RBS will release its Q3 earnings Thursday 24th October

Expectations:

EPS 8p

Revenue £3.14 billion

Key themes:

• PPI costs

• Alison Rose

• Brexit

• Outlook for net interest margins

PPI Costs

RBS kicks off the third quarter earnings season for major high street banks. The fallout from the PPI scandal is expected to dominate, following a late surge in claims ahead of the August deadline.

After a robust first half year, which saw RBS deliver a £1.7 billion special dividend pay-out, the third quarter is looking less encouraging, as the bank prepares for a big PPI mis-selling hit. RBS has already warned that it will need to take a hit of £600 - £900 million for PPI. This is in addition to the £5.3 billion that it has already has to pay out.

The bigger than expected payout comes at a time when RBS is still in the process of pursuing cost savings and comes just ahead of Brexit. RBS is facing more hurdles currently than we would have imagined a few years ago.

On a positive note the Q3 results, will be a line in the sand for the seemingly endless PPI scandal.

Alison Rose

The end of the fallout from the PPI scandal also sees a new RBS boss Alison Rose takeover from Ross McEwan. Alison Rose will be the first women to lead one of the UK’s top banks.

Brexit

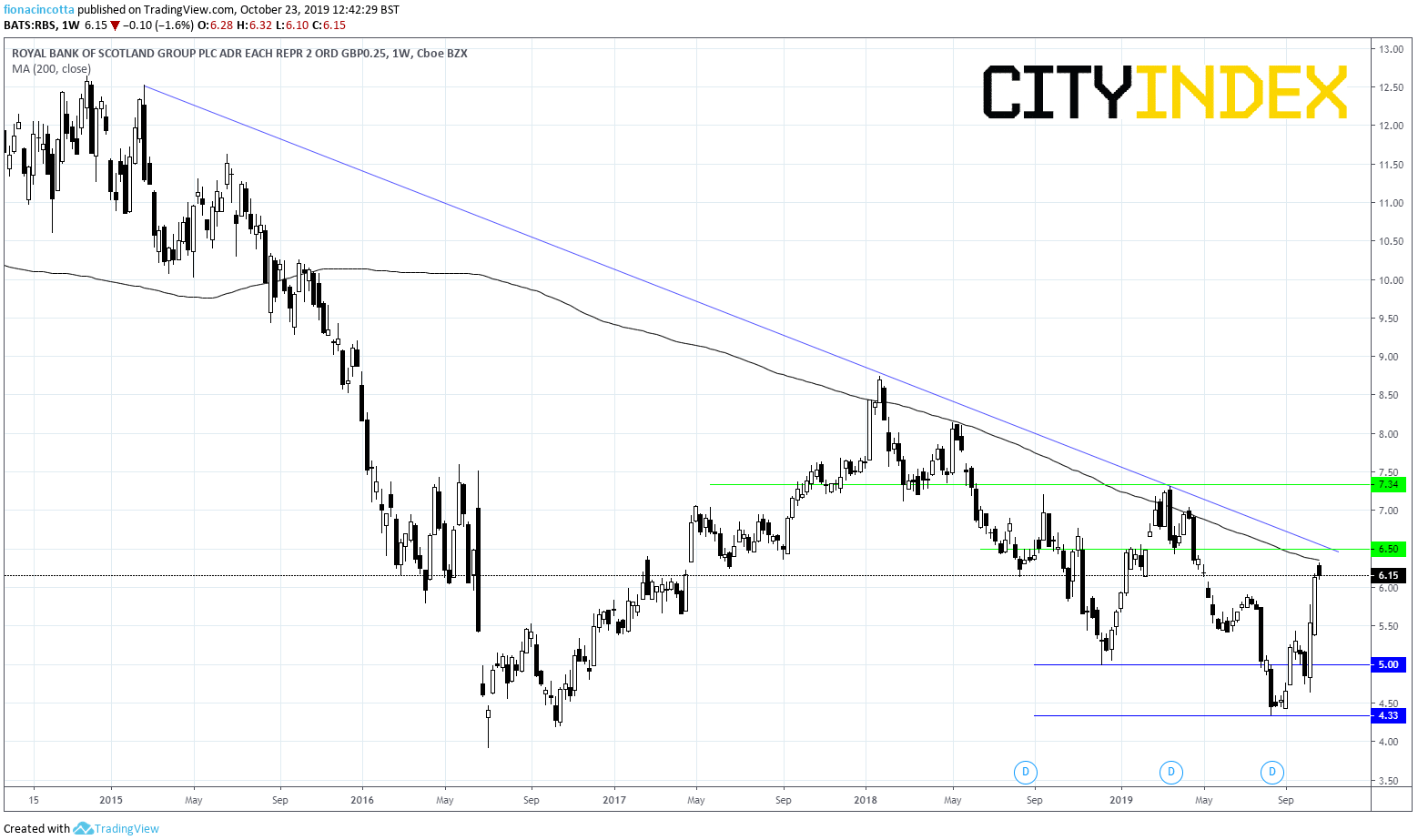

Shares in RBS have surged 12% over the past month as Brexit optimism picks up. Domestically focused RBS is exposed to the ups and downs of the UK economy and the tos and fros of Brexit. With a no deal Brexit as good as off the table, and a line drawn in the sand over PPI the mood towards the bank is starting to improve. Any comments surrounding Brexit and the outlook for the bank will be closely watched.

Net Interest Margins

NII will be a major focus given the low interest rate environment and its impact on bank’s profit. RBS is the most sensitive bank in the UK to interest rates. Whilst NII is up 3% qoq, it is down 6% yoy.

Conclusion:

Whilst the RBS comeback story is playing out well, there remain significant headwinds from lower margins and Brexit related political uncertainty which could keep any recent gains capped.