RBS is out of the woods and into the new normal for banks

RBS is definitively out of the woods in terms of risk-laden ‘problem bank’ status. The transformation, book-ended by settlement of a residential mortgages case with the U.S. Department of Justice last year, is a win from any perspective. But scrutiny of the group remains intense. The still mostly government-owned bank plays second fiddle to Lloyds as the biggest lender to British households and businesses whilst Brexit looms. As such, the shares are a no less a finely-tuned weather vane to signs of economic turbulence.

That’s the backdrop for the shares’ biggest loss since late-March, down approaching 5% at worst. It didn’t help that whilst 1Q pre-tax operating profit of GBP1bn beat RBS-compiled consensus of GBP900m, the market reacted to signs of deteriorating quality. Missed net interest income and total income forecasts give the game away. Positive inputs from declining strategic and legal costs enabled the bottom line, raising questions about how sustainable earnings momentum will be. RBS itself kept guidance but cautioned that the Brexit-tinged economic environment could “make income growth more challenging in the near term”. With investors now having to also keep tabs on the exit of CEO Ross McEwan, albeit well flagged, there are ample reasons to reduce.

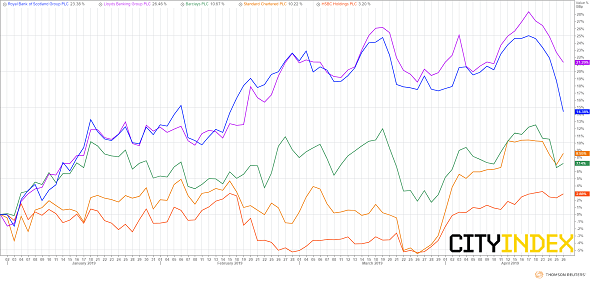

RBS shares, like those of its close rival Lloyds Banking Group, have reversed sharply after a solid 2019 start that took both as much 25%-28% higher. Bullish sentiment from expectations of a softer than feared Brexit and improving capital now looks to be ahead of fundamentals. Foremost among the latter: the volte face by key central banks from a tightening stance back to an accommodative one, including the Bank of England—under very different circumstances. Both lenders look set to continue catching down with the reasserted realities of the sector over the medium term. Lloyds releases a quarterly update on Thursday 2nd May.

Price chart: UK bank shares rebased – year-to-Friday 26th April 2019

Source: Refinitiv/City Index