Richemont under pressure after trading update

Richemont, the luxury goods company, announced that 1Q revenue declined 47% on year (-47% at constant exchange rates) to 1.99 billion euros, citing "strong impact from Covid-19".

The group attributed the sales decline in the first quarter to unprecedented disruptions and temporary closures of in-house, franchised and multi-brand partner stores, as well as the closure of online distributor order processing centers.

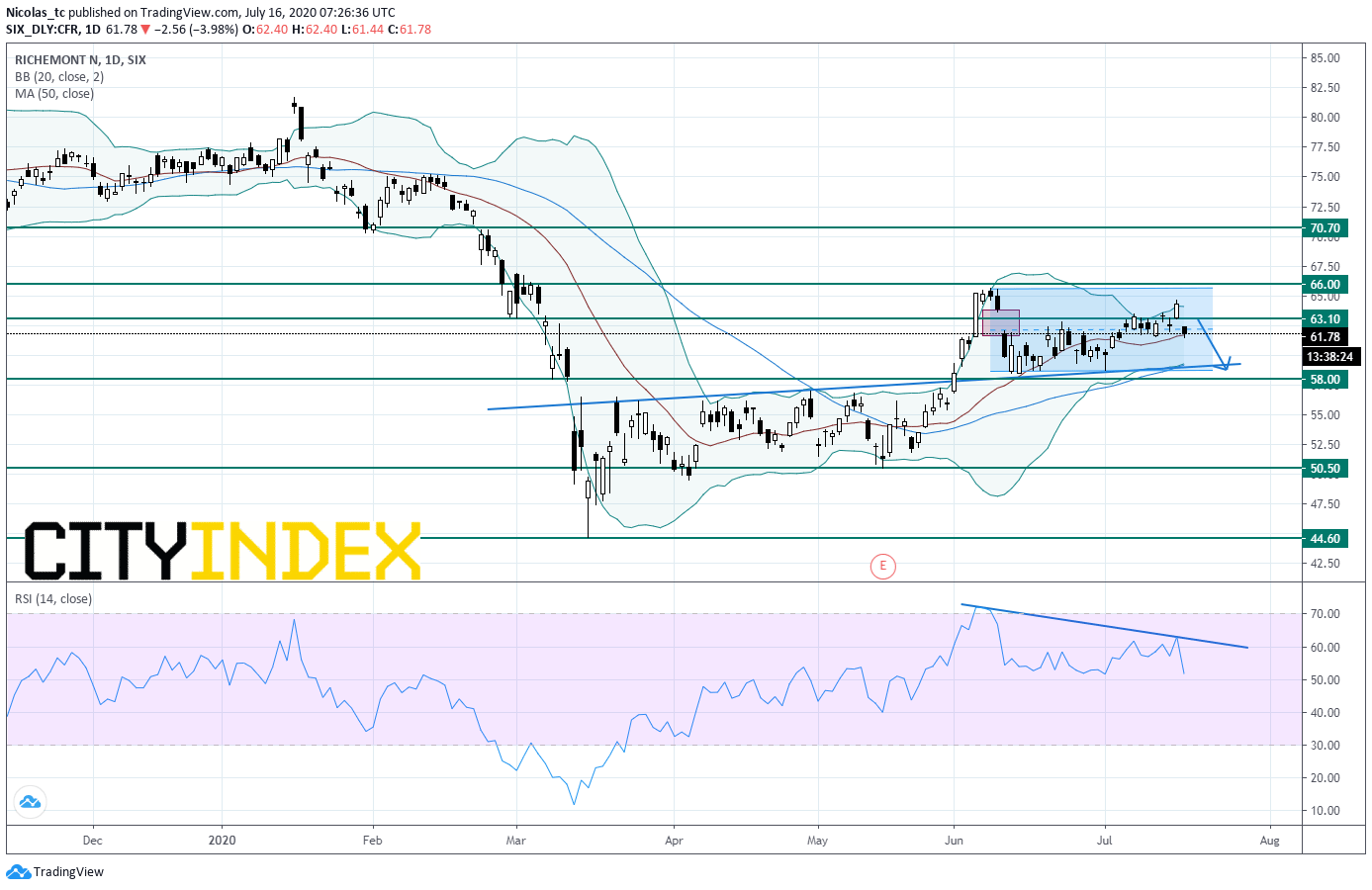

From a chartist point of view, the stock price is holding above an internal trend line in place since March 2020. However, prices remain stuck in a short term trading range. The bearish gap opened this morning may have opened a path to see the technical support threshold at 58CHF. The daily Relative Strength Index (RSI, 14) is losing upward momentum and may turn down below 50%. As long as 63.1CHF is resistance, the risk of a break below 58CHF will remain high. Alternatively, a push above 63.1CHF would deliver a bullish signal and would call for a rise towards 66CHF and 70.70CHF.

The group attributed the sales decline in the first quarter to unprecedented disruptions and temporary closures of in-house, franchised and multi-brand partner stores, as well as the closure of online distributor order processing centers.

From a chartist point of view, the stock price is holding above an internal trend line in place since March 2020. However, prices remain stuck in a short term trading range. The bearish gap opened this morning may have opened a path to see the technical support threshold at 58CHF. The daily Relative Strength Index (RSI, 14) is losing upward momentum and may turn down below 50%. As long as 63.1CHF is resistance, the risk of a break below 58CHF will remain high. Alternatively, a push above 63.1CHF would deliver a bullish signal and would call for a rise towards 66CHF and 70.70CHF.

Source: GAIN Capital, TradingView

Latest market news

Today 08:15 AM

Today 05:45 AM

Yesterday 11:09 PM

Yesterday 11:01 PM