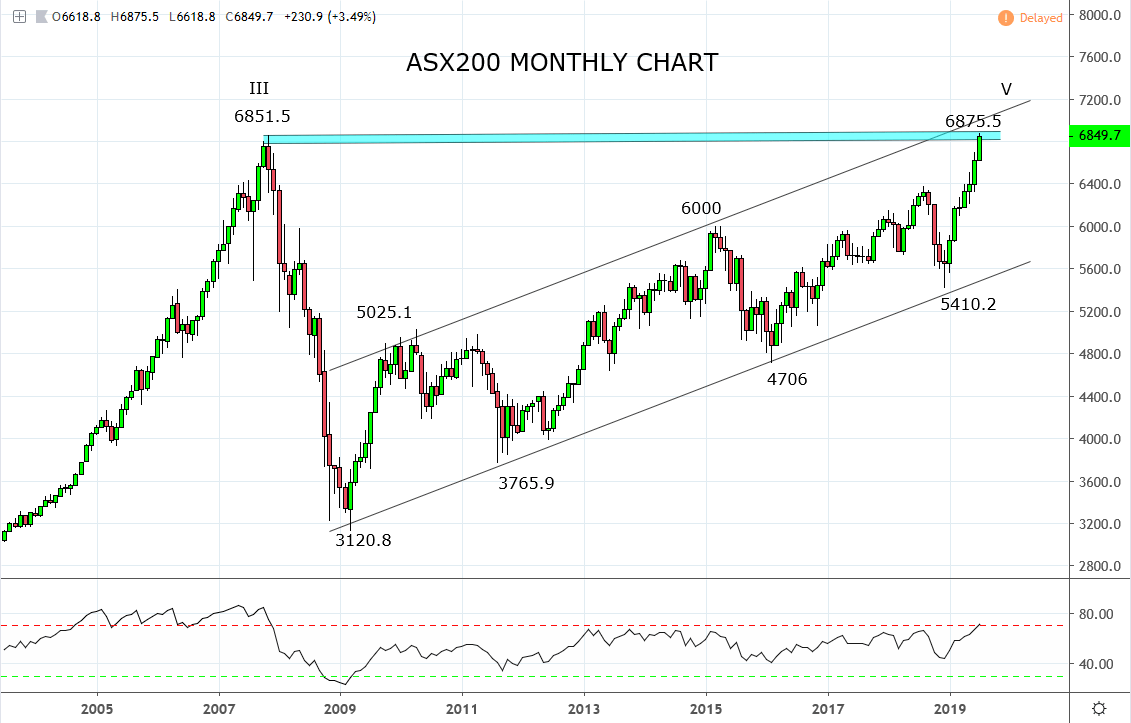

Celebrations today for local share investors as the ASX200 finally traded above its all-time pre-Global Financial Crisis, 2007 high. At the end of last year, as global stock markets tanked, the chances of this milestone being reached appeared extremely remote. However, several factors combined to make the first half of 2019 one to remember for investors.

In terms of the catalysts for the +20% rally in the ASX200 in 2019, front and centre has been a shift by central banks including our own RBA to ease monetary policy. This resulted in bond yields reaching record lows in Australia and left the ASX200 very cheap by comparison.

As I pointed out to delegates at a conference in Noosa last week, at the heart of the current rally in stock prices is a simple investment allocation decision. If investors were to shop around for term deposit rates, they might find a financial institution offering just north of 2.0% p.a. on a 12month term deposit. A return barely above the annual rate of inflation of 1.3%.

By comparison, the ASX200 historically trades on a dividend yield of around 4.1% pa. Within the ASX200 there are stocks such as NAB and Westpac currently offering a fully franked dividend yield over 6.0% p.a.

In some respects, an easy decision that become more compelling after the result of the Federal election which preserved franking credits and negative gearing of property. The later also went some way to ease fears of a property market crash in Australia.

Also coming to the support of the ASX200, a strong run-up in the price of one of Australia's key commodity exports, iron ore. Earlier this month iron ore reached a five year high above U.S. $125 per tonne boosted by strong demand from China as well as supply constraints. Stocks such as BHP and Rio Tinto have been big beneficiaries of this dynamic.

Where to from here?

After today's milestone, the ASX200 can now look towards the next upside target in the form of the long-term trend channel resistance viewed on the chart below. At the very least, I would expect to see a short-term pullback from ahead of this resistance zone to work off overbought readings.

Longer-term, the supportive fundamental backdrop of low-interest rates is likely to remain in place for some time yet, thereby keeping the dominant uptrend in place.

Source Tradingview. The figures stated are as of the 30th of July 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Disclaimer

TECH-FX TRADING PTY LTD (ACN 617 797 645) is an Authorised Representative (001255203) of JB Alpha Ltd (ABN 76 131 376 415) which holds an Australian Financial Services Licence (AFSL no. 327075)

Trading foreign exchange, futures and CFDs on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange, futures or CFDs you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange, futures and CFD trading, and seek advice from an independent financial advisor if you have any doubts. It is important to note that past performance is not a reliable indicator of future performance.

Any advice provided is general advice only. It is important to note that:

- The advice has been prepared without taking into account the client’s objectives, financial situation or needs.

- The client should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation or needs, before following the advice.

- If the advice relates to the acquisition or possible acquisition of a particular financial product, the client should obtain a copy of, and consider, the PDS for that product before making any decision.