RBNZ may get Its Cue from RBA Tomorrow

New Zealand releases its employment data on Wednesday with expectations for the Employment Change for Q3 to rise 0.3% from an increase of 0.8% in Q2. Next week, the RBNZ will meet and will decide whether they should cut key overnight interest rates or leave them on hold at 1.0%. But for the RBNZ, its not quite as simple as looking at their own economy. The RBNZ must also take into consideration China data and the China-US trade war, as China is a key importer from New Zealand. Currently, the market has mixed expectations as to whether they will cut or remain on hold. However, the markets may get a good idea as to what to expect from the RBA tomorrow when they meet and give their outlook on the economy and growth.

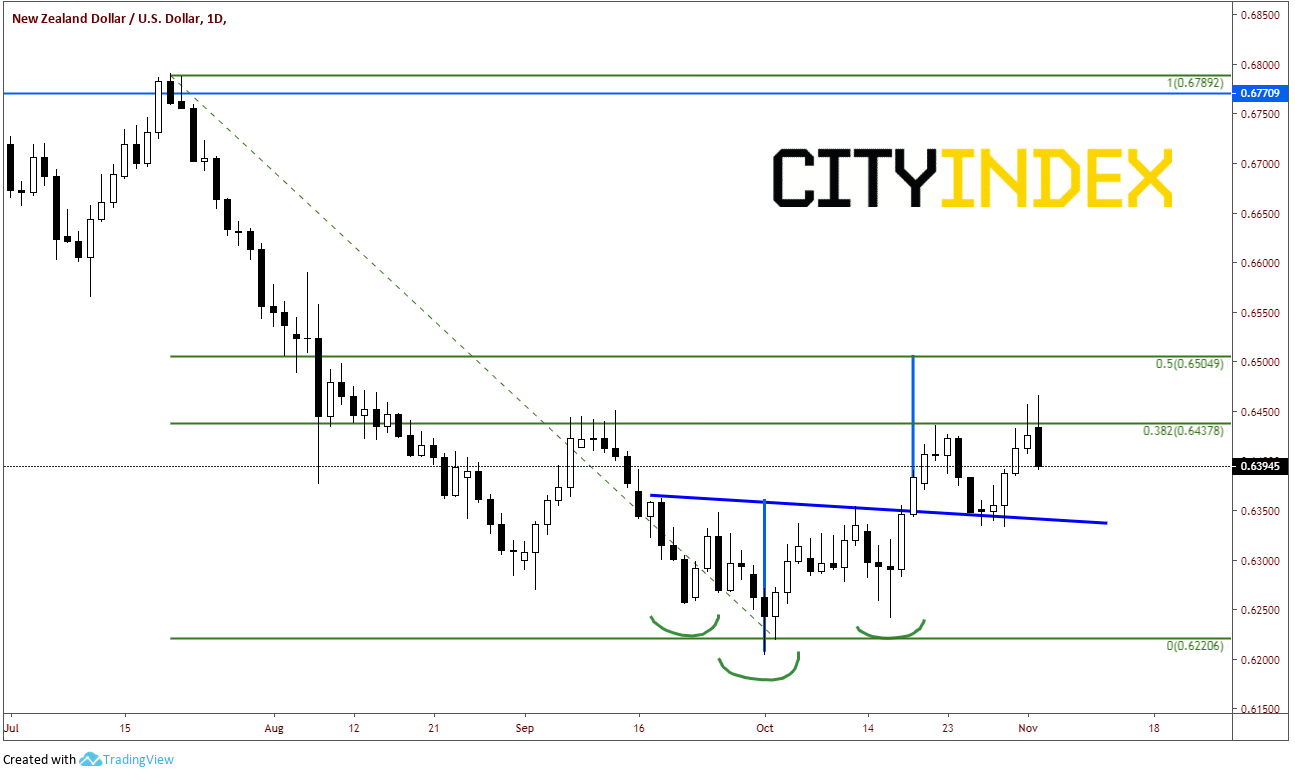

On a daily chart, NZD/USD broke out an inverted head and shoulders pattern on October 18th. The pair halted at the 38.2% Fibonacci retracement level near .6438 from the highs on July 19th to the lows on October 1st. It pulled back to retest the neckline and traded back up to the 38% retracement. On Friday, it appeared the pair was going to head higher to the Inverted head and shoulders target near .6505, however it reversed during the day to put in a shooting star candlestick formation. Today, NZD/USD put in a bearish engulfing pattern, which implies the bears managed to take control and the pair may be headed lower.

Source: Tradingview, City Index

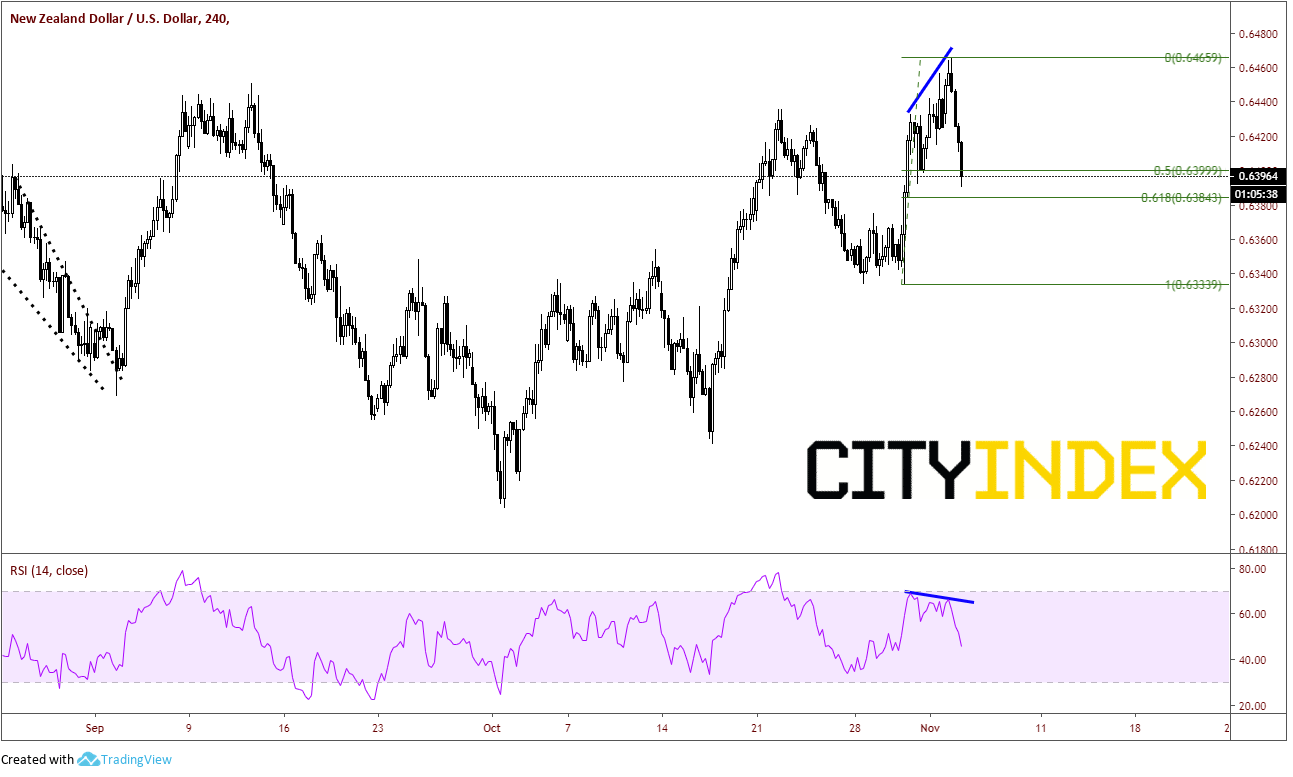

On a 240-minute chart, there is clear divergence between the RSI and price. As price was moving higher, the RSI was moving lower. NZD/USD sold off from the European session open until the US close, as the DXY traded higher. The pair closed the day down almost -0.5%, between the 50% and the 61.8% retracement levels of the October 30th low to todays highs, near .6395.

Source: Tradingview, City Index

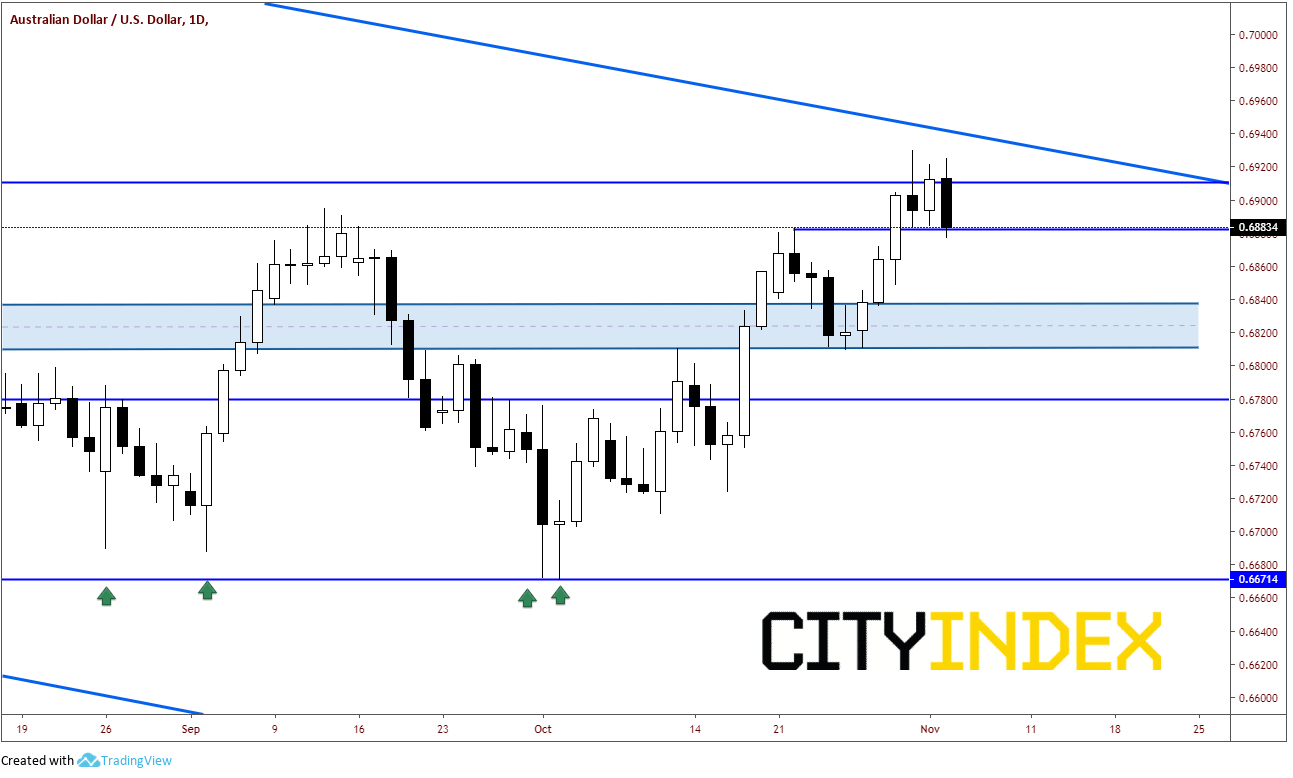

Not surprisingly, AUD/USD also put in a bearish engulfing candlestick formation as the DXY traded higher as well. The pair closed down -.43% near .6882, while the DXY was closed up +.43% near 97.54.

Source: Tradingview, City Index

In a few hours we will know exactly where the RBA stands in terms of their economic outlook. If you are trading the NZD/USD, take cues from both the RBA and the AUD/USD as to what the RBNZ may be considering when they meet next week! (The NZD/USD should begin pricing in expectations).