Ready for a Breakout?: EUR/AUD

Next week the ECB meets, and economists feel they will likely keep stimulus “unchanged” while they wait for staff projections at the December meeting. Meanwhile, the RBA recently suggested that they are ready to buy longer term bonds and provide more QE now. What does this potentially mean for EUR/AUD?

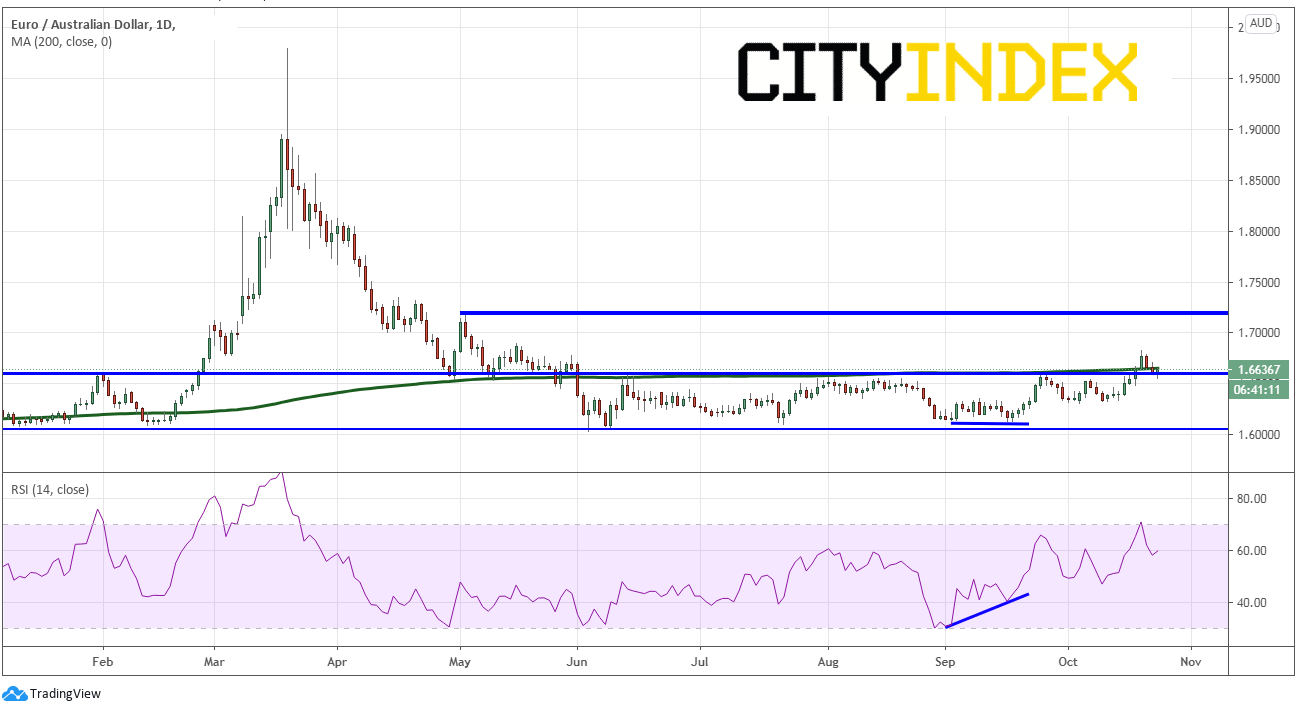

EUR/AUD

Source: Tradingview, City Index

The pair has been trading in a sideway channel since early June between 1.6033 and 1.6592, as it had pulled back from the overbought levels after the coronavirus outbreak In March. However, on Monday, the pair broke out and closed about the channel and right at the 200 Day Moving Average near 1.6635. The pair traded to a high of 1.6827, before pulling back and trapping weak longs, printing a low today of 1.6553 (back in the channel and currently oscillating around the 200 Day Moving Average.

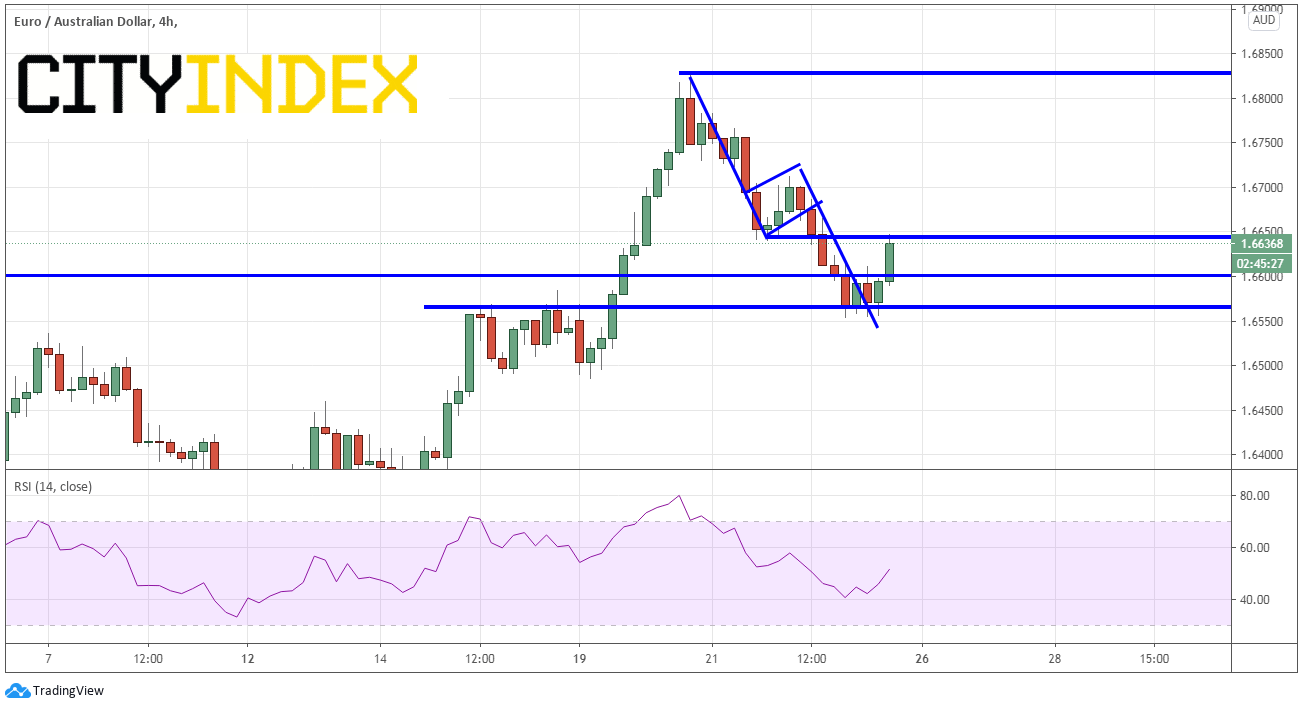

Source: Tradingview, City Index

Savoy traders may have looked at a 240-minute time frame and seen the completion of a flag pattern near the lows of the pullback, as well as horizontal support, and went long. However, there are still opportunities to enter long positions for those traders who feel this pullback was just a correction, and near the beginning of a longer rising trend. EUD/AUD is currently trading near short-term horizontal resistance near 1.6650. A close above this level may give bulls an opportunity to enter, looking for a larger move on the daily timeframe. Next resistance is at the top of the flag near 1.6712 and they the recent highs at 1.6827. Their resistance (and possible initial target) is the early May highs near 1.7200. First support (and possible stop level) is at 1.6553 and then Monday’s low at 1.6485.

EUR/AUD has potential for a large upside move on a daily timeframe. Proper risk management will help to minimize losses if the pair heads lower.