The hawkish surprise was that the RBNZ removed the “unconstrained OCR” in its published forecasts and after a 12-month absence, the reintroduced OCR track showed a full hike by Q3 2022 (markets had already priced this in) and a total of 150bp of hikes by mid-2024.

In a final knife twist to the cadre of remaining central banks still holding onto an ultra-dovish and patient mantra, the RBNZ removed its reference to a negative OCR.

In response, the NZ interest rates market has been thrown into turmoil. For those unfamiliar with the NZ interest rate market, it's very popular with macro hedge fund and bank traders, however, it is notoriously illiquid when it's time to exit.

Pricing for the August 2022 OIS has rallied 16bp to 0.66%. The yield on June 2022 bank bill futures has rallied 13bp from 0.45% to 0.58% and the yield on the 2yr swap rate is 7bp higher at 0.59%.

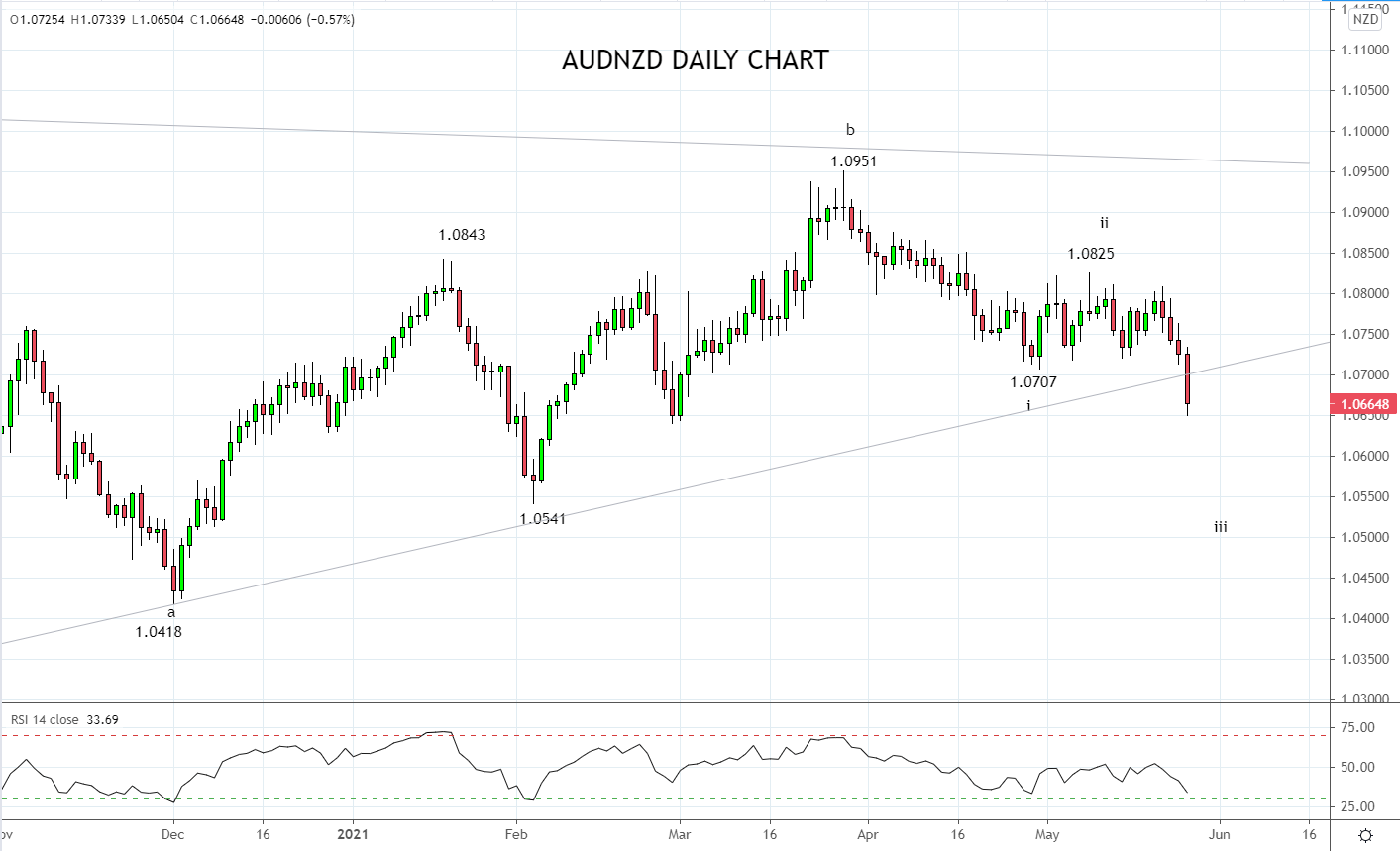

In the currency space, the NZDUSD has rallied from 0.7230 to a high near 0.7308, and the AUDNZD cross rate has fallen from 1.0725 to a low near 1.0651 at the time of writing.

This opens the way for AUDNZD to move lower towards medium-term support 1.0550/1.0450 and AUDNZD short positions are recommended. Aware that a break/daily close back above today’s high at 1.0835 is required to negate the bearish bias.

As expected the RBNZ made no changes to policy settings and the forward-looking guidance remained dovish. The RBNZ’s forecasts for GDP, inflation, and employment were again revised higher.

The hawkish surprise was that the RBNZ removed the “unconstrained OCR” in its published forecasts and after a 12-month absence, the reintroduced OCR track showed a full hike by Q3 2022 (markets had already priced this in) and a total of 150bp of hikes by mid-2024.

In a final knife twist to the cadre of remaining central banks still holding onto an ultra-dovish and patient mantra, the RBNZ removed its reference to a negative OCR.

In response, the NZ interest rates market has been thrown into turmoil. For those unfamiliar with the NZ interest rate market, it's very popular with macro hedge fund and bank traders, however, it is notoriously illiquid when it's time to exit.

Pricing for the August 2022 OIS has rallied 16bp to 0.66%. The yield on June 2022 bank bill futures has rallied 13bp from 0.45% to 0.58% and the yield on the 2yr swap rate is 7bp higher at 0.59%.

In the currency space, the NZDUSD has rallied from 0.7230 to a high near 0.7308, and the AUDNZD cross rate has fallen from 1.0725 to a low near 1.0651 at the time of writing.

As viewed on the chart below, the decline in AUDNZD from the March 1.0951 high has accelerated today post the break of the trendline support near 1.0700, coming from the March 2020 low.

This opens the way for AUDNZD to move lower towards medium-term support 1.0550/1.0450 and AUDNZD short positions are recommended. Aware that a break/daily close back above today’s high at 1.0835 is required to negate the bearish bias.

Source Tradingview. The figures stated areas of the 26th of May 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM