As expected the RBNZ left interest rates on hold at 0.25% and kept their Large Scale Asset Purchases program (LSAP) steady at $60bn. A firm dovish tone was wound into the text of the accompanying statement as the RBNZ highlighted that “the balance of economic risks remains to the downside”.

The RBNZ also noted that while fiscal stimulus was providing the main support for the economy, the RBNZ stood ready to provide additional monetary stimulus, alluding to a possible expansion of its LSAP as well as the use of negative interest rates.

In a warning to currency traders that the 4.5% appreciation in the NZ Trade Weighted Index (TWI) over the past six weeks had not gone unnoticed “The appreciation of New Zealand’s exchange rate has placed further pressure on export earnings.”

It is important to remember that the NZ TWI, a weighted measure of the currencies of New Zealand’s trading partners is of more importance to the New Zealand economy than the NZDUSD rate. The Australian dollar accounts for a weighting of 20% and is second only to the Chinese Yuan (21%). On the third rung is the U.S. dollar with a weighting of 13%.

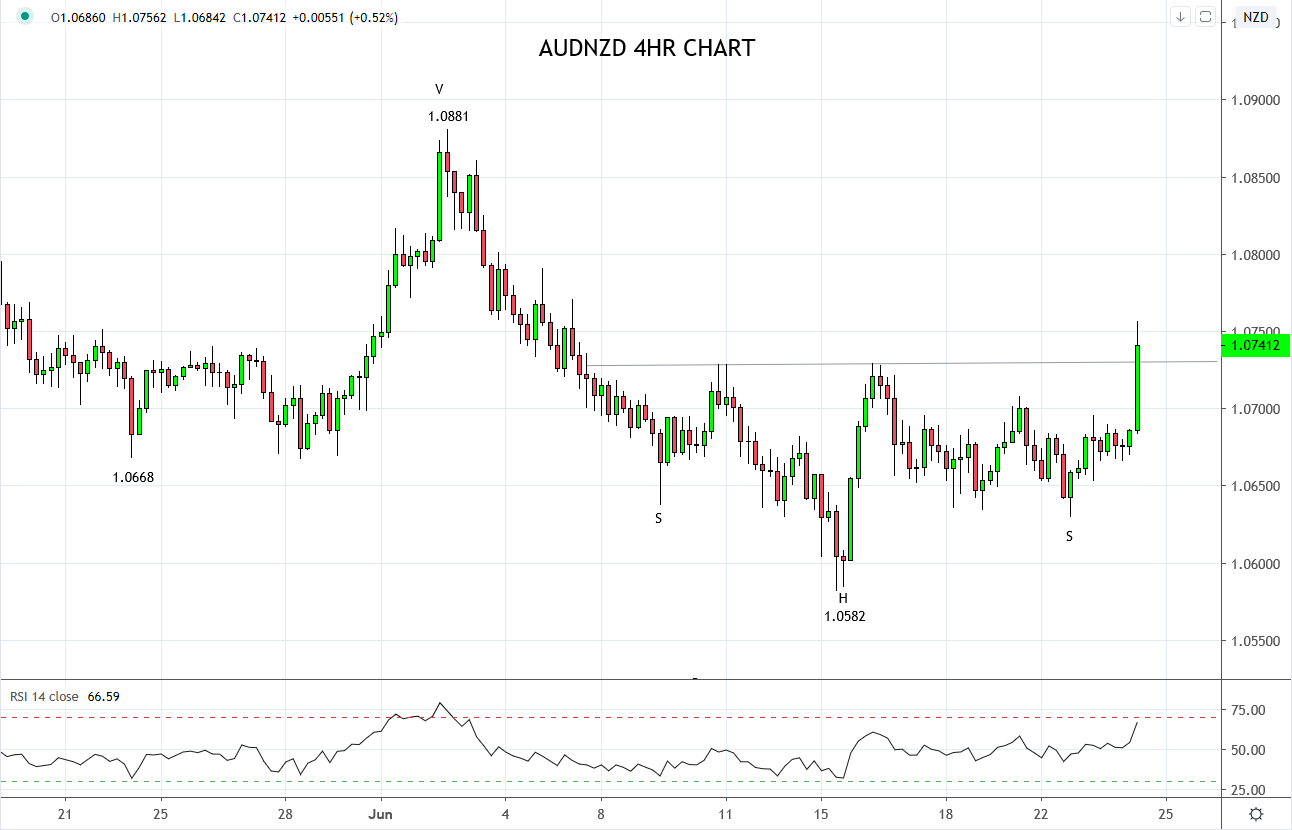

The reason I highlight the importance of the TWI is the AUNZD cross rate is firming in interest from a technical point of view. As seen on the 4hr chart below, AUDNZD is on the verge of confirming a break above the neckline of an inverted head and shoulders bottom.

The implications of this are should the current 4hr candle in AUDNZD close above the neckline (1.0730ish) it would suggest the cross is set to move higher and the trigger to consider entering longs in AUDNZD.

The stop loss would be placed initially below 1.0679 with a view to trailing it higher to 1.0710 if AUDNZD rallies towards 1.0800. The target for the trade is a retest and break above the June 1.0881 high.

Source Tradingview. The figures stated areas of the 24th of June 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation