Today marks the last day that New Zealanders live under Level 3 lockdown restrictions. From tomorrow retail stores, malls, cafes, restaurants, cinemas, and gyms re-open for business. Next Monday, schools will re-open to all learners.

The progressive relaxing of some of the world’s most onerous lockdown restrictions following the governments' success in suppressing the coronavirus, helps explain why the New Zealand equity market has experienced one of the strongest recoveries in the Asian Pacific region, trading approximately 30% above its March lows. In comparison, our index the ASX200 is currently up 20%.

Despite the good news, dark clouds remain. The spread of the virus and slowdown in world growth will reduce demand for New Zealand’s exports. Perhaps most significant is the closing of New Zealand’s borders to international tourism, potentially until a vaccine is found. Tourism is the country’s largest export earner and a large contraction in GDP and a sharp rise in the unemployment rates is all but baked in.

This has prompted the RBNZ to act decisively at today’s interest rate meeting. As expected the RBNZ kept the overnight cash rate (OCR) on hold at 0.25%. Catching the market off guard, the RBNZ’s Large Scale Asset Purchase Program (another name for QE) was increased to $60bn per month from the previous limit of $33bn. This is something we alluded to in an article last week.

“Members agreed that an expansion to the LSAP programme is the most effective way to deliver further stimulus at this time.”

At the increased rate of purchases, the RBNZ will own almost 50% of all NZ government bonds on issue within 13 months, a percentage that the RBNZ has previously stated it would be uncomfortable exceeding. As a result, the RBNZ discussed other monetary options, including negative interest rates.

“The Committee noted that a negative Official Cash Rate (OCR) will become an option in future, although at present financial institutions are not yet operationally ready.”

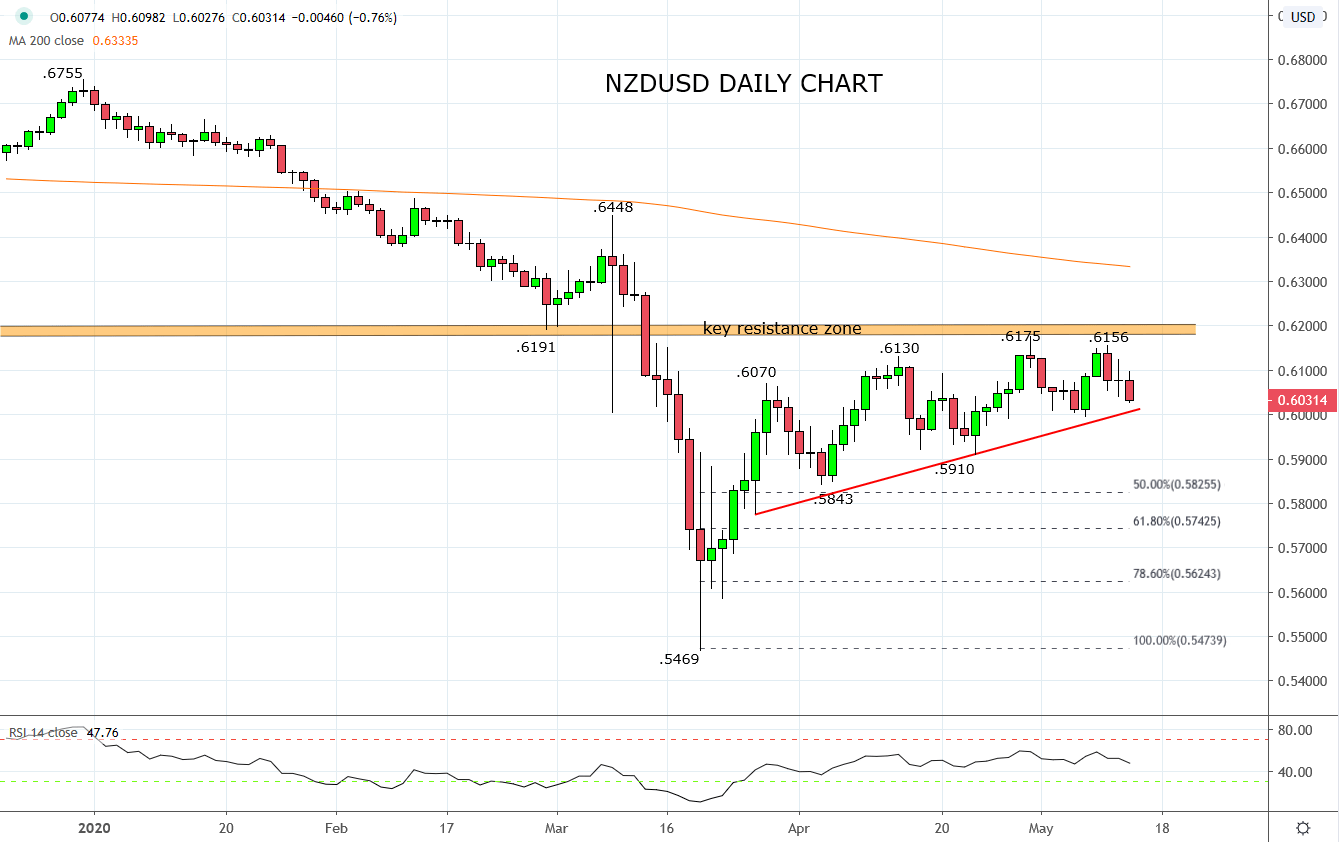

Not surprisingly, the more dovish than expected outcome has resulted in the NZDUSD tumbling from .6085 to .6030, to be now eyeing crucial trendline support and recent lows .5980 area.

Following multiple rejections in recent weeks from ahead of the strong band of resistance at .6200c, a break/close below .5980 would provide bearish confirmation that a deeper sell-off towards the next level of support at .5910/00 has commenced, with risk towards .5830/5740.

Source Tradingview. The figures stated areas of the 13th of May 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation