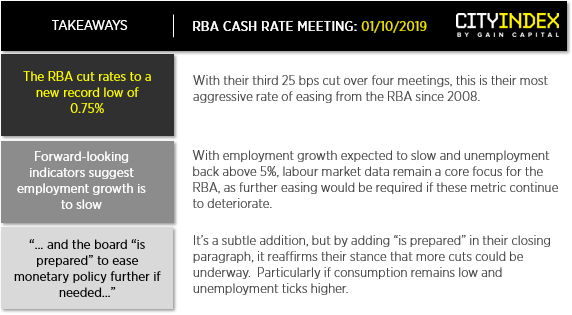

With futures markets implying an 80% chance of a cut, and around 70% of economists also on board, then it was always going to take more than a simple cut to sink AUD today with any vengeance. Yet looking through their October statement suggests that an easing bias remains, which leaves room for another cut this year. If markets agree, we could see some bearish follow through in due course.

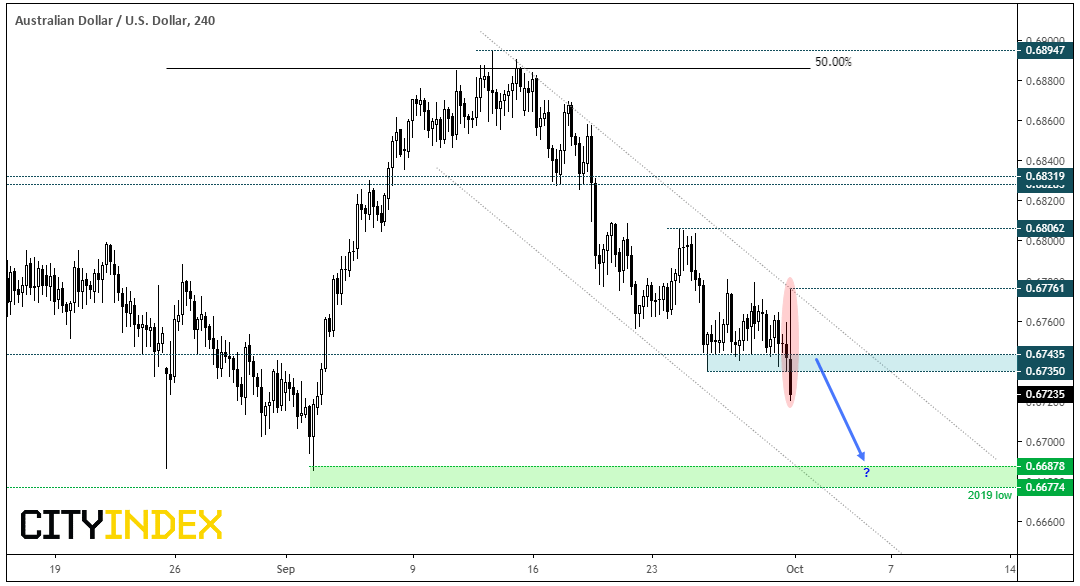

After an initially lacklustre reaction, AUD/USD has now sliced through key support and on track for a bearish outside day. Not helping of course is the stronger USD which has seen DXY hit its highest level since May 2017. From here, bears could target the YTD lows and intraday bears could seek short setups whilst price action remains below prior support around 0.6740. A solid upside break of the bearish channel and / or the current four-hour candle high invalidates the bearish bias.

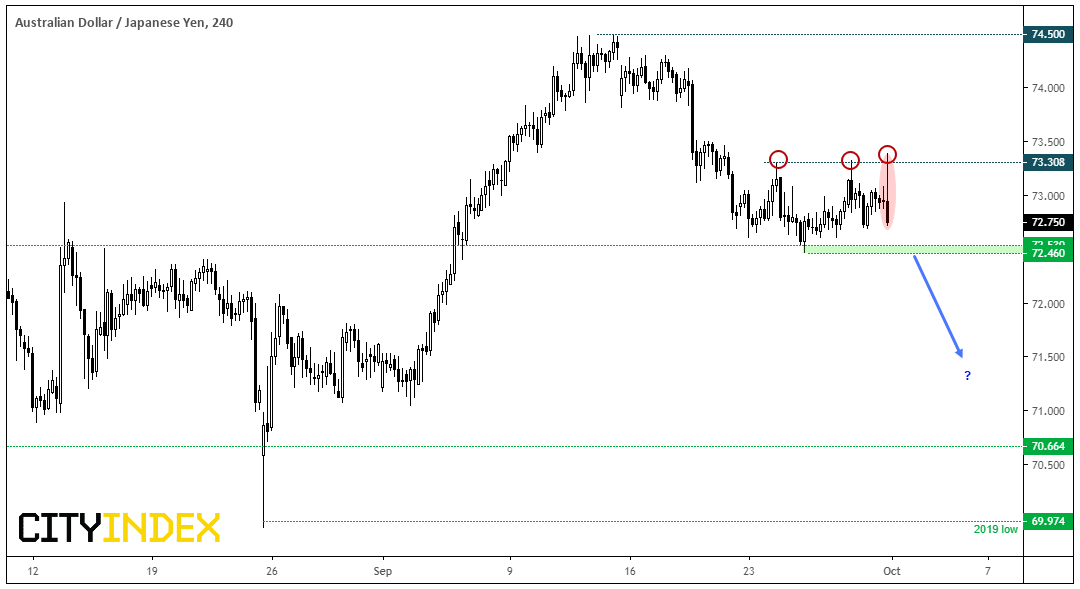

AUD/JPY remains reluctant to break out of compression, although the current four-hour candle is the most volatile in the entire range. So the fact that’s its bearish and provided a failed break higher could appeal to bears and show there is plenty of supply around 73.30.

Whilst we may have seen the swing high in place, a more cautious approach is to wait for a clear break of support around 72.50 before assuming its next leg lower in underway. Keep an eye on indices too, as we’d want to see these falling lower to confirm a break lower on AUD/JPY.

Related analysis:

AUD Under Pressure Ahead Of Tomorrow's RBA Meeting

It Could Be Make Or Break For The Aussie, With Several Pairs Sitting At Support

AU Unemployment Rises, RBA To Ease Again In October?

RBA Hold Rates, AUD Sticks To Its Lows Ahead Of GDP