RBS profits fell in 1Q - Range-bound strategy

Royal Bank of Scotland Group, a major U.K. banking group, reported that 1Q net income fell to 288 million pounds from 707 million pounds in the prior-year period, and operating profit was down 48.8% on year to 519 million pounds. Return on tangible equity shrank to 3% from 8.3% a year earlier.

The Bank pointed out: "Net impairment losses of 802 million pounds equate to 90 basis points of gross customer loans, compared with 11 basis points in Q1 2019. Q1 2020 includes a 628 million pounds charge in respect of a more uncertain economic outlook, bringing our total multiple economic scenario (MES) overlay to 798 million pounds. Bank net interest margin (NIM) of 1.89% was 4 basis points lower than Q4 2019 reflecting continued structural pressure in the mortgage business."

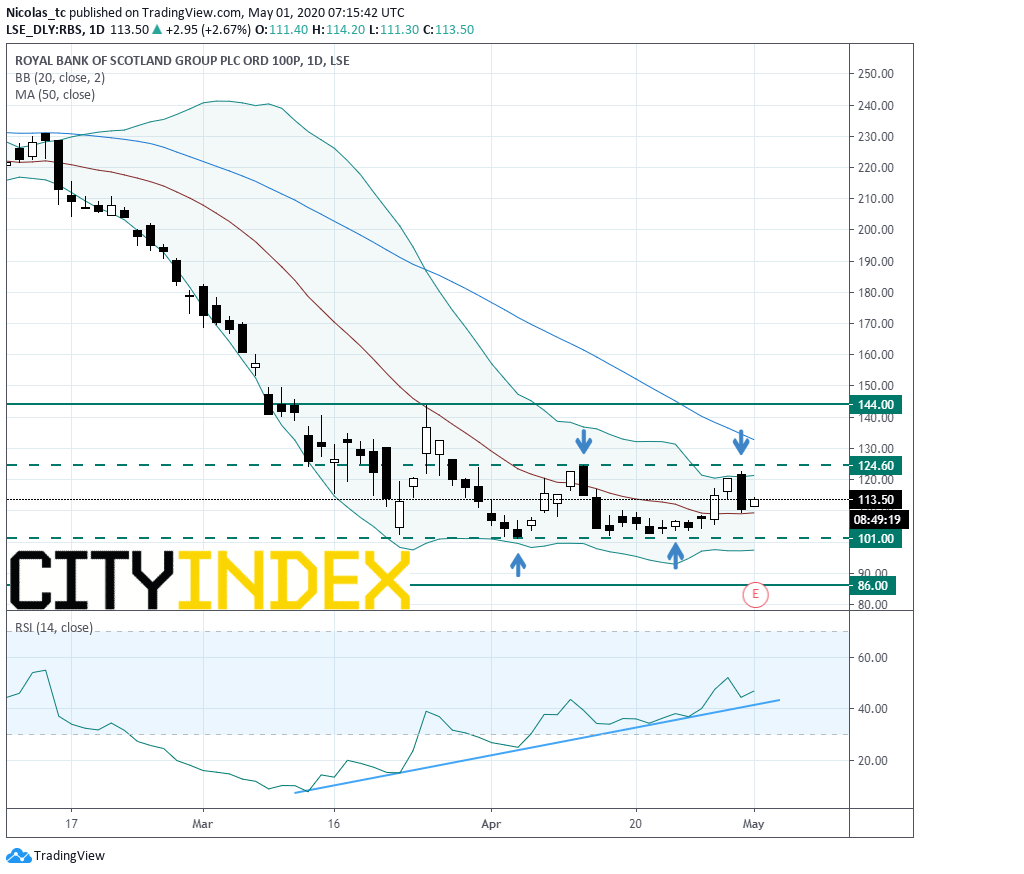

From a technical perspective, the stock price should be range-bound from here on as prices swing up and down but with no resulting overall price movements in either direction on a short term basis. However, the medium term trend remains bearish. Readers may want to consider the potential for short trades below horizontal resistance at 124.6p and for long trades above horizontal support at 101p.

From a technical perspective, the stock price should be range-bound from here on as prices swing up and down but with no resulting overall price movements in either direction on a short term basis. However, the medium term trend remains bearish. Readers may want to consider the potential for short trades below horizontal resistance at 124.6p and for long trades above horizontal support at 101p.

A break below 101p would reinstate a bearish bias with 86p as next target. A push above 124.6p would trigger a bullish acceleration towards 144p.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM