Recent RBA communique had warned of this outcome. A note in the August minutes that fiscal rather than monetary support is more appropriate for this temporary shock and that additional QE would have maximum effect in 2022, with only a marginal impact at this time when additional support is required.

The RBA said today it would maintain its flexible approach to the rate of bond purchases, and the board will "continue to review the bond purchase program in light of economic conditions and the health situation."

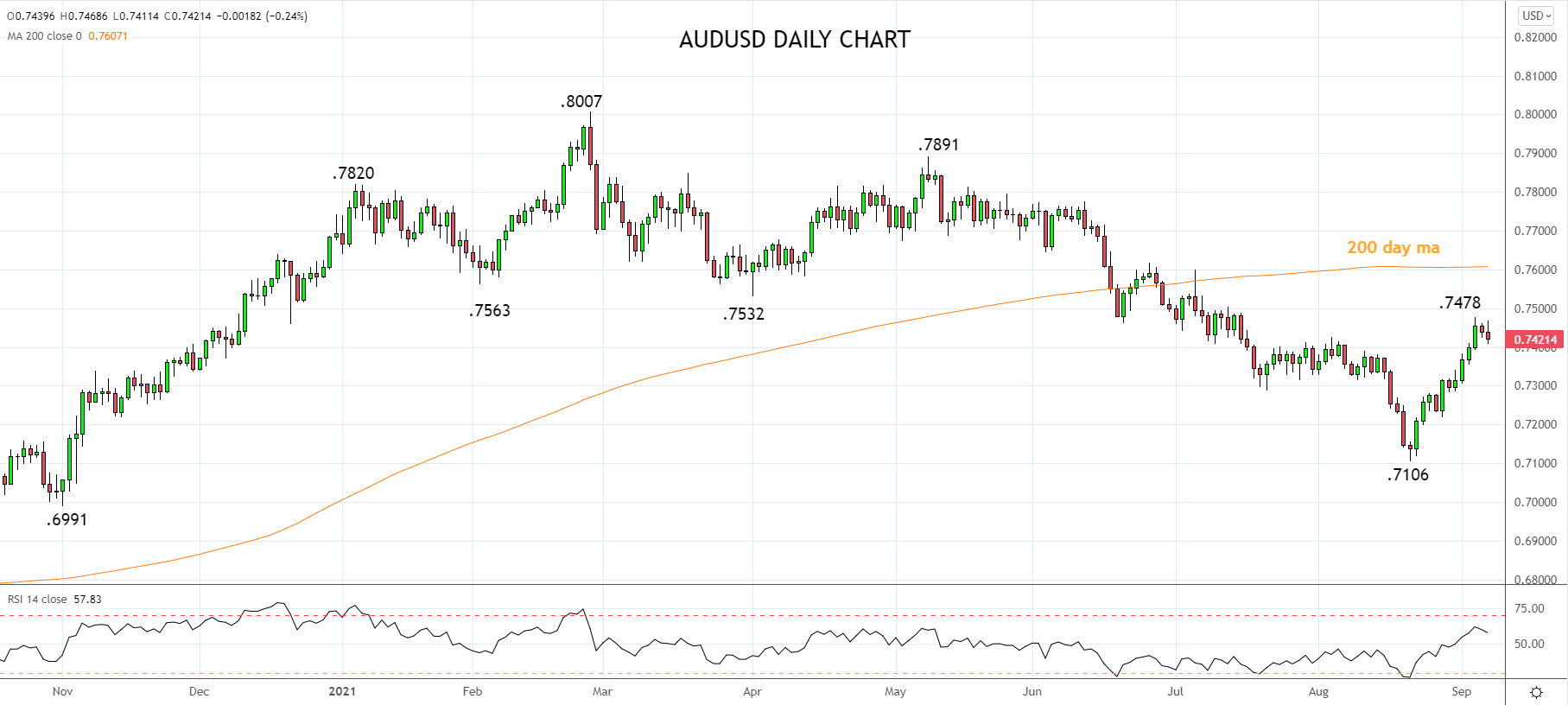

The AUDUSD initially rallied 25 pips after the announcement to .7468 before reversing lower, possibly some position squaring following its 5% rally over the past two weeks from the .7106 low.

Near term, the AUDUSD is potentially settling into a new higher trading range with sellers operating ahead of the 200 day moving average .7550/.7600 and dip buyers likely emerging ahead of the .7350/00 support region.

Source Tradingview. The figures stated areas of September 7th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation