Fears of a second wave of coronavirus persisted overnight dragging on risk sentiment, pulling Asian markets lower and setting European bourses up for a lower start on the open.

The number of cases in some US states are rising to record levels, which is unnerving investors. Texas, saw its largest daily increase in infections since the start of the coronavirus pandemic. However, it is worth keeping in mind that this is timing. Whilst states such as New York have passed the peak and are now reopening, some US states are experiencing the first wave of daily rises, just later. However, the chances of this spreading are still very real.The BoE Is not expected to cut interest rates from the current 0.1% when it meets today. It is broadly expected to increase its Asset Purchase Programme by £100 billion. There is a good chance that some policy makers will be more dovish and push for a bigger increase.

Since the pandemic started the central bank has slashed rates from 0.75% to the 300 year low of 0.1%. It has also added £200 billion to its quantitative easing programme, taking the total to £645 billion.

US initial jobless claims a frustrating slow come down

Jobless claims are expected to increase by 1.3 million, down from the previous week’s 1.5 million. Whilst this will be the lowest increase in 3 months, it is still 6 x the pre-coronavirus February figure. Continuing claims are also expected to show a drop to 19.8 million, down from 20.9 million as starts slowly reopening and Americans are gradually rehired. The pace is frustratingly slow and suggests that another knockout month of retail sales is looking unlikely. A weak reading could feed risk aversion boosting USD and weighing on equities.

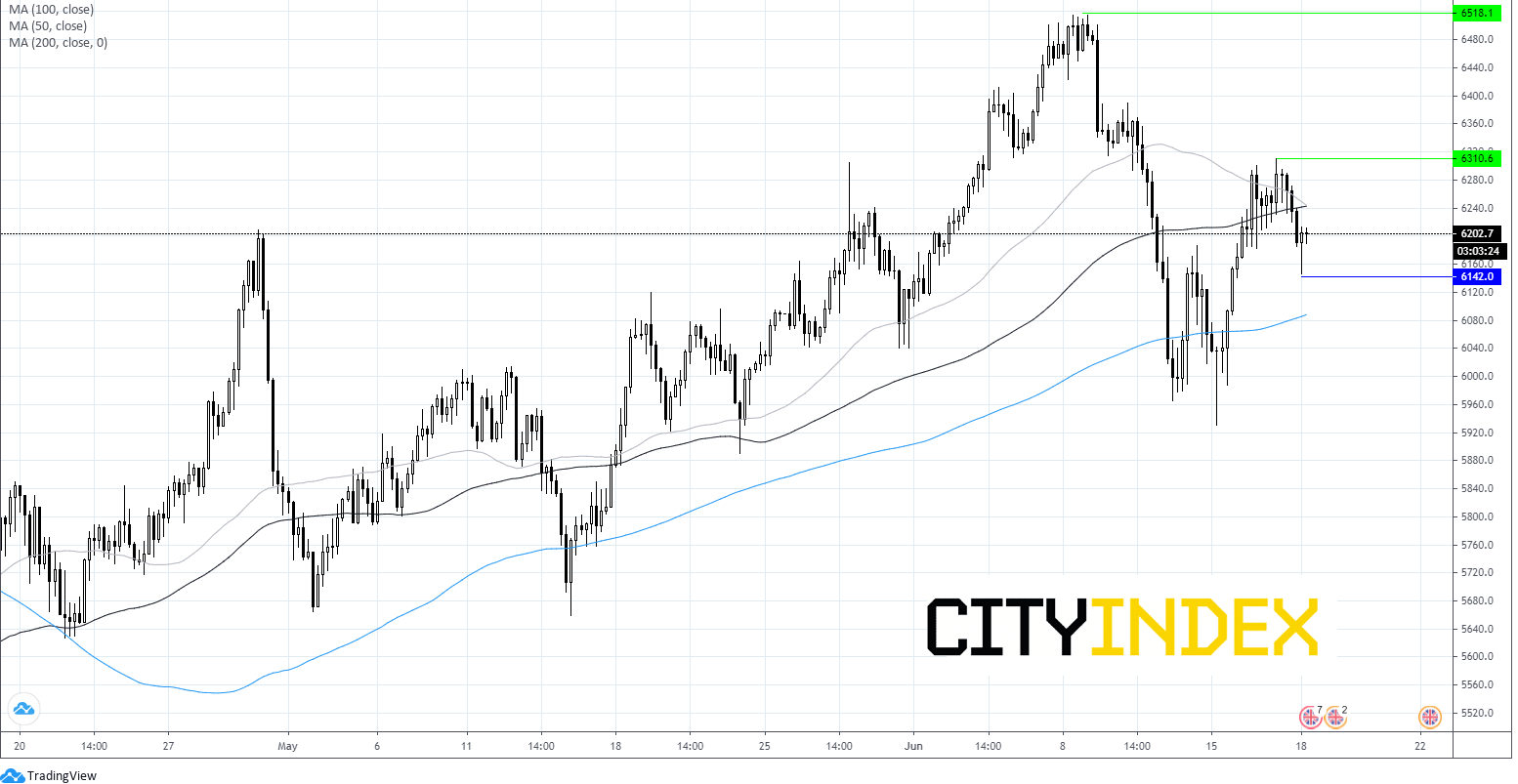

FTSE Chart