Last night, I sat down to update a webinar I am presenting this evening for City Index Australia on “How to hedge an equity portfolio using CFDs” along with five reasons to do so.

The last time I presented this webinar was in September 2019, a few weeks before the U.S. and China first signalled an intent to sign a trade deal. Four months later and with markets firmly in the grip of the reflation trade, there appeared to be a lack of immediate reasons to hedge.

The most likely candidates, a re-emergence of U.S. - China trade tensions, signs of excess in equity markets, anaemic global growth and geopolitical tensions ranging from Russia – NATO conflict, North Korean sabre-rattling, to Gulf tensions resulting in oil supply disruptions.

This morning two potential catalysts have sprung to light and caught traders' attention in the Asian time zone.

The first was an overnight downgrade to global growth by the IMF. Due mainly to weakness in India, the global economy is expected to grow at 3.3% in 2020, 0.1% lower than previously forecast. The growth forecast for 2021 was trimmed to 3.4%, 0.2% lower than previously forecast. Thereby bringing into question the upswing to global growth that was expected after the U.S.- China trade truce.

The second catalyst, the confirmation that a fourth person has died in China from the Coronavirus. The World Health Organization has confirmed the virus can spread from person to person and not just from animals to humans as originally hoped for. The China health commission has given the Coronavirus the same rating as the SARs virus from 17 years ago that killed 800 people and rattled markets.

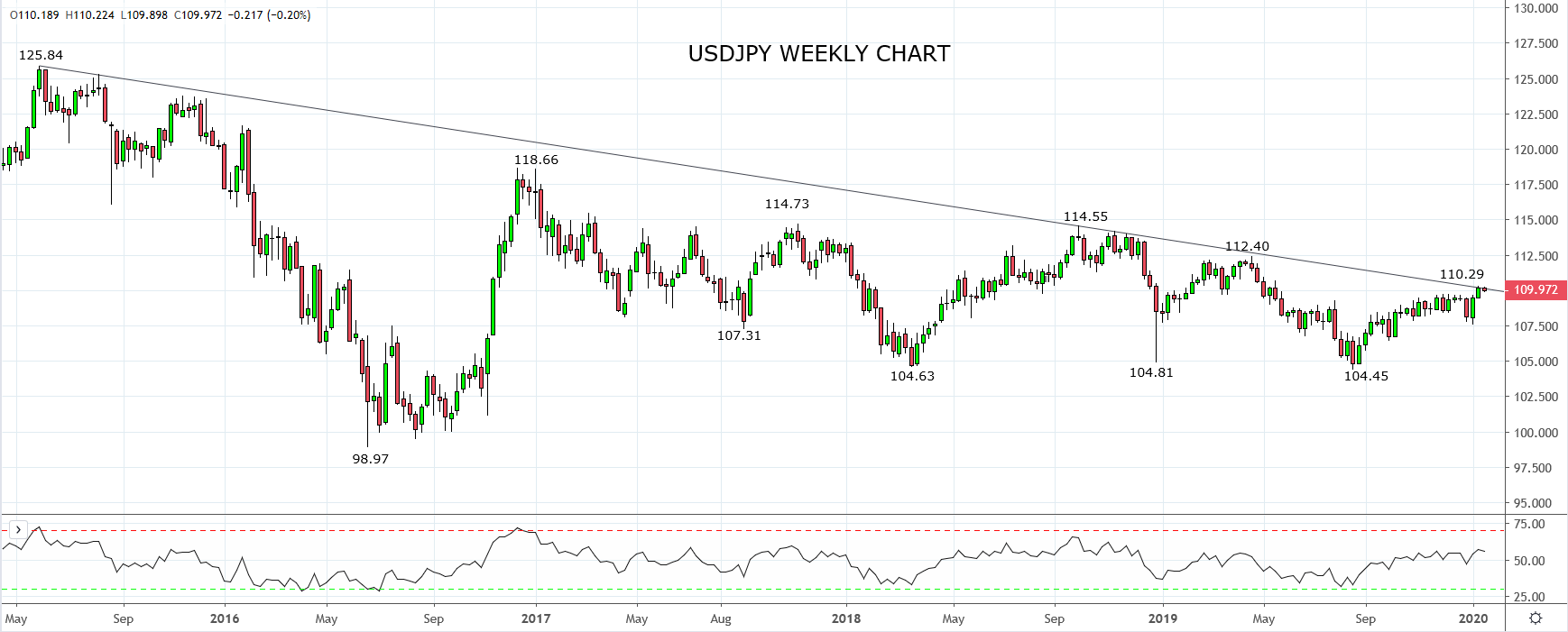

With the Bank of Japan expected to maintain the status quo at their meeting this afternoon the setup in USDJPY offers traders a potentially attractive risk-reward setup should equities continue to wobble.

After breaking above recent highs 109.70 area, USDJPY has stalled ahead of the trendline resistance at 110.30 which comes from the 2015, 125.85 high. Providing USDJPY remains below resistance at 110.30 and was then to break below 109.70 (formerly resistance now support) the risks are for a decline towards the recent 107.65 low. Conversely, should USDJPY break and close above 110.30 it would allow USDJPY to extend its recovery towards 111.50.

Source Tradingview. The figures stated areas of the 21st of January 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation