With several countries closed today for holidays including the United Kingdom, Japan, and China, it is unlikely the U.S dollar will slip too far ahead of the release tonight of US ISM manufacturing data, currently at 35-year highs.

Furthermore, the month of May is usually one of the strongest for the U.S dollar (the weakest for the AUD and NZD). With some Fed officials (albeit non-voters) calling for the Fed to raise rates in 2022 and to start tapering talk, it does leave the AUD/USD vulnerable into tomorrow's RBA interest rate meeting.

Tomorrow the RBA is expected to keep monetary policy on hold and reiterate that while the recovery has been stronger than expected, inflation and wages remain weak. Evidence of this, last week’s core inflation data for Q1 that printed at +0.3% QoQ, putting the annual rate at just 1.1% YoY.

The RBA has stated many times it won’t raise rates until inflation is “sustainably within the 2% to 3% target range.”

As such, the focus of the RBA meeting will be on clues around the banks Quantitative Easing (QE) program. Specifically as to whether it will taper or perhaps increase its size and/or extend its Yield Curve Control (YCC) program to the November 2024 bond.

Any clues that might suggest the program will be extended/increased, is likely to weigh on the AUD/USD. More so as one of the key macro thematic driving FX markets currently is central bank divergence. A recent example, the CAD’s appreciate after the hawkish Bank of Canda meeting.

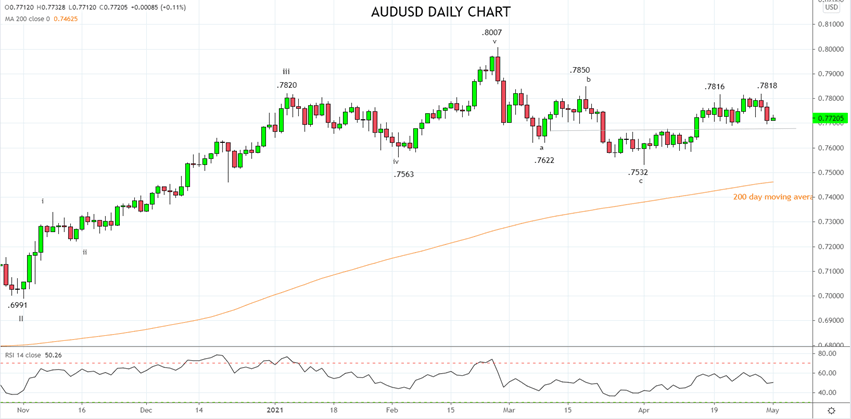

Technically the view has been the decline in the AUD/USD from the Feb .8007 high to the April .7532 low, completed a corrective pullback and the uptrend has resumed. However, the rejection into the end of last week from the double top at .7815/20ish is a setback to the bullish bias.

In this context, the AUD/USD must hold above support at .7670/60 to remain with a positive bias. Aware that should the AUD/USD break/close below support at .7670/60 a retest of the .7532 low is possible.

Source Tradingview. The figures stated areas of the 3rd of May 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation