Wall Street experienced a sharp decline after a series of warnings from the US Federal Reserve. Federal Chair Jerome Powell reiterated that the US economy still had a long way to go before recovery weighed on sentiment. His comments were supported by Fed Vice Chair Richard Clarida who considers the US economy to be in a “deep hole”.

The Fed sees a strong case for additional fiscal support. However, another rescue package before the November elections is starting to look very unlikely.

UK Chancellor Rishi Sunak won’t be making a budget this year, instead, he will roll out a winter economic plan to see the UK through the coming month, which are set to be extremely challenging. With the furlough scheme set to end of 31st October, the markets have been concerned with what’s next? The centre piece to Rishi Sunak’s plan, to be announced today, is expected to be a wage support scheme similar to that in Germany. A scheme to subsidise wages of people in part time work, replacing the more expensive £39 billion furlough scheme. This should mean that the 4 million or so people that are neither in employment or out of employment on furlough, won’t necessarily face a cliff edge. This should at least soften the blow to the economy.

Oil extend losses

Oil process declined on Thursday and are extending losses weighed down today, despite inventories falling by 1.6 million. Concerns that the economic recovery in the US is stalling and concerns that Europe will soon be under tighter lockdown restrictions is dragging on the demand outlook.

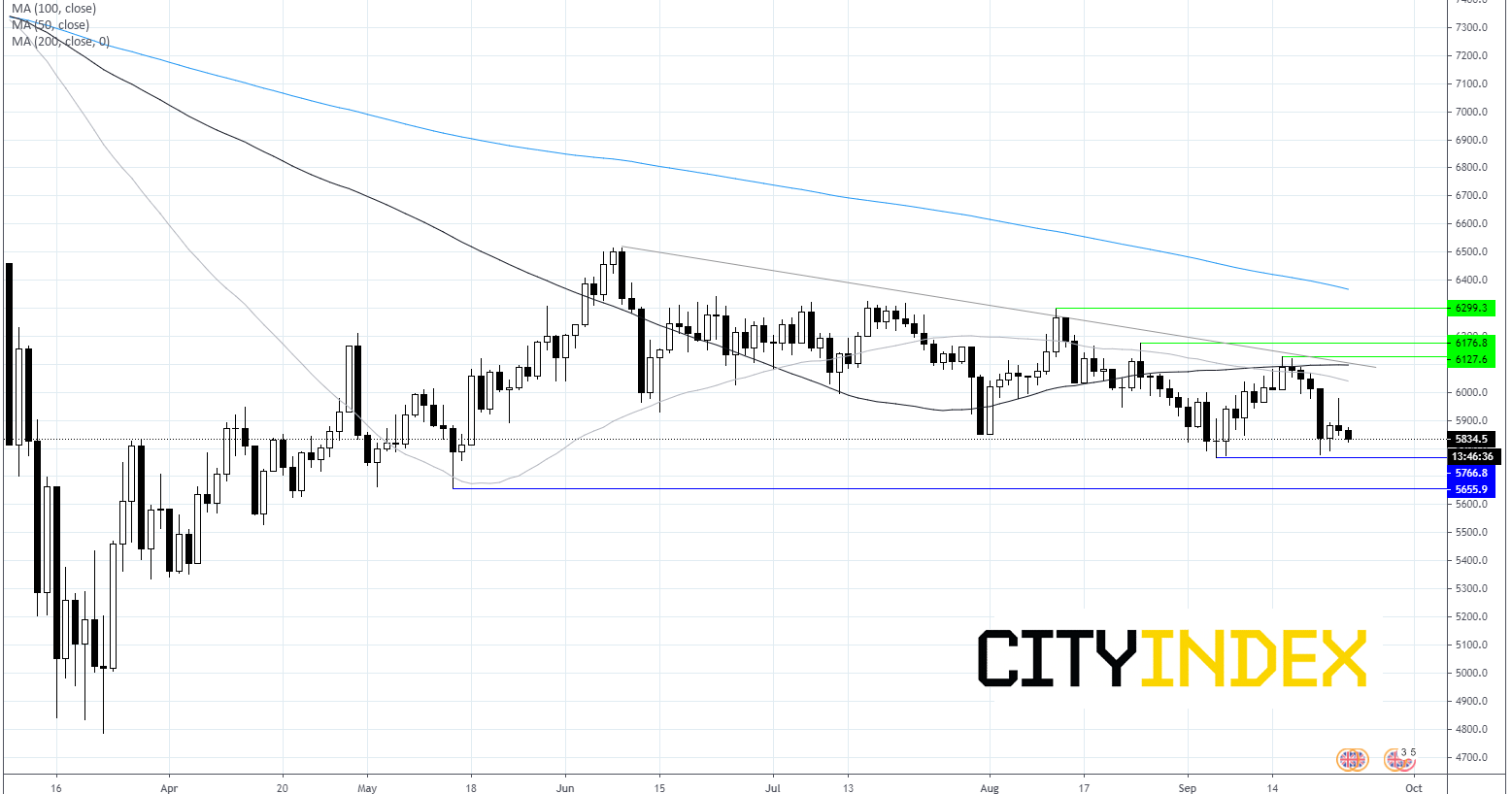

FTSE Chart