As universally expected, the RBNZ kept its overnight cash rate on hold today at 1.00%, an acknowledgment to the run of better domestic data of late including GDP, inflation, unemployment, wages growth as well as the improvement in business surveys and the positive impact of upcoming fiscal stimulus in an election year.

A polite hat tip as well to the uncertainties around the coronavirus. While there have been no reported cases of the virus in New Zealand, China’s ports have been impacted, disrupting the handling of New Zealand’s key dairy exports as has demand for tourism and education services. This uncertainty is reflected in the paragraph below from the accompanying statement.

“We assume the overall economic impact of the coronavirus outbreak in New Zealand will be of a short duration, with most of the impacts in the first half of 2020. Nevertheless, some sectors are being significantly affected. There is a risk that the impact will be larger and more persistent”

Despite the downside risks the virus presents, the RBNZ felt confident enough to signal that rates are likely to remain on hold at 1.00% for the remainder of 2020, disappointing the market who were looking for explicit dovish guidance. In response to this, the NZDUSD has rallied from .6410 pre the announcement to a high near .6465 at the time of writing.

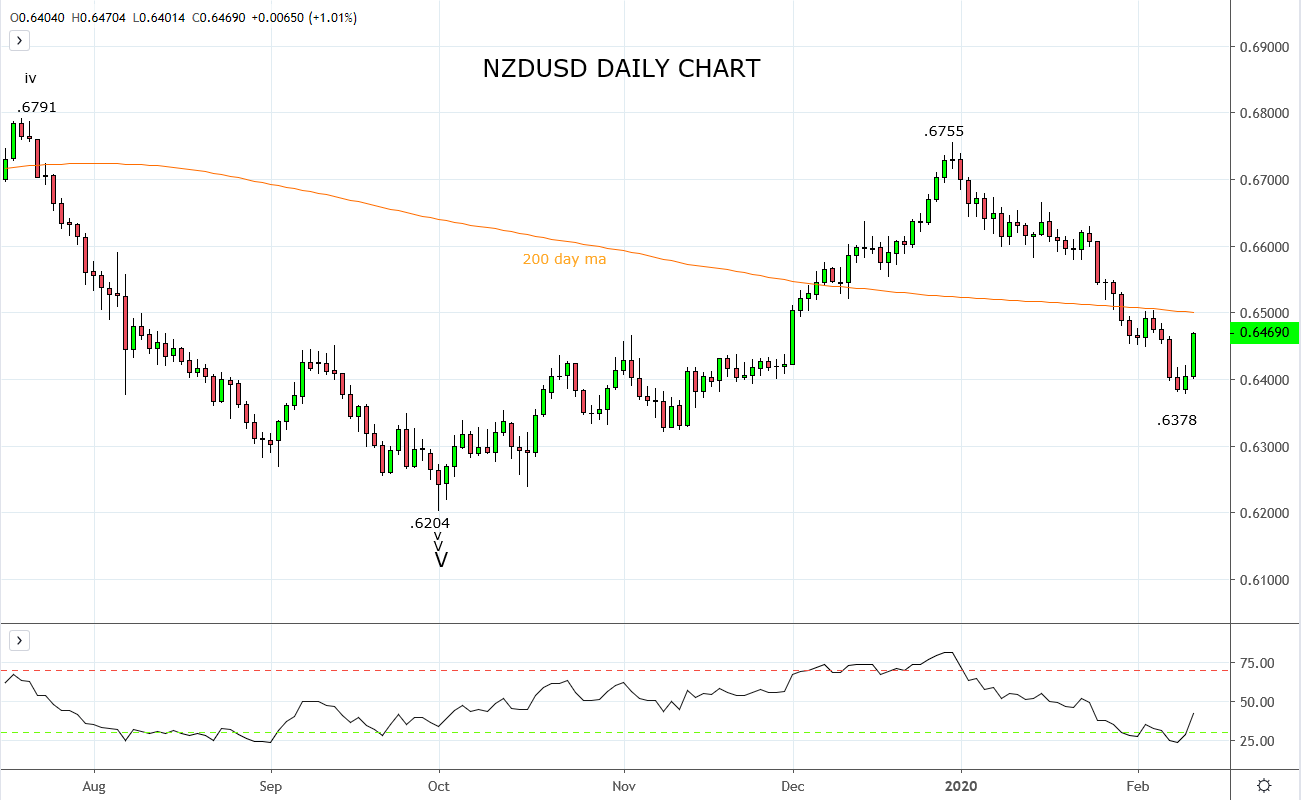

Technically the NZDUSD chart started the year as one of our favorites. After a strong rally during the last weeks of 2019, the NZDUSD tagged perfectly the monthly downtrend resistance at .6755 coming from the 2014, 8836 high. Our expectation from here was for an orderly pullback in the vicinity of -3%. The emergence of the virus resulted in a much deeper pullback than expected.

However, the strong rebound from yesterday’s .6378 low suggests the NZDUSD can test the resistance from the 200 day moving average at .6500c with a break above here opening the way for a move towards .6570. Thereby recovering the majority of the losses that followed the emergence of the virus without threating our overarching view of a stronger U.S. dollar, particularly against the negative yielding EURUSD.

Source Tradingview. The figures stated areas of the 12th of February 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation