Sixteen months later at a scheduled meeting today, the RBNZ was expected to become the first major central bank to raise interest rates since the COVID-19 pandemic commenced.

Last week after a run of hot economic data, the NZ interest rate market was fully priced for a 25 bp hike today, with a 30% chance of a 50 bp hike. In a dramatic turn of events, an outbreak of a handful of Covid cases in Auckland yesterday has encouraged the RBNZ to leave rates on hold at 0.25%.

“However, the need to reinstate COVID-19 containment measures in some regions highlights the serious health and economic risks posed by the virus” and “in light of the current Level 4 lockdown and health uncertainty, the Committee agreed to leave the OCR unchanged at this meeting.”

Post the announcement, the NZDUSD fell from .6943 to a low near .6870, before rebounding back to .6920, a reflection the market had largely braced itself for rates to stay on hold and a recognition the rate hike have only been delayed.

Attention now turns to the release tomorrow of the Australian labour market report for July. Given the spate of lockdowns that commenced in late June, a negative number is forecast. The median expectation is for a 50k drop in employment and the unemployment rate to rise to 5% from 4.9% in June, with the impact softened by a fall in the participation rate from 66.2% to 66.1%.

As noted by AMP’s Chief Economist Shane Oliver, employment is expected to fall this time around by approximately 300,000, less than the -857,000 jobs lost last year. “This is because not all of Australia is in lockdown, businesses may be less inclined to lay off this time around given the rebound seen last year and only recent talk of labour shortages, and business confidence and job ads don’t seem to have fallen as rapidly as seen last year.”

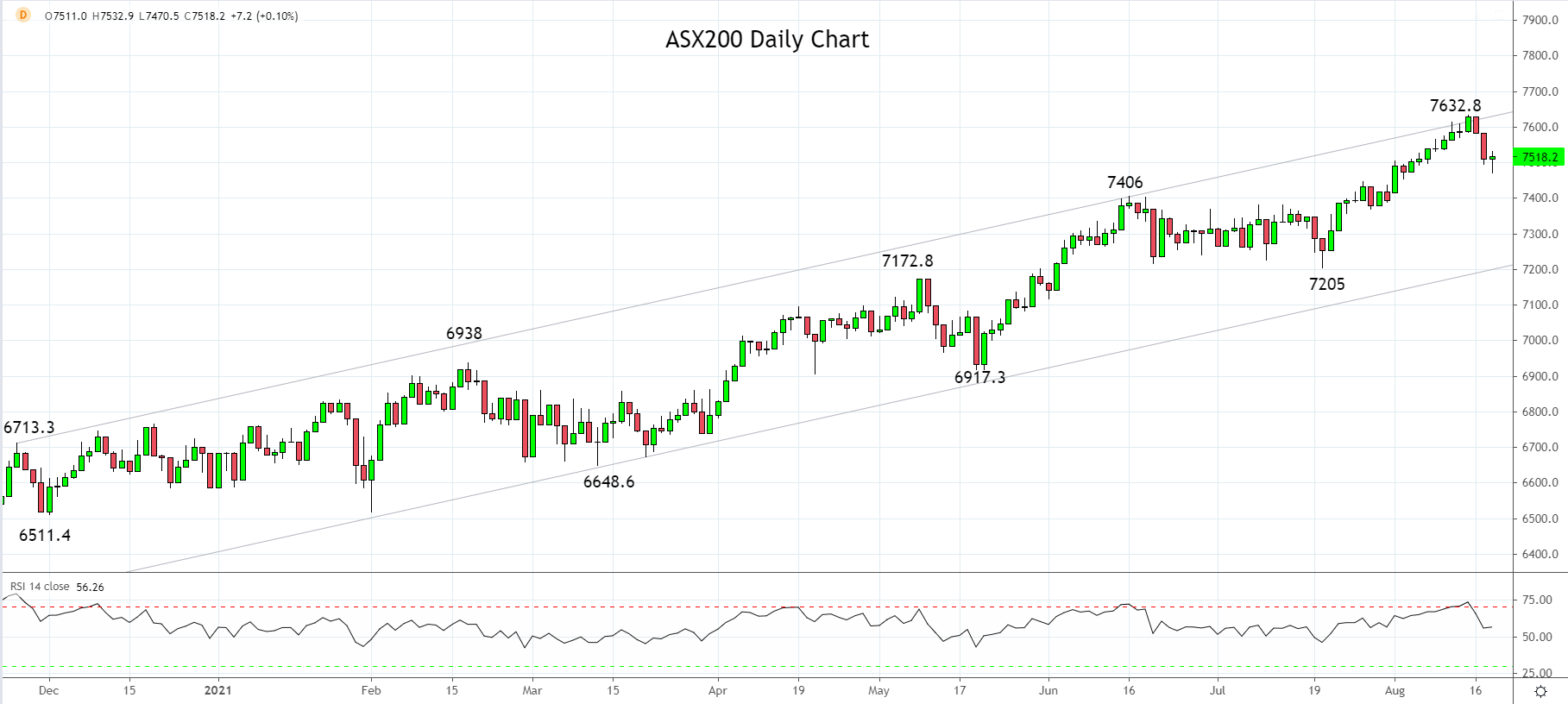

After a 3% rally during the first two weeks of August on the back of M&A activity and good earnings news, the ASX200 reached the top of an eight-month trend channel, just above 7600.

From this resistance, a correction commenced this week, including yesterday’s 71 point fall, the biggest in two months. While we are mindful that buyers have been very quick to snap up any dips, the current pullback has scope to deepen in the coming weeks towards 7400 and then to trend channel support 7250/00 area region, the preferred buying level.

Source Tradingview. The figures stated areas of August 18th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation