Despite the continued run of good economic data locally, including the release this morning of a consumer confidence survey that printed just below a decade high, the tone of the RBA was unquestionably dovish.

The RBA reiterated that it remains committed to the 3yr bond yield target of 0.1% until late 2024 and pushed back against current interest rate market pricing that has the RBA raising the cash rate in late 2022 and again in 2023.

“As I discussed earlier, over the past couple of weeks market pricing has implied an expectation of possible increases in the cash rate as early as late next year and then again in 2023. This is not an expectation that we share.”

The RBA again providing explicit forward guidance that they will not raise interest rates until inflation is within their 2-3% target band for a sustainable period, as well as the need for a stronger labour market and higher wages growth.

“We want to see a return to full employment in Australia and inflation sustainably within the 2 to 3 per cent target range. These are our goals and we are committed to achieving them.”

Backing away from a possible run in with the currency market and likely to be relieved to see some of the heat come out of the exchange rate, Governor Lowe commented he would be comfortable if the AUD was lower but could not say it was overvalued. Likely an acknowledgement of strong commodity prices.

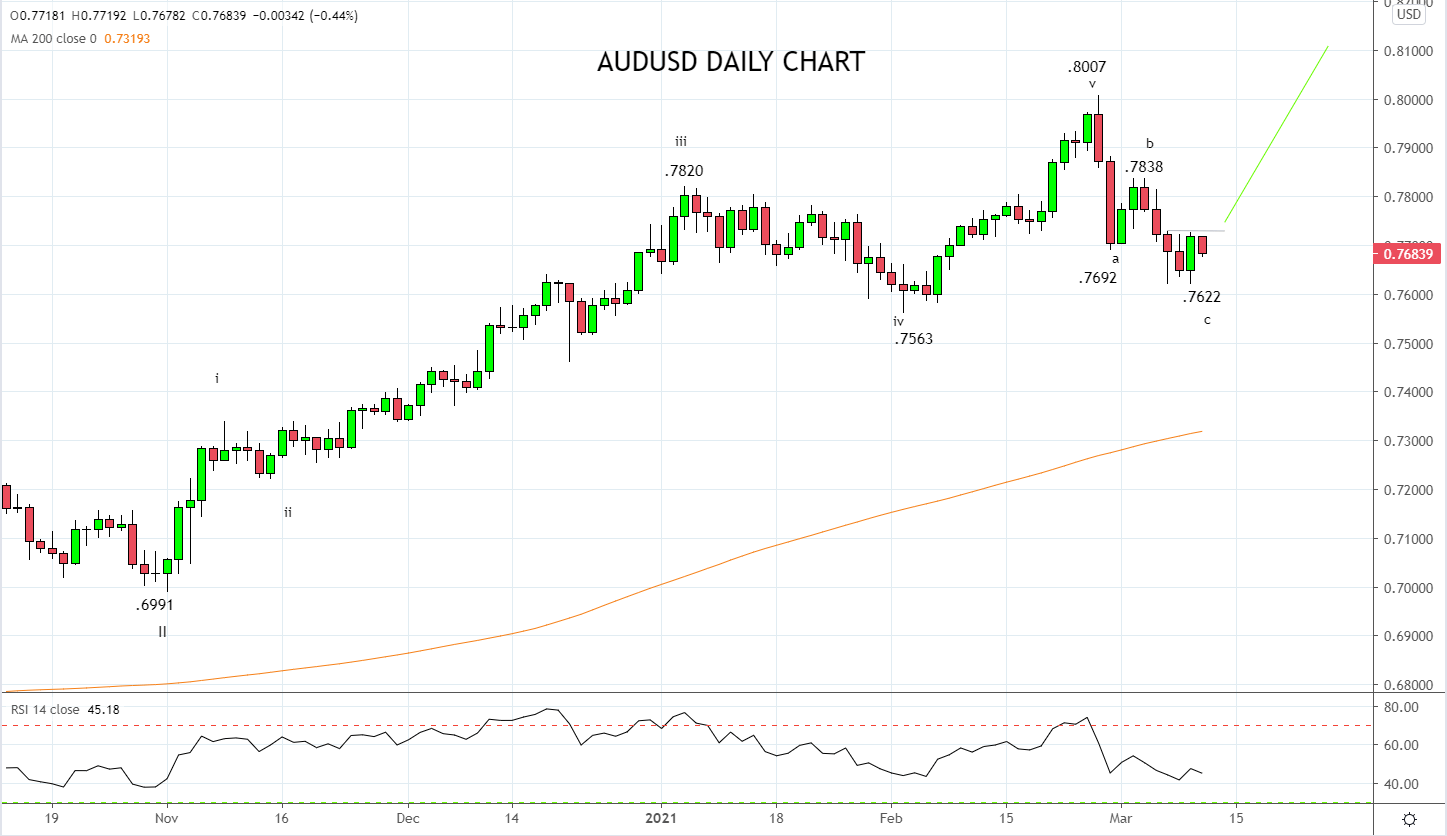

In our last update on the AUD/USD here we called for the corrective pullback to continue and that “Ideally this correction will unfold in three waves back towards medium term support .7600/.7550.”

The bullish loss of momentum candle that formed last Friday night and again overnight at the .7622 low are initial warnings the correction is close to completion. Should the AUD/USD break/close above near term resistance .7720/30 area, it would signal a push towards .7820 is underway, with scope to retest the recent .8007 high.

Source Tradingview. The figures stated areas of the 10th of March 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation