The RBA's forward guidance remained dovish, again signalling that the conditions needed to raise interest rates (inflation sustainably between the 2% to 3% target rate and wages growth of 3%) are unlikely to be met until 2024 the earliest.

After tapering its Quantitative Easing program at its last meeting, it committed to keeping the rate of bond purchases steady at $4bn a week until February.

The RBA remains confident that once the current lockdowns end, the economy will bounce back, although the rebound may be less dynamic than the one that followed the 2020 lockdown.

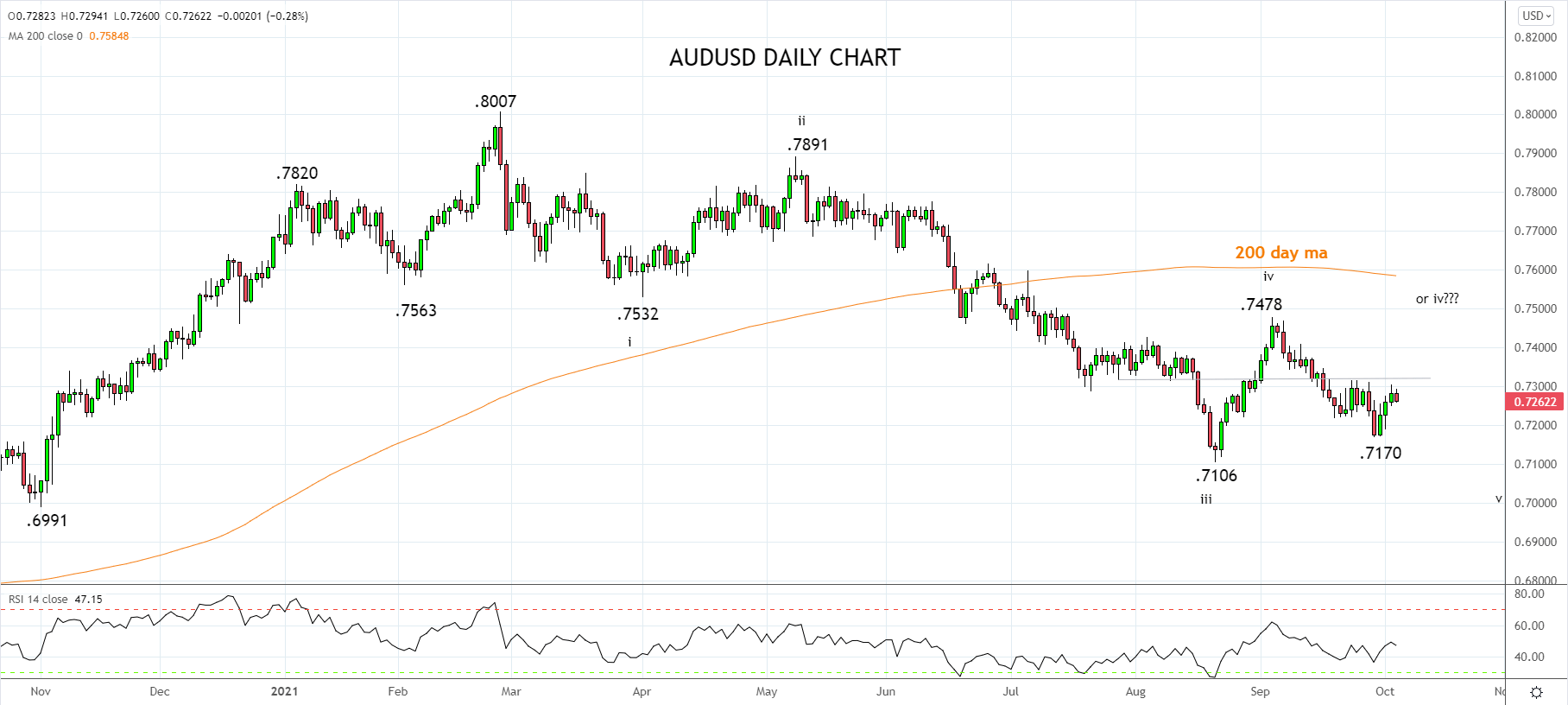

Following the announcement, the AUDUSD dropped from .7275 to a low of .7260 after the RBA reinforced its support for the economy and dovish guidance.

The market remains heavily short of the AUDUSD and should the AUDUSD break above the .7320/40 resistance area, it may prompt some short covering back towards .7450.

Until then, however, the AUDUSD remains vulnerable to a retest of the August .7106 low.

Source Tradingview. The figures stated areas of October 5th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation