Risk Off/Risk On - Markets pare Losses from Asian Open

Risk off was the theme to start the day as stocks gapped lower on the open, continuing Friday’s selloff. However, as Trump and China traded tweets during the European session, markets bounced and are now trading higher at the US open. Markets seem to have ignored negative data today, including Germany’s IFO, which came in weaker than expected. As for US Durable goods, although the headline number came in better than expected for July (2.1% MoM vs 1.1% MoM expected), the more important Core Durable goods came in much worse (-0.4% MoM for 0.1% expected). As such, markets this morning seem to be focused on only one thing: the trade war.

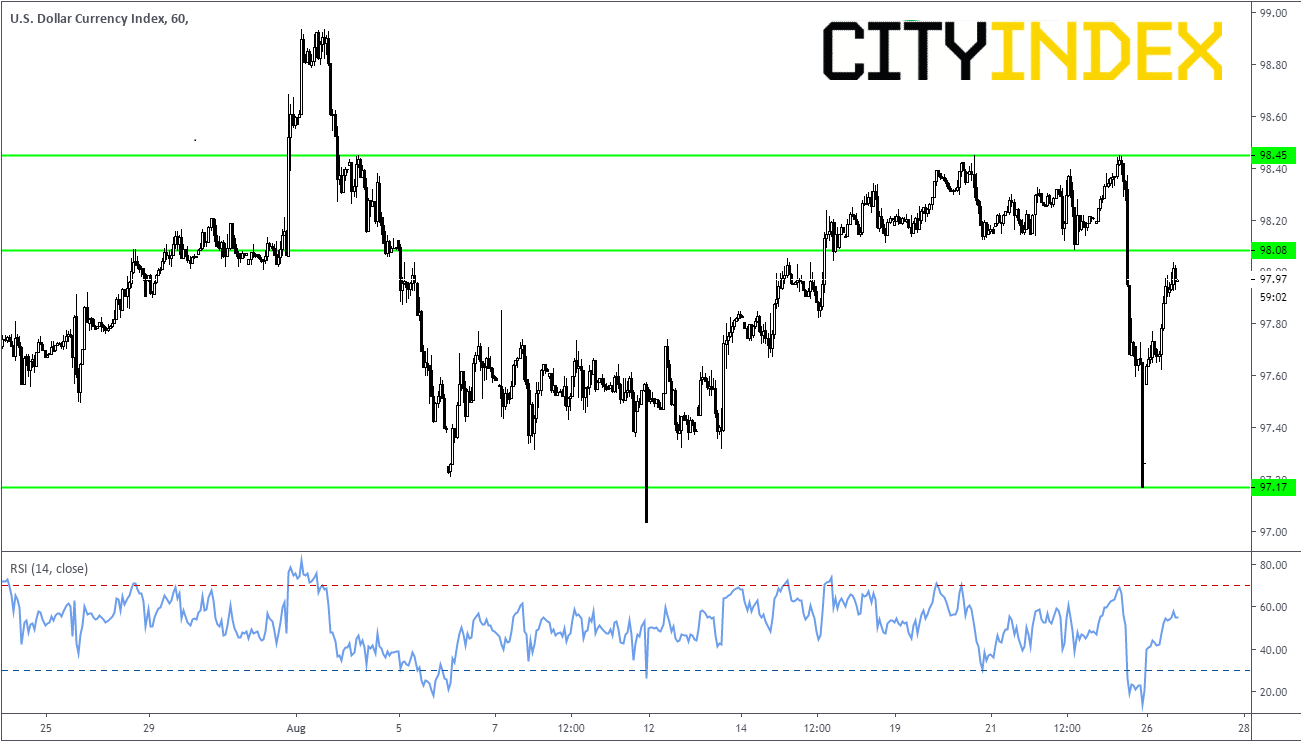

DXY led on the upside, opening at 97.53 after closing near 97.20 on Friday. Initial horizontal resistance at 98.08, and above that at Friday’s highs at 98.45

Source: Tradingview, City Index

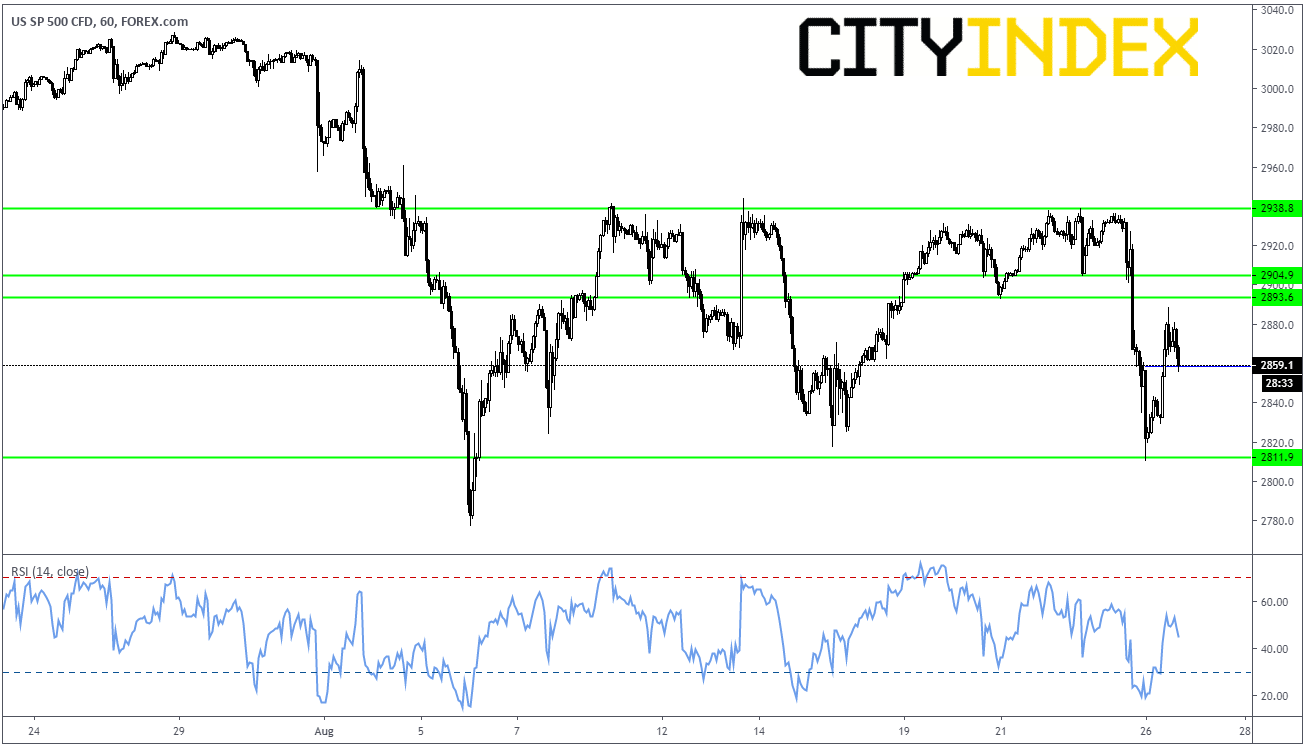

S&P 500 is 40 handles off the lows earlier. First support will at Friday’s highs at 2856.60. Below that, watch for overnight lows at 2810.30. Initial resistance comes in at 2904, then horizontal resistance that the market hasn’t been able to push through at 2938.80.

Source: Trading View, City Index

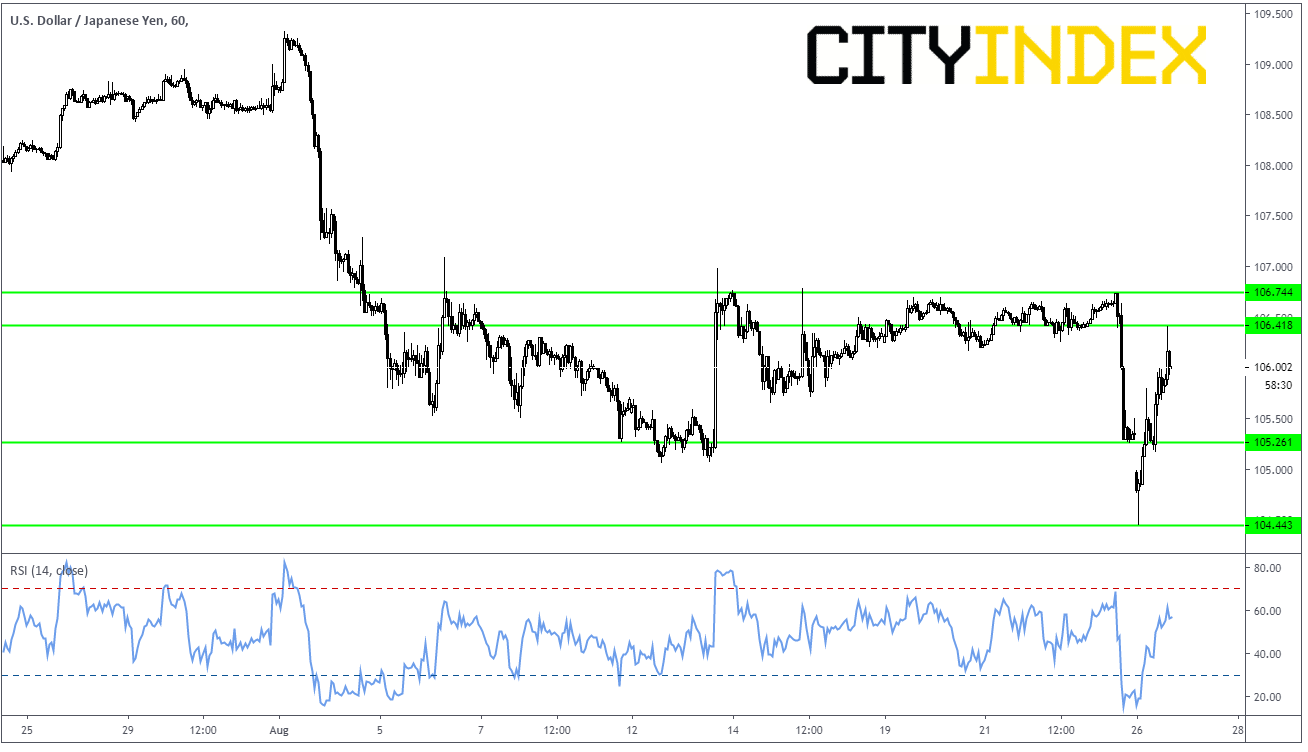

USD/JPY also gapped down on the open, almost 80 pips, however has since rebounded and is currently up 68 pips near 106.00. Initial horizontal resistance 106.41. Next level is 106.75, which is the highs from Friday. Support is all the way down at the intraday lows near 104.50.

Source: Tradingview, City Index

Keep a close eye out for headlines this morning! With UK on public holiday, as well as with many traders on vacation (last week of summer), we could see some volatility today!