Shares of Evergrande plunged as much as 19% today as the group weighed down by over US$300 billion in debt, again warned that it could default. Property developers account for around 50% of China's steel demand, helping to explain the 21% fall in iron ore price last week.

Compounding the impact, markets in mainland China, Japan, South Korea, and Hong Kong are closed at various stages of this week, celebrating national holidays, which means liquidity has and will be patchy at times.

Illustrating this, iron ore futures in Singapore fell more than -11% at one stage today before recovering to be trading -5.1% lower, at $96 p/t at the time of writing.

Given the sharp surge in volatility to start the new week, it is with some relief that tomorrow's RBA meeting minutes will provide little in the way of fresh news. This follows RBA Governor Lowe's speech at the Anika Foundation lunch last week, where he reiterated interest rate hikes are highly unlikely before 2024.

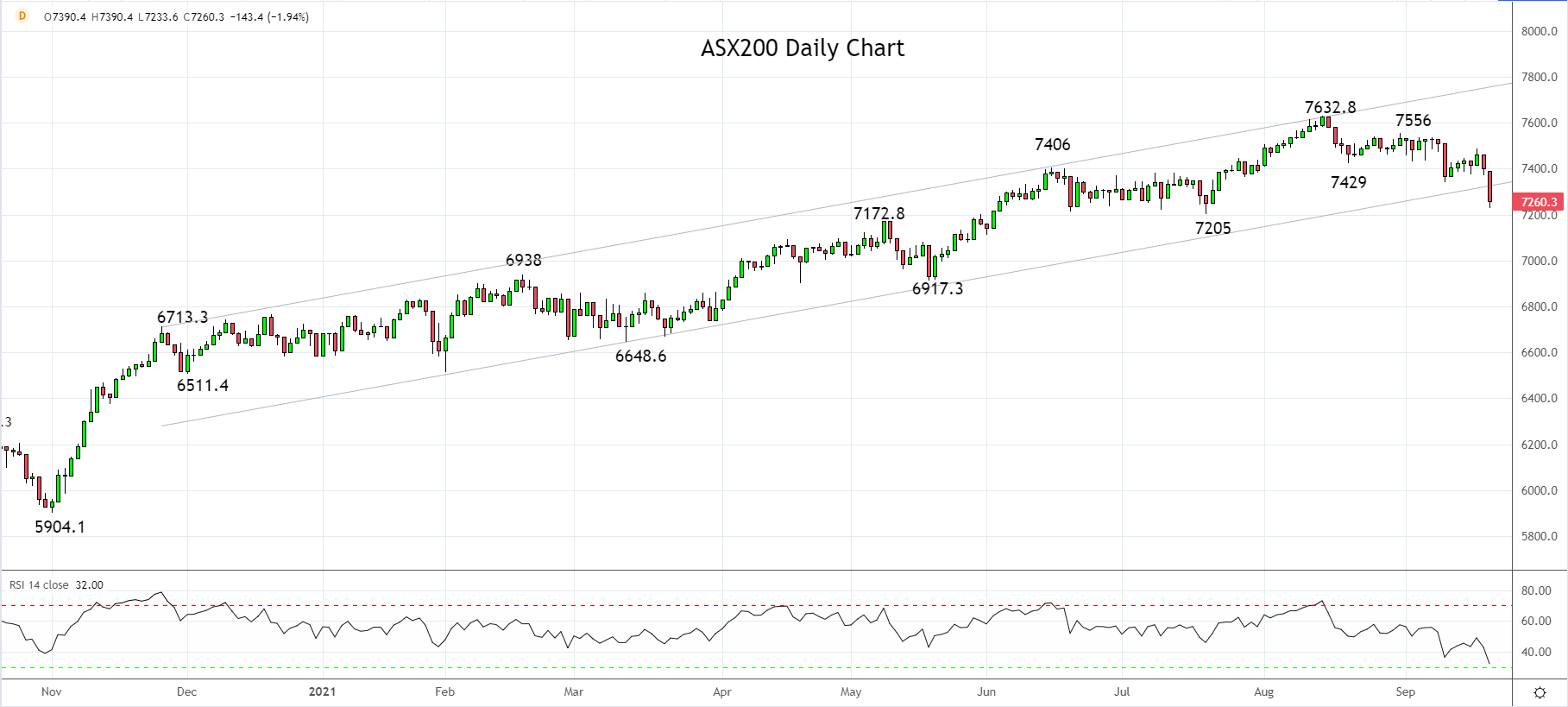

Turning to the ASX200, with 30 minutes of the trading day left, it is trading -2.00% lower at 7253, after plunging below its long-standing trend channel support near 7300.

Not far below resides important support at 7220/00 coming from the pre Covid crash 7197.6 high. Should the ASX200 fail to hold above this support zone, the risks are for a deeper pullback towards 7000 in the coming sessions.

Source Tradingview. The figures stated areas of September 20th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Latest market news

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM