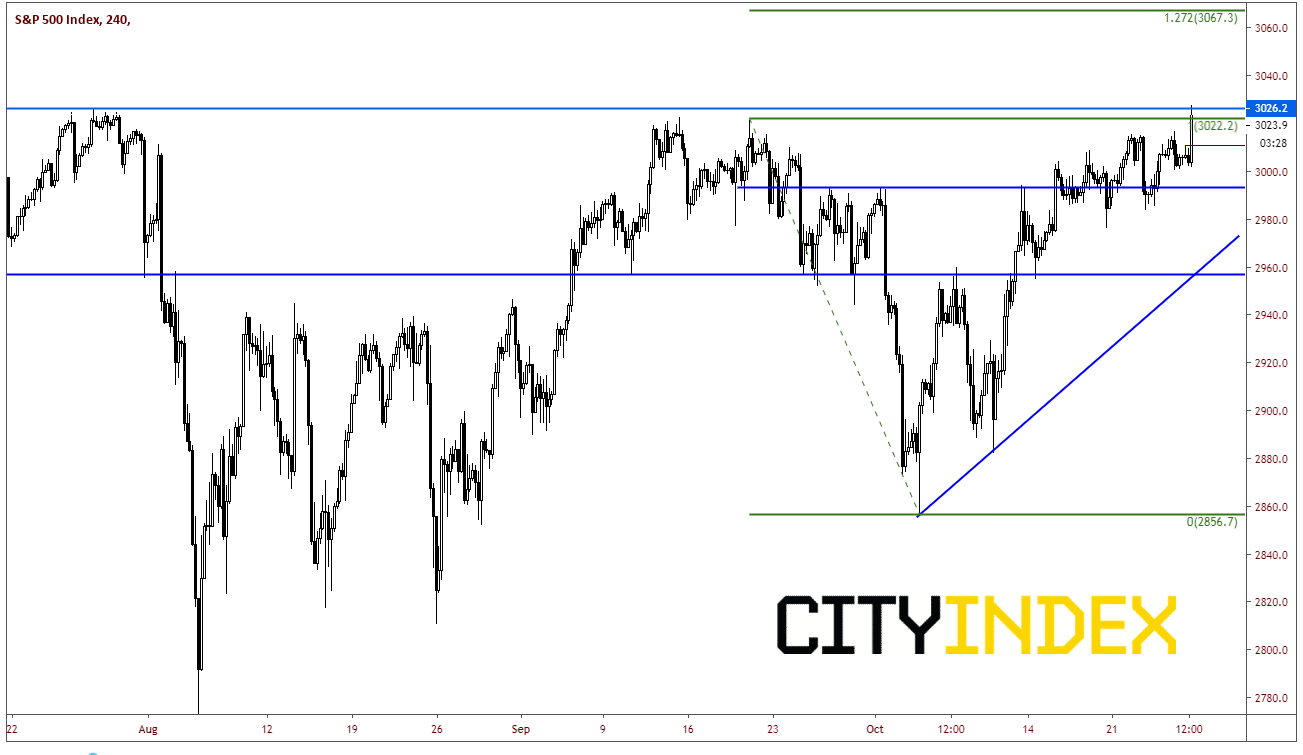

In what was thought to be a slow Friday as we wait for the plethora of data, earnings, and FOMC meeting next week, stock Indices are trading at or near all time highs today as the USTR said they are close to finalizing some sections of the trade deal. Conversations are continuing and will be ongoing. Afterwards, President Trump also stated that China will be buying more agriculture products and that they want a deal “Very badly”. The S&P500 cash index made all time highs today and the futures are right behind, with today’s high just 3 handles off the all-time highs. First target for SPX 500 (cash index) is 3067, which is the 127.2% extension from the September 19th highs to the October 3rd lows. First support comes across at Wednesday’s highs near 3010.

Source: Tradingview, City Index

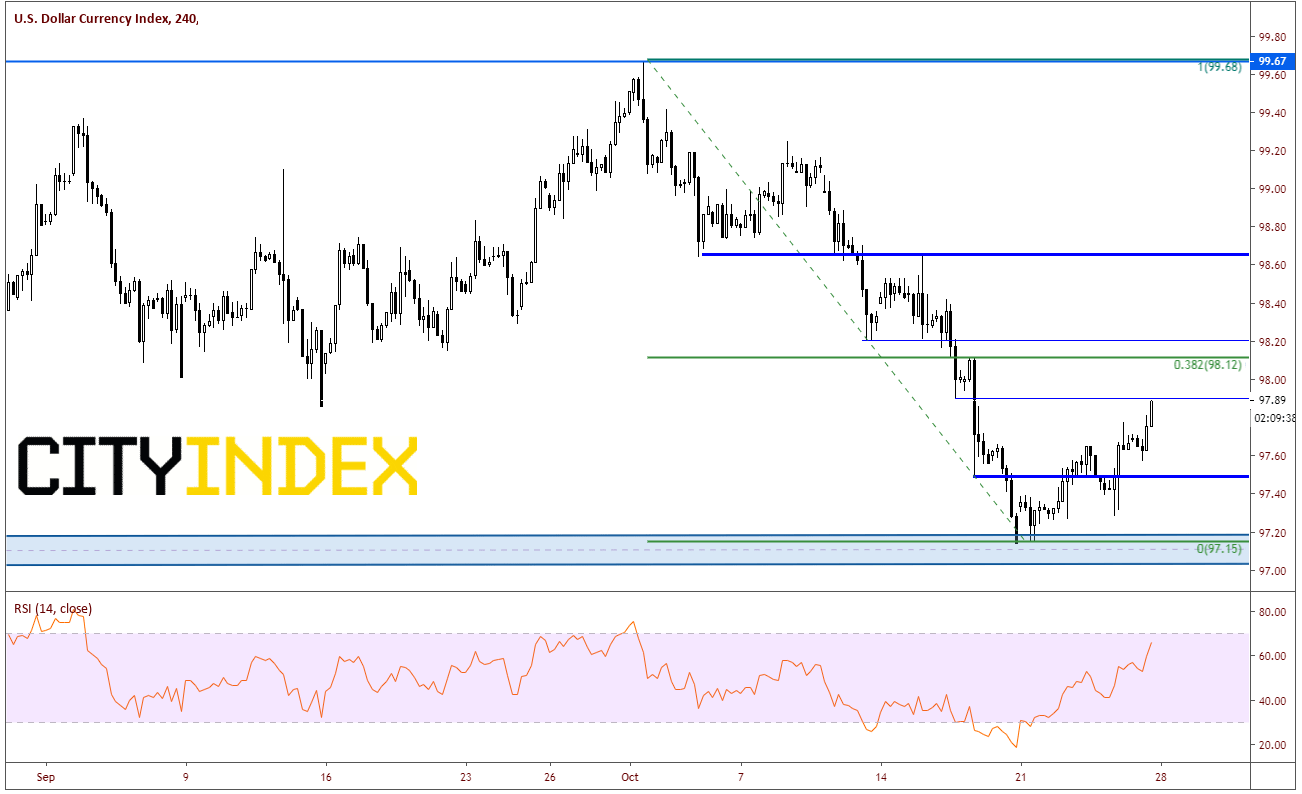

The DXY is also rebounding from last week’s wicked selloff towards horizontal resistance at 97.88 and the 38.2% retracement from the October 1st highs to the October 18th lows at 98.12. Support comes in on the day at 97.50.

Source: Tradingview, City Index

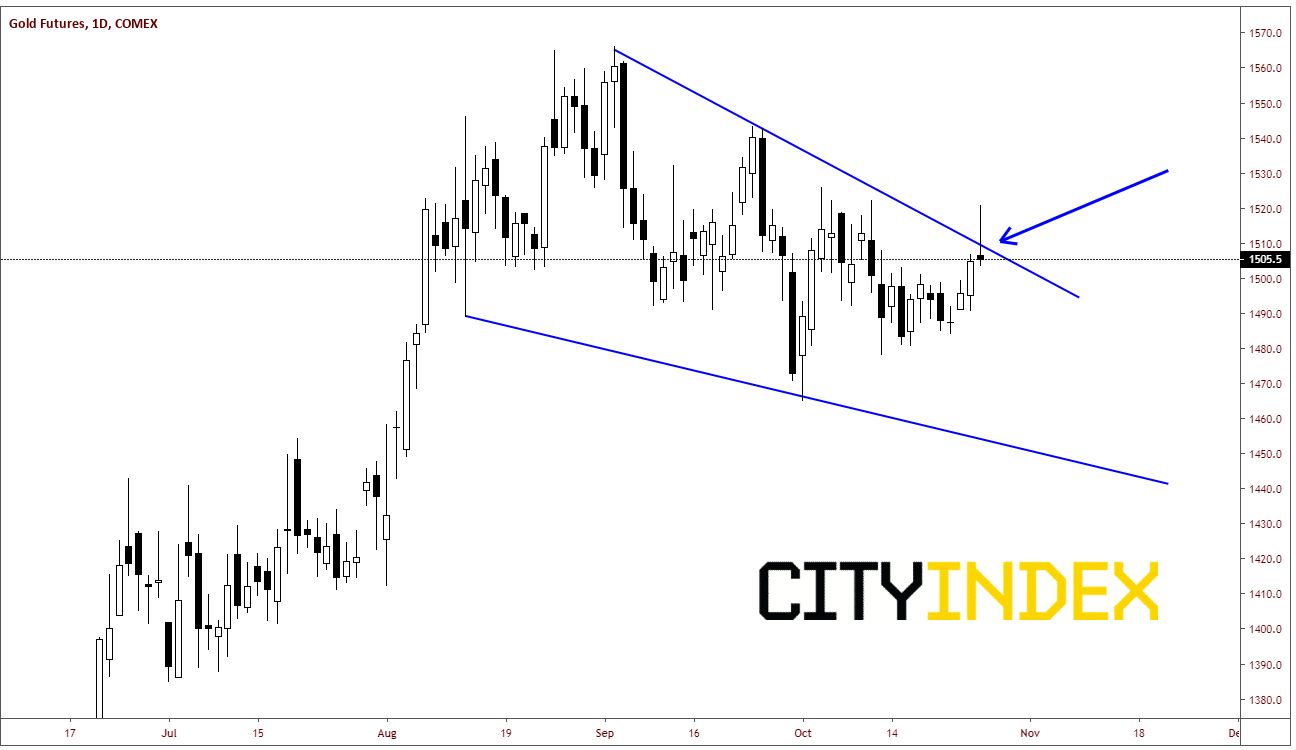

As a result, Gold futures are near unchanged on the day at 1505. The precious metal was trying to break out of a bullish pattern (either a descending wedge or flag) and was up as much as $14.50 before pulling back to unchanged. If gold were to close below 1505, the daily candlestick would be a shooting star or inverted hammer, both of which have reversal implications.

Source: Tradingview, City Index, COMEX

The expectations are now set that “something” will be done regarding Phase One of the US-China trade war. Watch for more headlines over the weekend and early next week. In addition, keep in mind the looming announcement of a Brexit extension, as well as economic data, including NFP on Friday, more earnings, and the FOMC meeting on Wednesday. We may see some volatility next week!