It’s preparing for worst Brexit fears to be confirmed

Amongst Britain’s large banks, it was RBS that sounded the earliest and most strident warnings about the impact of Brexit on its business. The group faces a particularly challenging mix of state-ownership, regulated size, strategy and domestic market positioning that means it can take even fewer chances than its risk-averse rival Lloyds Banking Group. As such, not even a massively above consensus pay-out is being seen by investors as enough compensation for RBS adopting an even deeper defensive posture. It has abandoned 2020 goals, particularly those relating to the return on tangible equity, which determine improvements (or not) in the level of profits that could be available for investors in the form of dividends or buybacks.

From the H1 statement: “Given current market conditions, continued economic and political uncertainty and the contraction of the yield curve, it is very unlikely that we will achieve our target return on tangible equity of more than 12% and cost: income ratio of less than 50% in 2020.”

Making perceptions of the group’s performance so far this year worse, first-half and quarterly earnings are of questionable quality.

RBS’s second quarter operating income of £1.68bn beat an average analyst estimate compiled by the group of £1.32bn. Or, rather it did, if a £990m gain from the merger of Saudi Arabian banks SABB and Alawwal is included. RBS held a 40% stake in the latter via a Dutch subsidiary. Before the announcement in June, the gain wasn’t on the radar for many. With proceeds removed, the £690m underlying operating profit is a big miss.

Also, as the rates environment deteriorates, RBS’s net interest income and margins are deteriorating, in common with all large lenders, often more than feared.

- Q2 net interest income: £1.97bn; estimate: £2.16bn

- Q2 net interest margin: 1.78%; estimate: 1.985%

With the 50% cost: income target also dropped, the bank is giving itself maximum flexibility to deal with likely intensification of economic and monetary headwinds in coming months.

“The most important thing we can do as a bank is that we have the right liquidity” in the event of a no-deal Brexit, Katie Murray, the bank’s chief financial officer told Bloomberg TV. That’s prudent. It also seals the fate of RBS shares for the rest of the year, at least. They were already slightly underperforming those of its chief rival Lloyds over the year to date. That gap is now set to widen.

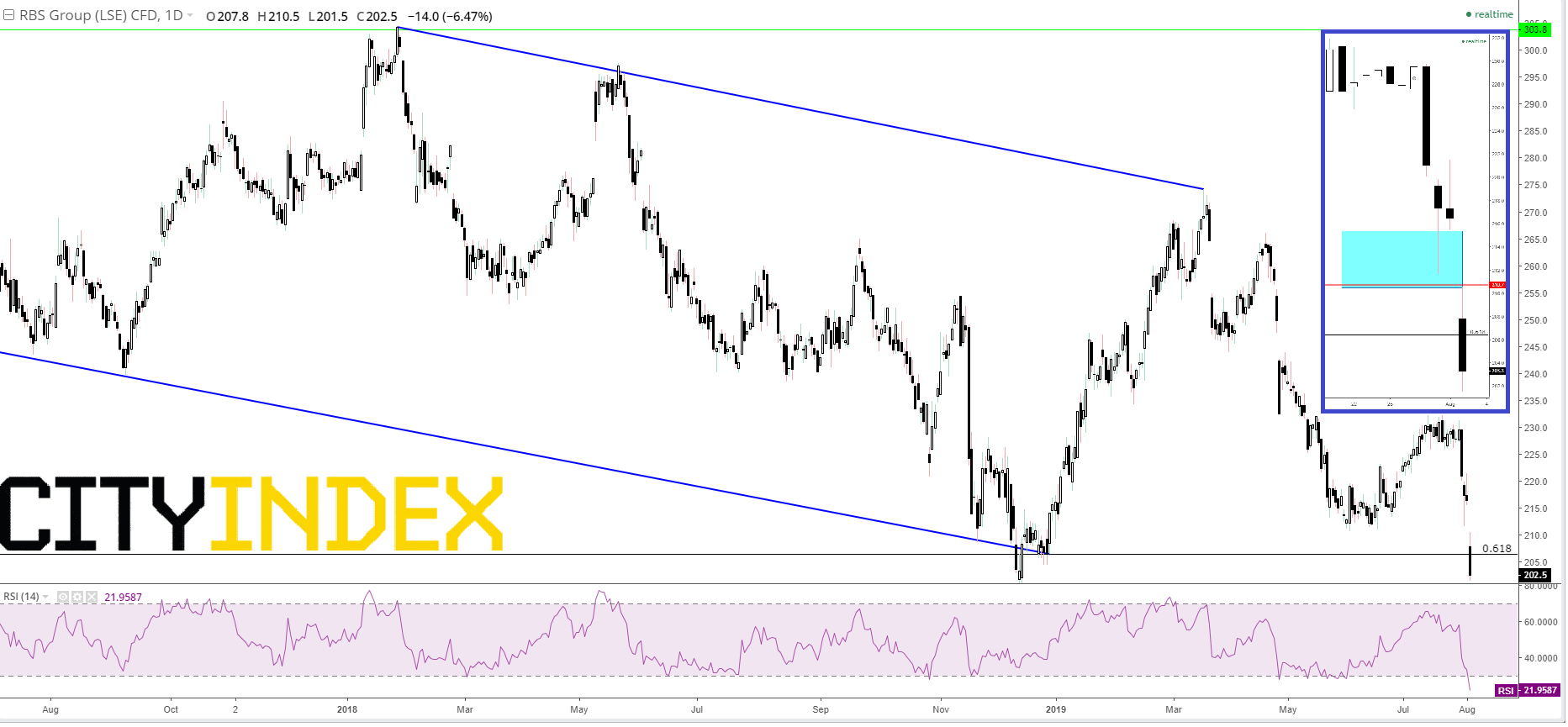

Chart thoughts

It’s critical to bear in mind the stock’s ‘lost decade’ following the financial crisis and subsequent bailout, during it which it has been stuck in a chronic range. As economic pessimism set in, following the 2016 referendum, that range has tightened even more. The swing off post-24th June 2016 lows just below 150p reversed in January 2018 some 150p higher. Since then, note the formation of a declining trend from late-April 2017 to end-December 2018 together with a rougher falling line from January last year to last March. Apart from flagging resumption of a ‘bear’, it stabilized the downtrend right back to the 61.8% retracement of the move higher beginning June 2018. Implied support there (206p) was violated first at the bottom of last winter’s correction. Friday’s crash through it thereby looks all the more emphatic. The inset reveals that a 5-penny gap remains between Thursday’s 215.5p low and Friday’s 210.5 high. The normal instinct to fill it is impeded by supportive consolidation lows in June that are now resistant; especially 4th June’s 210.7p. As such, the line of lesser resistance should be lower still, whilst RSI shoots deep into oversold territory. December’s bottom at almost 200p dead will be a tempting objective.

RBS GROUP CFD – daily

Source: City Index