Retail Sales Weaker but China Trumps Data

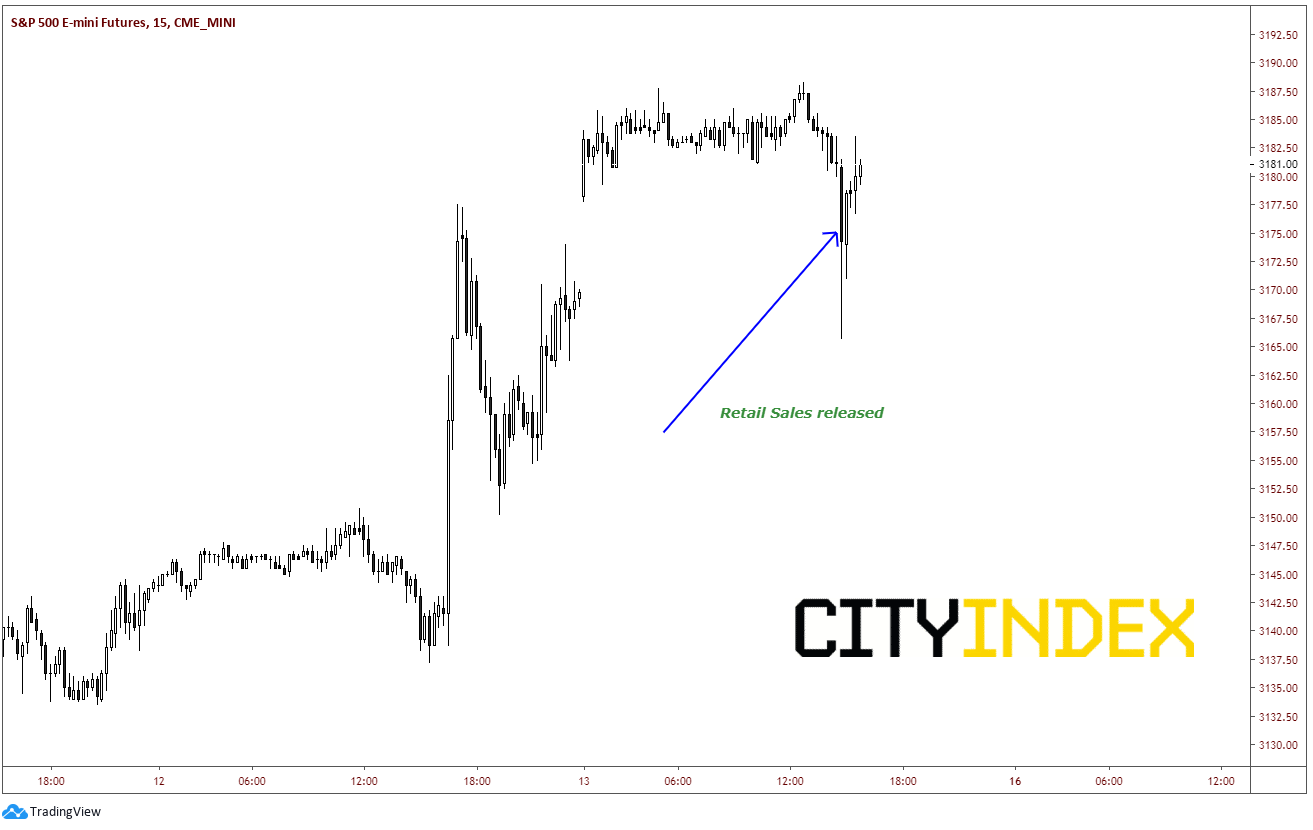

US Retail Sales (MoM) for November was 0.1% was 0.5% expected, which was a huge miss in the data. October’s number was revised slightly higher to 0.4% from 0.3%, however that was not enough to make up for this month’s miss. In addition, The Core Retail Sales (MoM) was 0.1% for November vs 0.3% expected. Again, October’s number was revised slightly higher to 0.3% from 0.2%, however this also was not enough to make up for this month’s miss. The S&P 500 Futures initially sold off on the data release, however they were immediately bought back up.

Source: Tradingview, City Index, CME

Why were stocks bought on the release of the poor data? Trump yesterday announced that a Phase One trade deal between the US and China has been reached. China has yet to comment on the deal, however they announced that they will have a press conference at 10:30pm local time to discuss the “relevant progress of China-US economic and trade consultation”. As a result, the market is expecting China to announce that a deal has been reached and therefore a risk-on scenario should result.

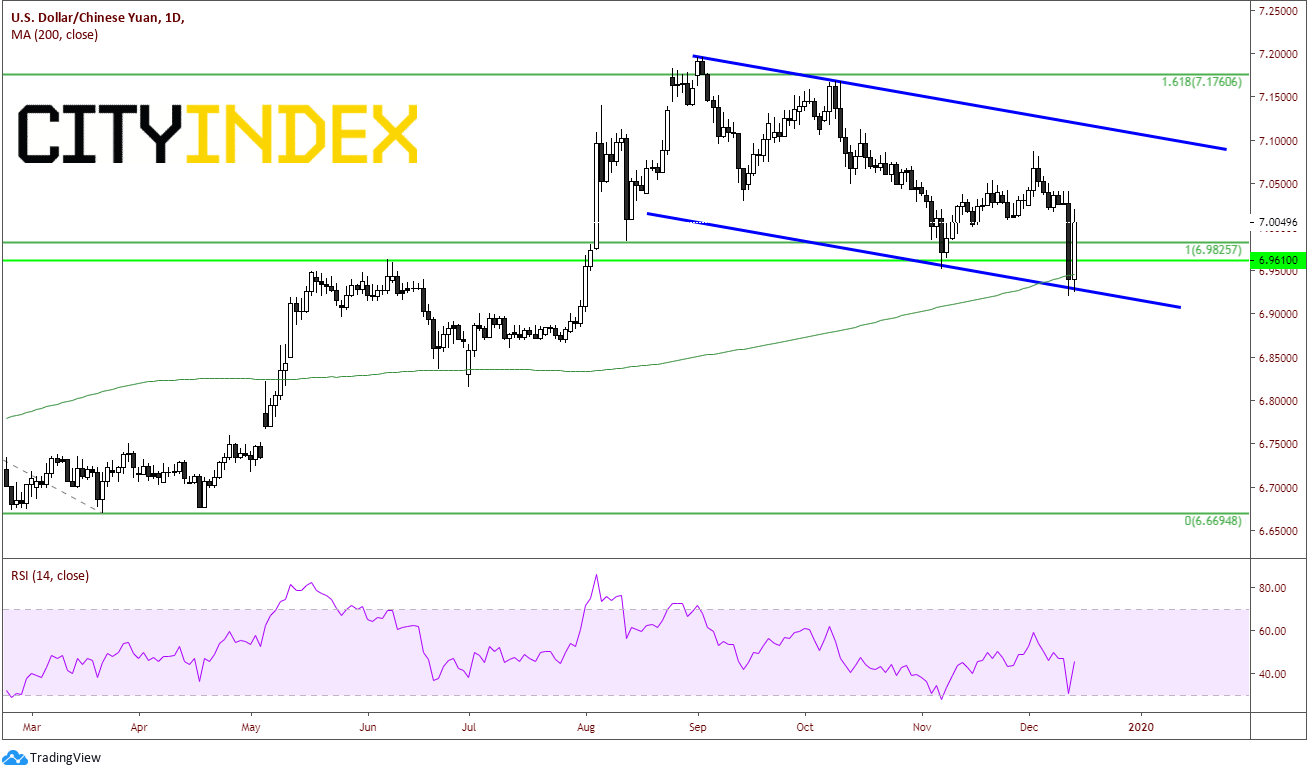

USD/CNH is not pricing in a positive press conference at the moment. After yesterday’s selloff in USD/CNH, one has to wonder why the pair isn’t currently trading even lower today. Granted, price did halt that the 200-day moving average and the bottom of the downward sloping channel on the daily timeframe dating back to mid-August, but with a deal so grand as this, one would expect technicals not to matter as much and continue to move lower.

Source: Tradingview, City Index

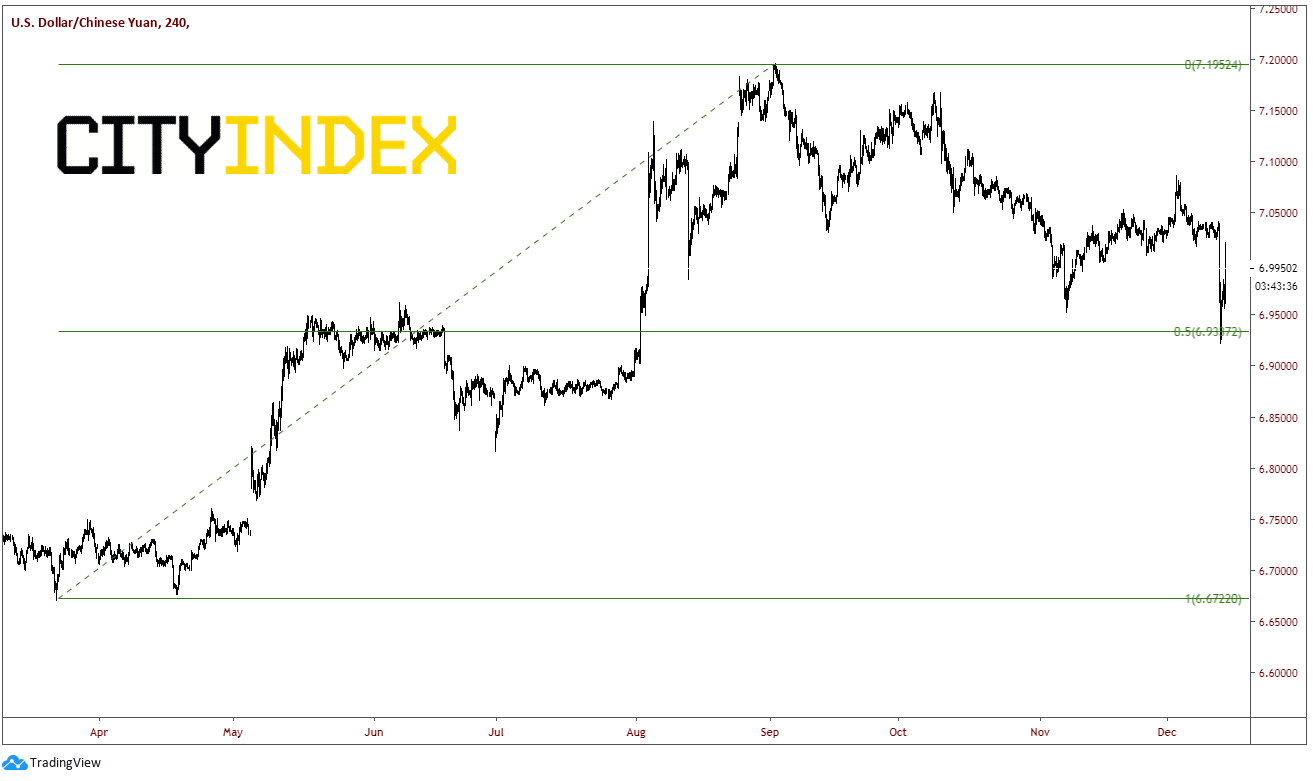

On a 240-minute timeframe, price moved overnight to its lowest levels since June and the 50% retracement level from the March 20th low to the September 2nd highs, and has since bounced ahead of the press conference. Support continues to be at today’s lows near 6.9200.

Source: Tradingview, City Index

Keep an eye on the press conference. If there is any hesitation on Phase One being a done deal, we could see a risk off move with S&P 500 moving lower and USD/CNH moving higher!