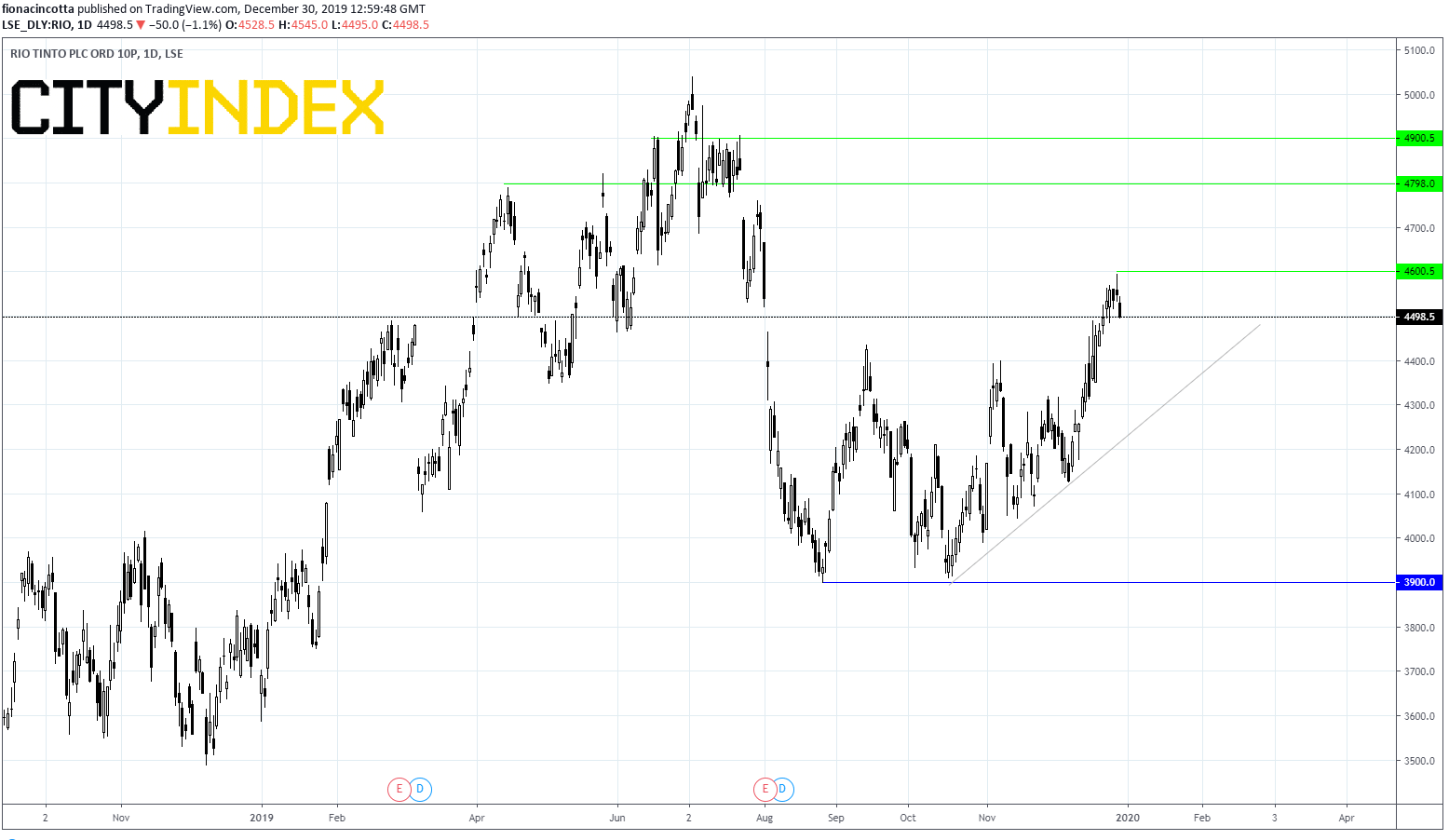

Rio Tinto rallied an impressive 39% across the start of the year, hitting an all-time high of 5039 in early July on rising commodity prices. The stock slumped across the summer months amid elevated US – China trade tensions and has since put in a bit of a rebound as global risks, particularly US – China trade tensions have eased towards the end of 2019.

Rio Tinto is ending 2019 up 27%, outperforming the FTSE100 which gained 12%. With the US - China first phase trade deal potentially being signed in early 2020 Rio Tinto could have more upside.

Metals for the global economy

The three metals that the global economy needs the most are iron ore (an important component of steel which is used in construction, cars, machinery etc), aluminium and copper. The importance of these metals plays right into Rio Tinto’s hand, as it is a global leader in iron ore production, a leader in aluminium and in the top 10 producers of copper.

When the global economy is growing strongly and the prospect of further growth is high, demand and the demand outlook for these metals increases, boosting prices and lifting the share price of the miners.

As trade tensions eased between US and China, and the outlook for the global economy improved and Rio Tinto pushed higher, benefitting greatly from the recent rebound in commodity prices, most notably iron ore.

Low production costs

Production costs are incredibly low. At the flagship Pilbara mines production costs are under $15 a tonne, average market prices were five times higher in the region of $80 per tonne. Mining and then selling on for 5 times the cost is always an attractive proposition.

Low net debt

Rewind 3 to 4 years and Rio Tinto had a mountain of debt and embarked on a brutal cost cutting exercise, the benefits of which are apparent today. Rio has $4.9 billion of net debt as from mid 2019, which is small given its $95 billion enterprise value.

With debt back under control Rio is free to use the cash flow it generates to give back to shareholders and reinvest to grow the business.

Risks

Given that Rio is heavily reliant on iron ore (62% of underlying EBITDA) it’s high exposure to that market can also be a risk. Should the price off iron ore weaken, Rio Tinto would be more at risk than other diversified miners.

Conclusion

Rio Tinto has a lot to offer as the outlook for the global economy improves. Low production costs of key industrial metals and low debt levels mean it is well positioned to prosper.