European bourses are pointing to a deep sell off on the open. News that President Trump has tested positive for COVID-19 has put the safe haven trade into overdrive. Investors are dumping riskier assets and currencies such as stocks, EUR and AUD in favour of safe haven assets such as the, the Japanese Yen, US Dollar and Gold.

The degree of economic and political fallout will depend on the severity of the ill. There is of course, a protocol for everything. However, the overriding fear for investors is the impact that Trump testing positive for COVID could have on the US Presidential Elections. This election already had a cloud of uncertainty hanging over it as Trump has refused to say whether he will accept the final vote and has also said that the final result may not be known for months. The markets are already fretting about an uncertain election and his just adds another layer of uncertainty, favouring the risk off trade until there is more clarity.

Adding to the down beat mood in the market, was the lack of a bipartisan US stimulus. The Democrats passed the $2.2 trillion stimulus package, which the Republicans rejected. With Trump out of office uncertainty surrounding additional stimulus is also on the rise.

Brexit trade talks going no-where?

Sticking with the theme of uncertainty, Brexit talks are according to Michael Gove are making little progress. With significant divisions still between the two sides as the 9th round of talks come to an end, the chances of entering into an in tense round of talks next week to finish this off seems highly unlikely, which is reflected in the weaker Pound. The FTSE 250 which is more domestically focus could remain under pressure until there is more clarity over the likelihood of a post Brexit trade deal, particularly as

Sticking with the theme of uncertainty, Brexit talks are according to Michael Gove are making little progress. With significant divisions still between the two sides as the 9th round of talks come to an end, the chances of entering into an in tense round of talks next week to finish this off seems highly unlikely, which is reflected in the weaker Pound. The FTSE 250 which is more domestically focus could remain under pressure until there is more clarity over the likelihood of a post Brexit trade deal, particularly as

NFP in focus

Attention will now turn to the US non-farm payroll report. Without additional stimulus the recovery in the US labour market has continued but at a slowing pace. Expectations are for 850k new jobs to have been added in September. This is weaker than August’s 1.37 million. The closely watch US jobs report also has a political component this month, as the last NFP report before the elections. Whilst Trump has be supported by solid macros data for the first three years as President, that change significantly with the pandemic.

Given the better than expected ADP report, there is a good chance that the NFP will beat expectations, which could be beneficial for risk sentiment.

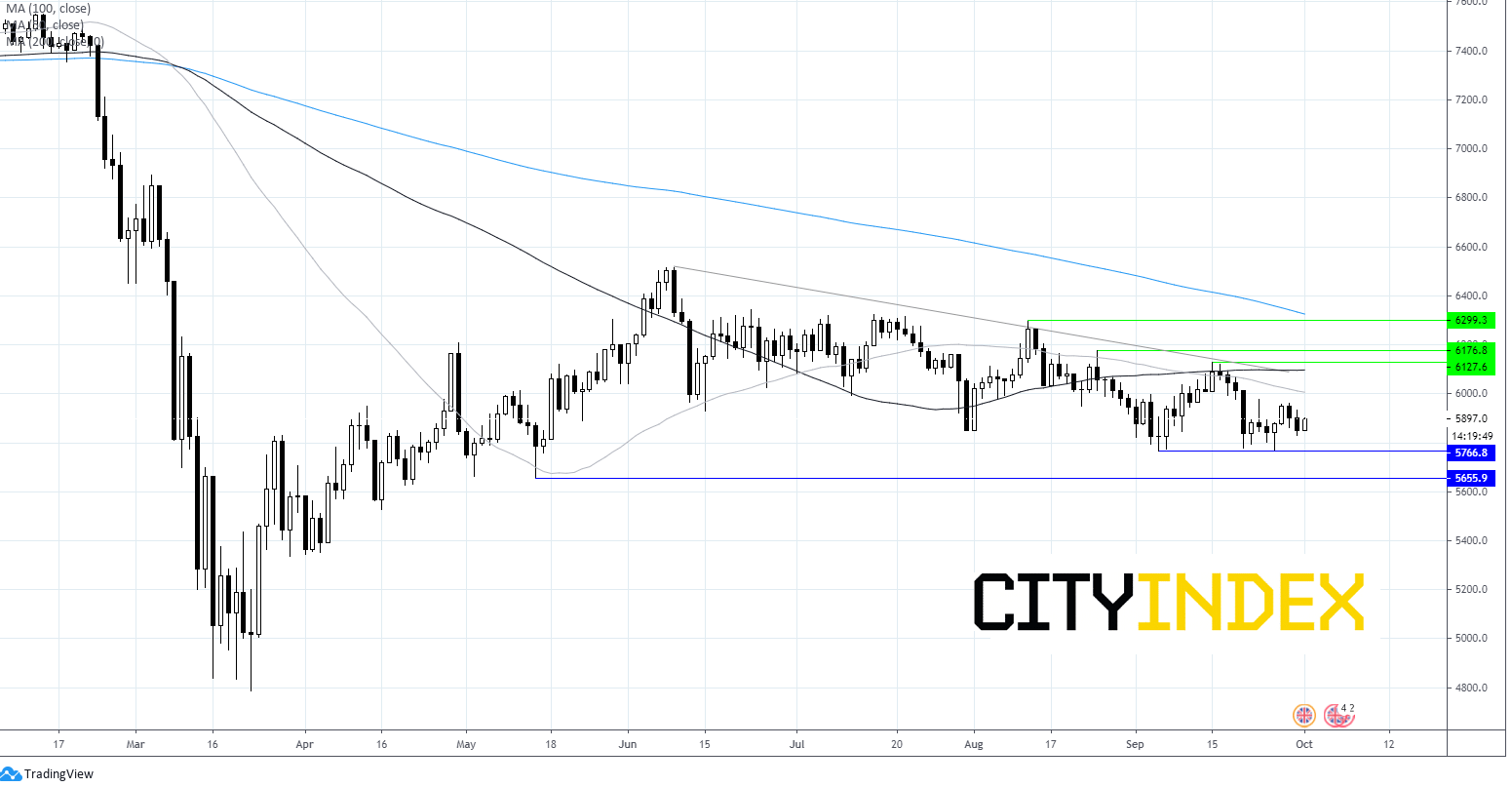

FTSE Chart

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM