There are some suggestions the weaker than expected payrolls print in April (266,000 actual vs expectations of almost 1 million new jobs) was the result of technical issues or labor supply factors rather than an indication of underlying labor market weakness.

Nonetheless another miss this month would likely raise more questions and present a setback to the timetable that the Federal Reserve can announce its plans to taper.

Expectations for May payrolls are for a 650,000 rise in new jobs, and for the unemployment rate to drop from 6.1% to 5.9%, supported by a further easing of business restrictions, offsetting the headwinds of labour supply factors.

How will markets react to another out-of-consensus payroll print?

Some care is required in defining exactly what constitutes a payroll's “beat” or a “miss”, given the multiple feeds into the print (revisions, hourly earnings, sub-components).

Hence we will work on a “miss” being +/-200,000 on either side of the consensus expectation of 650,000.

An increase of 850,000 new jobs will likely be taken as confirmation the US recovery remains on track, and lead to a more hawkish Federal Reserve and a stronger US dollar. Value stock indices such as the S&P500 should outperform the Nasdaq that traditionally struggles under the weight of higher interest rates.

Learn more about trading indices

A softer than expected number of 450,000 new jobs or less will be taken by the market as an indication the Federal Reserve will remain dovish for longer and open the way for another bout of US dollar weakness. The Nasdaq should outperform value indices and gold would likely set sail towards the next layer of resistance near $1965.

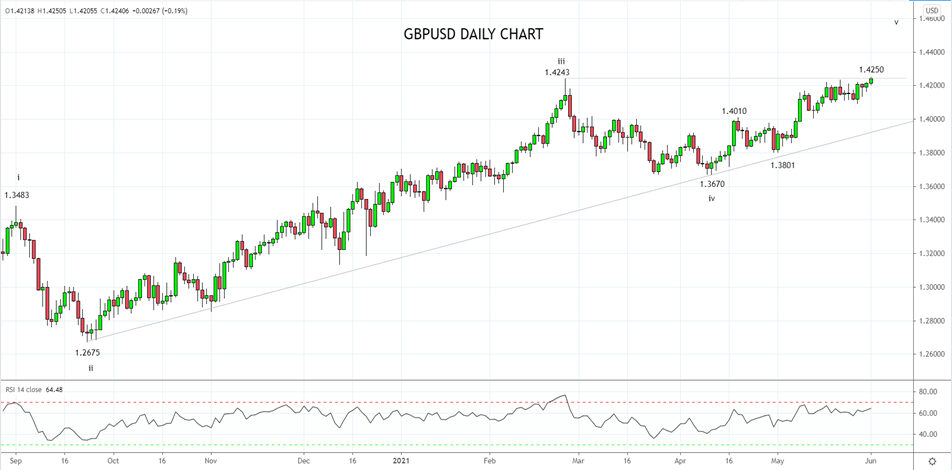

Currency pair to watch during NFP: GBP/USD

GBP/USD continues to test the layer of resistance at 1.4245/55 coming from the February high, at this point lacking the conviction to either convincingly break above or reject it.

Should Friday's US payroll data be weaker than expected and GBP/USD can cement a break above resistance at 1.4245/55, look for GBP/USD to extend its rally towards 1.4600.

Source Tradingview. The figures stated areas of the 1st of June 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation