As such, most interest will be in the Board's commentary around the stronger than expected Q3 GDP print and discussions around potential disruption to the outlook from the Omicron variant and high inflation.

While the Australian interest rate market remains priced for rates “lift-off” by mid-2022 and has almost three rate hikes priced before the end of 2022, tomorrow's RBA meeting isn’t likely to provide much gratification for overly eager bond traders.

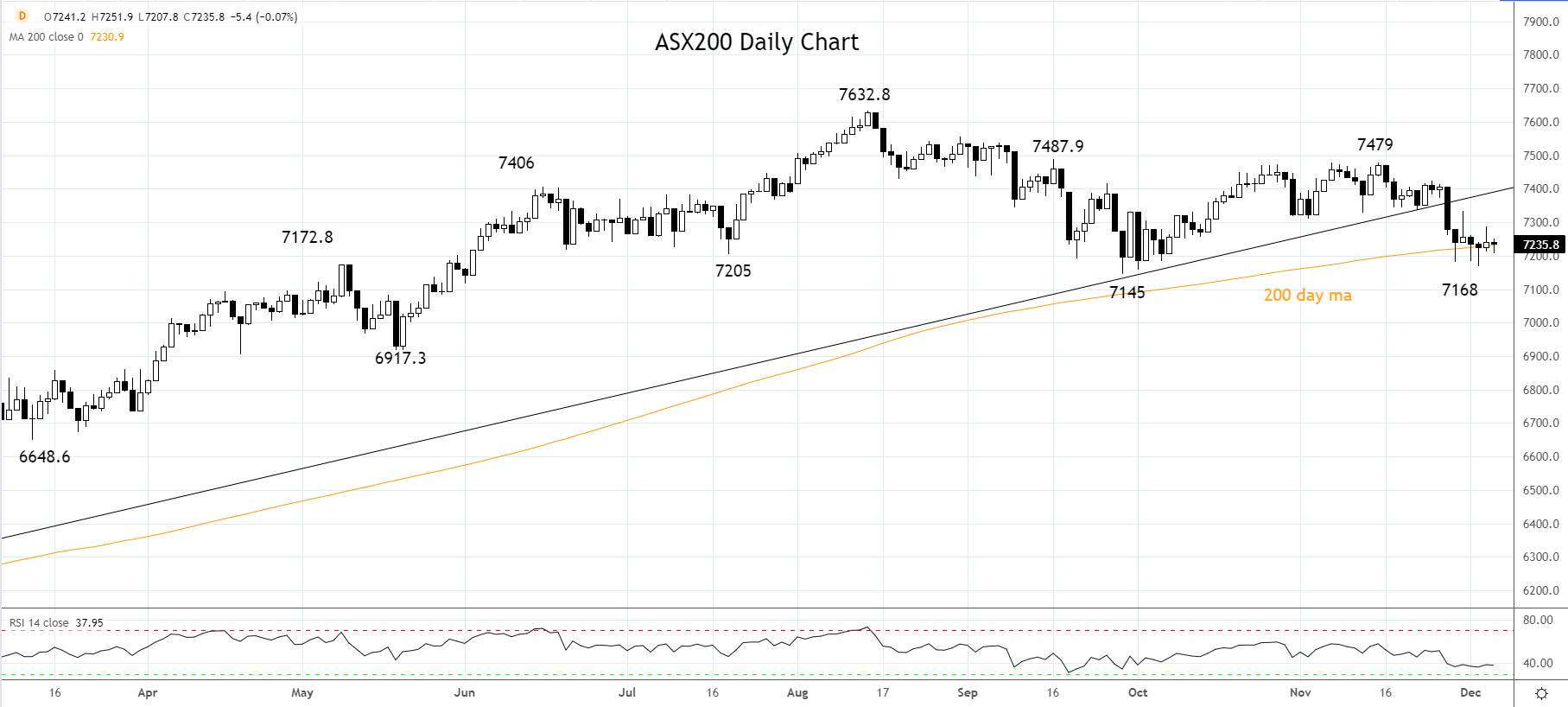

Turning now to the ASX200, a hawkish Fed pivot, high inflation, and the latest Covid-19 variant, Omicron, have created an unstable mix of growth and policy tightening concerns for Australian equity investors. In response, the ASX200 closed lower last week, for a fourth straight week.

For traders that have come to expect the ever-reliable Christmas rally, more information around Omicron's transmission rates, the efficacy rate of existing vaccines, and the virus's severity are first needed before the rally can take hold.

Presuming research confirms early reports that Omicron is more transmissible but results in milder cases, the ASX200 will likely springboard higher from the 200-day moving average at 7230, where it is attempting to base and retest the August 7632 high.

Until then, the market remains susceptible to headlines. A retest of the September 7145 low is possible with scope towards wave equality and psychological support at 7000 before the correction is complete.

Source Tradingview. The figures stated areas of December 6th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade