Following the suspension of the trans-Tasman travel bubble following the Sydney outbreak in late July, quarantine-free travel is unlikely to resume between Australia and New Zealand in September as previously planned.

Higher vaccination rates are needed on both sides of the Tasman. To help achieve this, New Zealand will speed up its vaccine rollout by increasing the gap between doses to six weeks from three to ensure more people are partially vaccinated.

In a plan outlined today, New Zealand will move to a risk-based phased reopening of its border early next year, meaning that New Zealand will have been isolated from the rest of the world for over 18 months after the pandemic commenced.

Despite this, the New Zealand economy is showing signs of overheating. Property prices are booming, the unemployment rate recently fell to a one-year low of 4.0%, inflation is running at 3.3% y/y, above the top of the RBNZ’s 1-3% band, and a 25 bp rate hike is expected and priced for next week’s RBNZ meeting.

After today's release of a closely watched RBNZ survey that showed inflation expectations for two years out firmed to 2.27%, the highest since 2014, the odds of a 50bp hike from the RBNZ next week are rising.

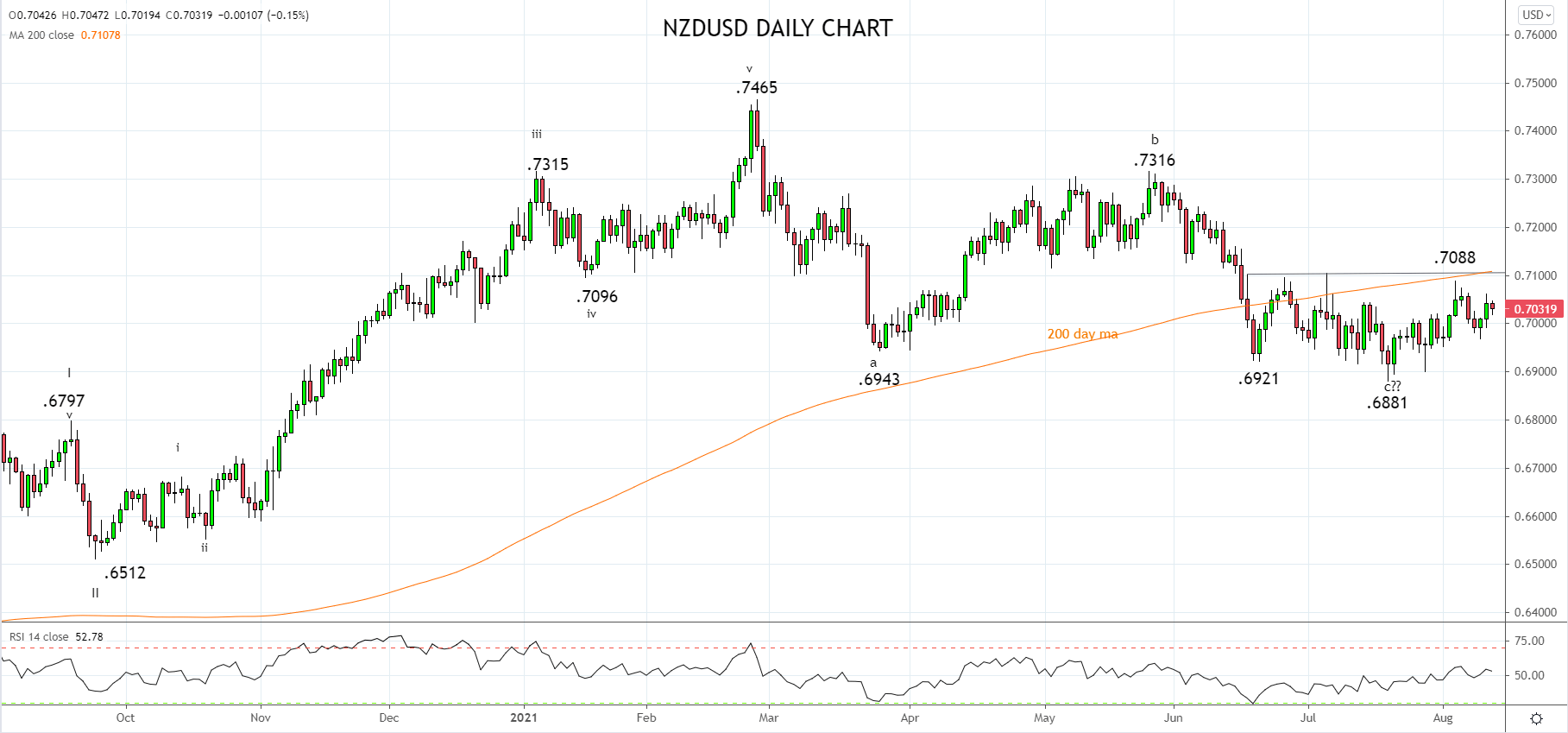

The positive signs that emerged in the NZDUSD in early August following the robust Q2 NZ jobs data faded after the NZDUSD failed to clear the 200-day moving average at .7100 and resulted in the NZDUSD returning to its former .7050 - .6880 type range.

Today's events outlined above have failed to shift the NZDUSD higher. However, given the positive backdrop and the potential for a 50bp hike at next week’s RBNZ, the bias remains to the upside.

A break and close above resistance at .7100c would confirm that a medium-term low is in place at the July .6881 low and be the catalyst for the NZDUSD to test the .7300c region.

Source Tradingview. The figures stated areas of 12th of August 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM