In both our introductory and advanced series of trader educational webinars, we highlight the critical role interest rate differentials and the future direction of interest rates play in determining the direction of FX pairs.

Presuming stable economic growth and moderate inflation, relatively higher interest rates will be supportive of a currency's value and vice versa. However, following the COVID-19 outbreak, interest rates have converged towards zero in most of the developed world, rendering the traditional FX trading manual obsolete for now.

This means the merits of currencies will be assessed on measures that include the success of a countries virus containment, the level of government stimulus, the degree of central bank stimulus via quantitative easing, the timeline towards a possible re-opening of economies and risk sentiment (equities).

We touched on this in yesterday's note where we spoke about how the successful containment of the virus in Australia in conjunction with a backdrop of ample government fiscal and RBA stimulus was “good news” for the “lucky country” and likely to be supportive of the AUDUSD.

Unfortunately, the ongoing COVID-19 crisis in Europe combined with an overnight failure by EU leaders to agree on a longer-term rebuilding program as member states disagreed on how to split the financial burden, leaves the EURUSD teetering towards the other end of the spectrum.

Next week's ECB meeting is shaping as a critical as to whether political bickering and debt constraints will be put aside to allow the ECB to implement enough QE to offset the economic impact of the coronavirus or leave the EURUSD vulnerable to further declines.

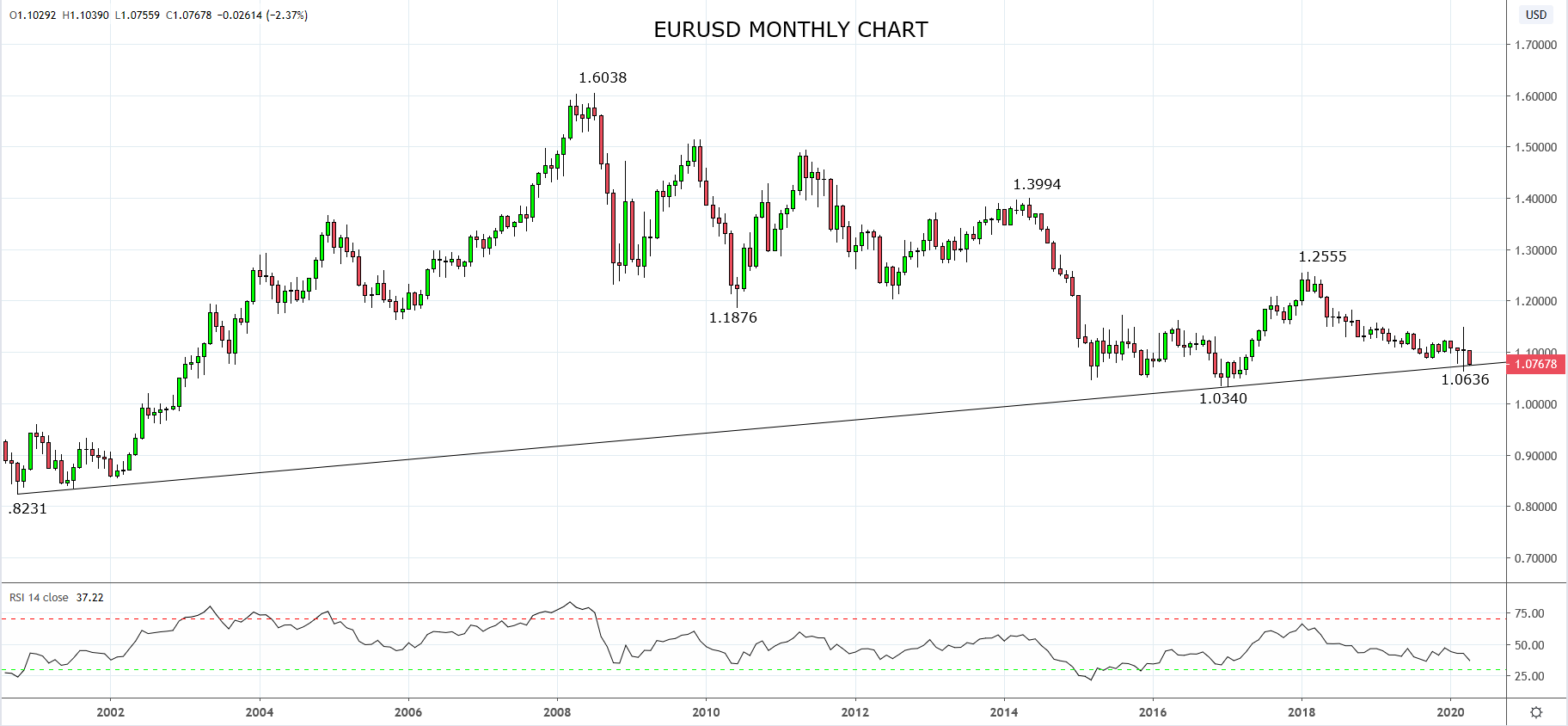

As can be viewed on the monthly chart below, the EURUSD is trading just above long term trendline support from the low of .8231 in 2000. Admittedly, the EURUSD has been an absolute nightmare for breakout traders over the past 15 months but much below the March 1.0636 low, should see the EURUSD visit the 1.0340 low from January 2017, with a break and close below here likely to lead to a move below parity.

In summary in the new world of FX trading, the fate of the EURUSD will be determined by the ECB’s action or lack of it this coming Thursday.

Source Tradingview. The figures stated areas of the 24th of April 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation